Evercore Investment Banking Pitch Book

Preliminary Valuation of SIRE Common Units

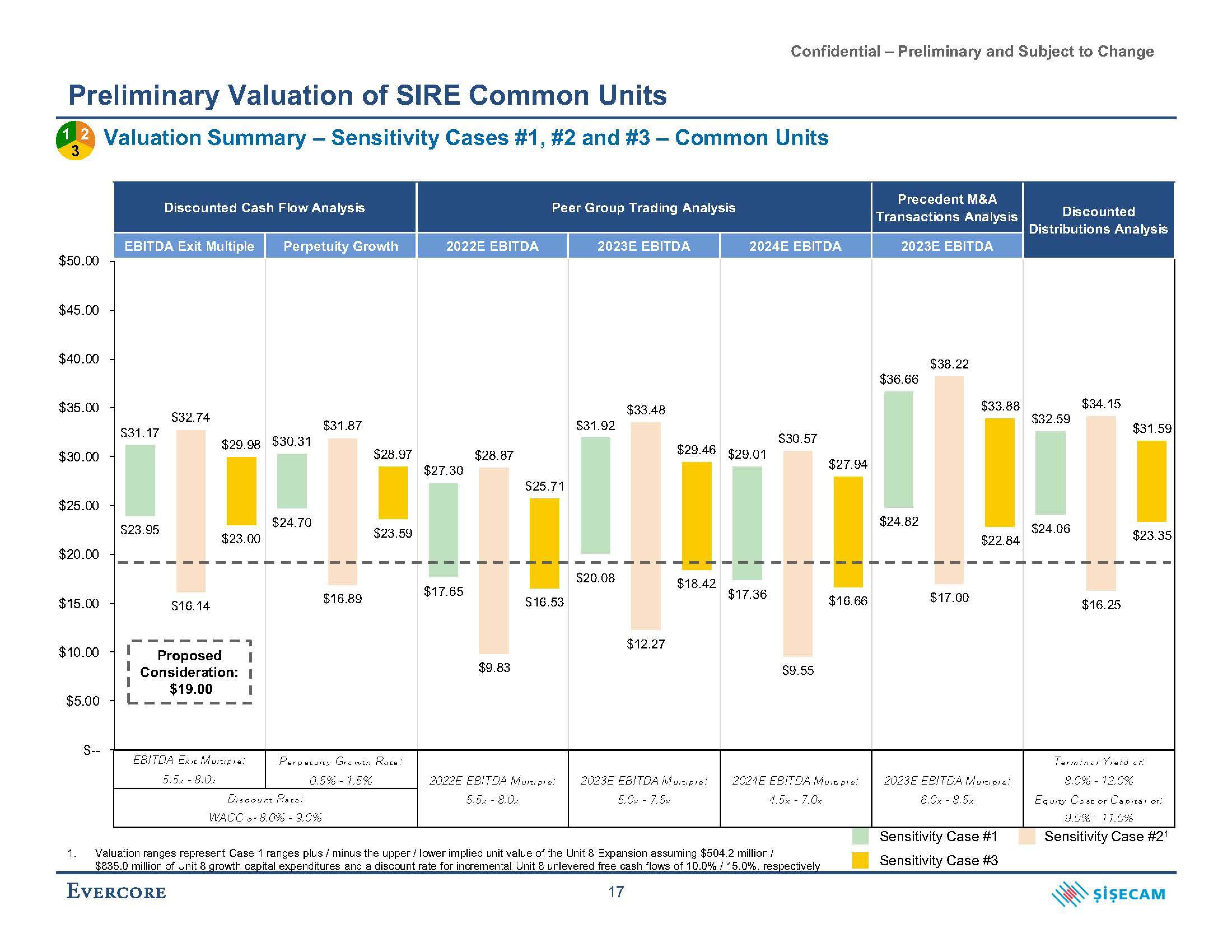

1,2 Valuation Summary - Sensitivity Cases #1, #2 and #3 - Common Units

3

$50.00

$45.00

$40.00

$35.00

$30.00

$25.00

$20.00

$15.00

$10.00

$5.00

$--

1.

EBITDA Exit Multiple Perpetuity Growth

$31.17

Discounted Cash Flow Analysis

$23.95

$32.74

$16.14

$29.98 $30.31

$23

1

I

Proposed

Consideration: I

$19.00

I

EBITDA Exit Multiple:

5.5x - 8.0x

$24.70

$31.87

Discount Rate:

WACC or 8.0% - 9.0%

$16.89

$28.97

$23.59

Perpetuity Growth Rate:

0.5% -1.5%

2022E EBITDA

$27.30

$17.65

$28.87

$9.83

Peer Group Trading Analysis

$25.71

$16.53

2022E EBITDA Multiple:

5.5x - 8.0x

2023E EBITDA

$31.92

$20.08

$33.48

$12.27

$29.46 $29.01

$18.42

2023E EBITDA Multiple:

5.0x - 7.5x

Confidential - Preliminary and Subject to Change

2024E EBITDA

$17.36

$30.57

$9.55

Valuation ranges represent Case 1 ranges plus / minus the upper / lower implied unit value of the Unit 8 Expansion assuming $504.2 million/

$835.0 million of Unit 8 growth capital expenditures and a discount rate for incremental Unit 8 unlevered free cash flows of 10.0% / 15.0%, respectively

17

EVERCORE

$27.94

$16.66

2024E EBITDA Multiple:

4.5x - 7.0x

Precedent M&A

Transactions Analysis

2023E EBITDA

$36.66

$24.82

$38.22

$17.00

$33.88

$22.84

2023E EBITDA Multiple:

6.0x - 8.5x

Sensitivity Case #1

Sensitivity Case #3

Discounted

Distributions Analysis

$32.59

$24.06

$34.15

$16.25

$31.59

$23.35

Terminal Yield of:

8.0% - 12.0%

Equity Cost or Capital or

9.0% - 11.0%

Sensitivity Case #21

ŞİŞECAMView entire presentation