Getaround SPAC Presentation Deck

Transaction summary

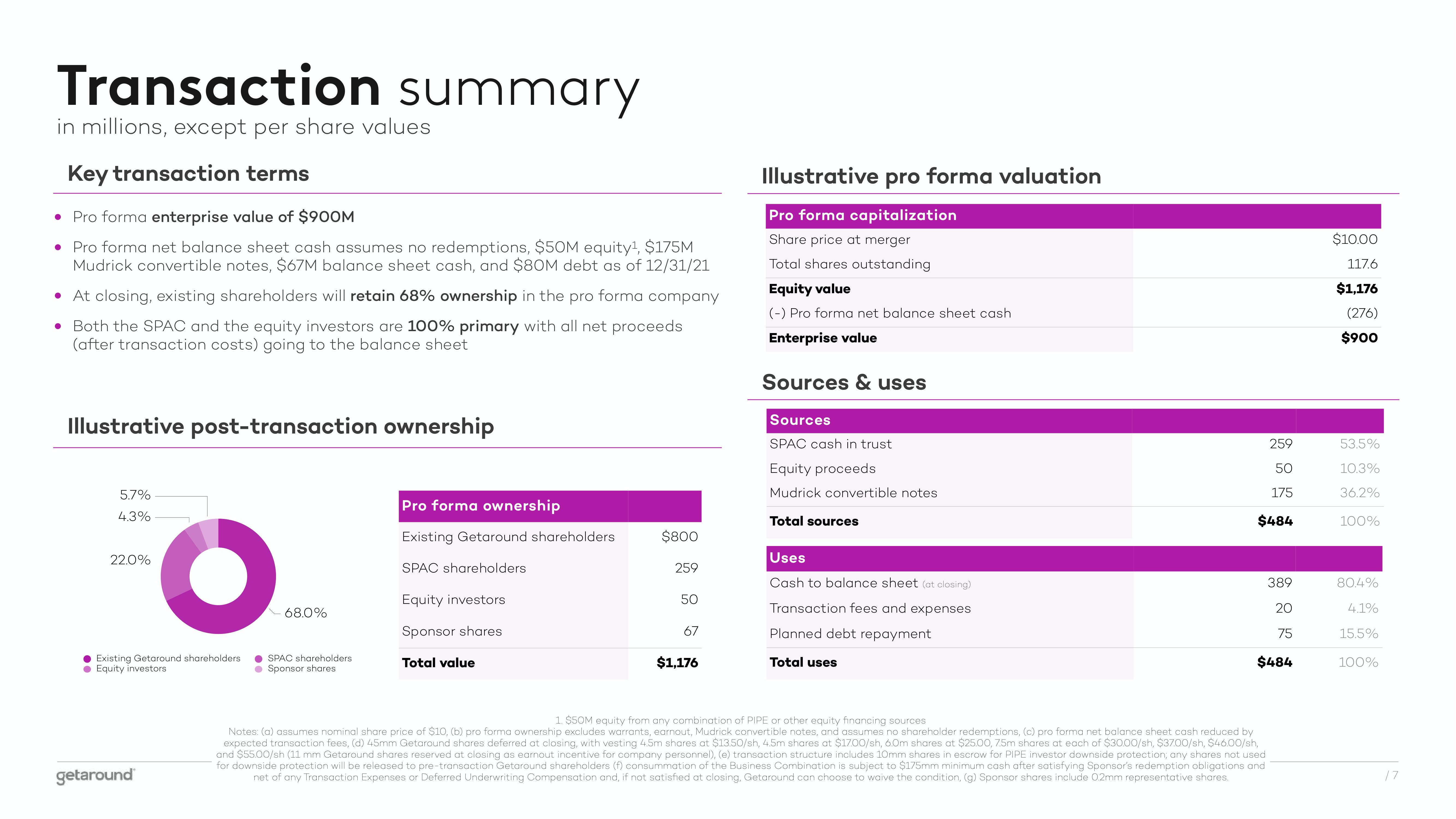

in millions, except per share values

Key transaction terms

• Pro forma enterprise value of $900M

• Pro forma net balance sheet cash assumes no redemptions, $50M equity¹, $175M

Mudrick convertible notes, $67M balance sheet cash, and $80M debt as of 12/31/21

●

●

At closing, existing shareholders will retain 68% ownership in the pro forma company

Both the SPAC and the equity investors are 100% primary with all net proceeds

(after transaction costs) going to the balance sheet

Illustrative post-transaction ownership

5.7%

4.3%

22.0%

O

Existing Getaround shareholders

Equity investors

getaround

68.0%

SPAC shareholders

Sponsor shares

Pro forma ownership

Existing Getaround shareholders

SPAC shareholders

Equity investors

Sponsor shares

Total value

$800

259

50

67

$1,176

Illustrative pro forma valuation

Pro forma capitalization

Share price at merger

Total shares outstanding

Equity value

(-) Pro forma net balance sheet cash.

Enterprise value

Sources & uses

Sources

SPAC cash in trust

Equity proceeds

Mudrick convertible notes

Total sources

Uses

Cash to balance sheet (at closing)

Transaction fees and expenses

Planned debt repayment

Total uses

259

50

175

$484

389

20

75

$484

1. $50M equity from any combination of PIPE or other equity financing sources

Notes: (a) assumes nominal share price of $10, (b) pro forma ownership excludes warrants, earnout, Mudrick convertible notes, and assumes no shareholder redemptions, (c) pro forma net balance sheet cash reduced by

expected transaction fees, (d) 45mm Getaround shares deferred at closing, with vesting 4.5m shares at $13.50/sh, 4.5m shares at $17.00/sh, 6.0m shares at $25.00, 75m shares at each of $30.00/sh, $37.00/sh, $46.00/sh,

and $55.00/sh (11 mm Getaround shares reserved at closing as earnout incentive for company personnel), (e) transaction structure includes 10mm shares in escrow for PIPE investor downside protection, any shares not used

for downside protection will be released to pre-transaction Getaround shareholders (f) consummation of the Business Combination is subject to $175mm minimum cash after satisfying Sponsor's redemption obligations and

net of any Transaction Expenses or Deferred Underwriting Compensation and, if not satisfied at closing, Getaround can choose to waive the condition, (g) Sponsor shares include 0.2mm representative shares.

$10.00

117.6

$1,176

(276)

$900

53.5%

10.3%

36.2%

100%

80.4%

4.1%

15.5%

100%

17View entire presentation