Affirm Results Presentation Deck

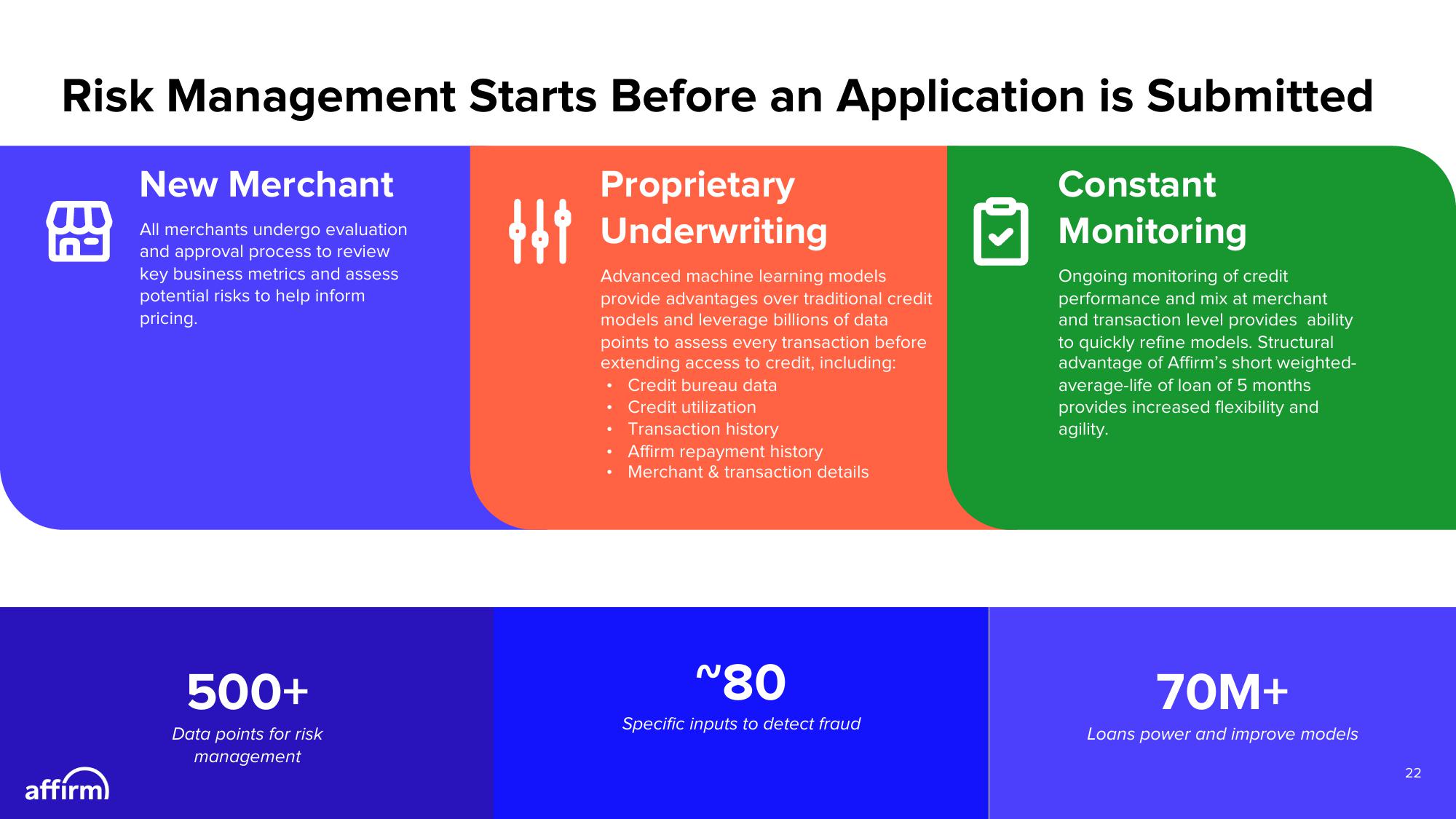

Risk Management Starts Before an Application is Submitted

New Merchant

Proprietary

Underwriting

All merchants undergo evaluation

and approval process to review

key business metrics and assess

potential risks to help inform

pricing.

affirm)

500+

Data points for risk

management

Advanced machine learning models

provide advantages over traditional credit

models and leverage billions of data

points to assess every transaction before

extending access to credit, including:

• Credit bureau data

Credit utilization

Transaction history

• Affirm repayment history

Merchant & transaction details

●

●

~80

Specific inputs to detect fraud

Constant

Monitoring

Ongoing monitoring of credit

performance and mix at merchant

and transaction level provides ability

to quickly refine models. Structural

advantage of Affirm's short weighted-

average-life of loan of 5 months

provides increased flexibility and

agility.

70M+

Loans power and improve models

22View entire presentation