Evercore Investment Banking Pitch Book

Transaction Overview

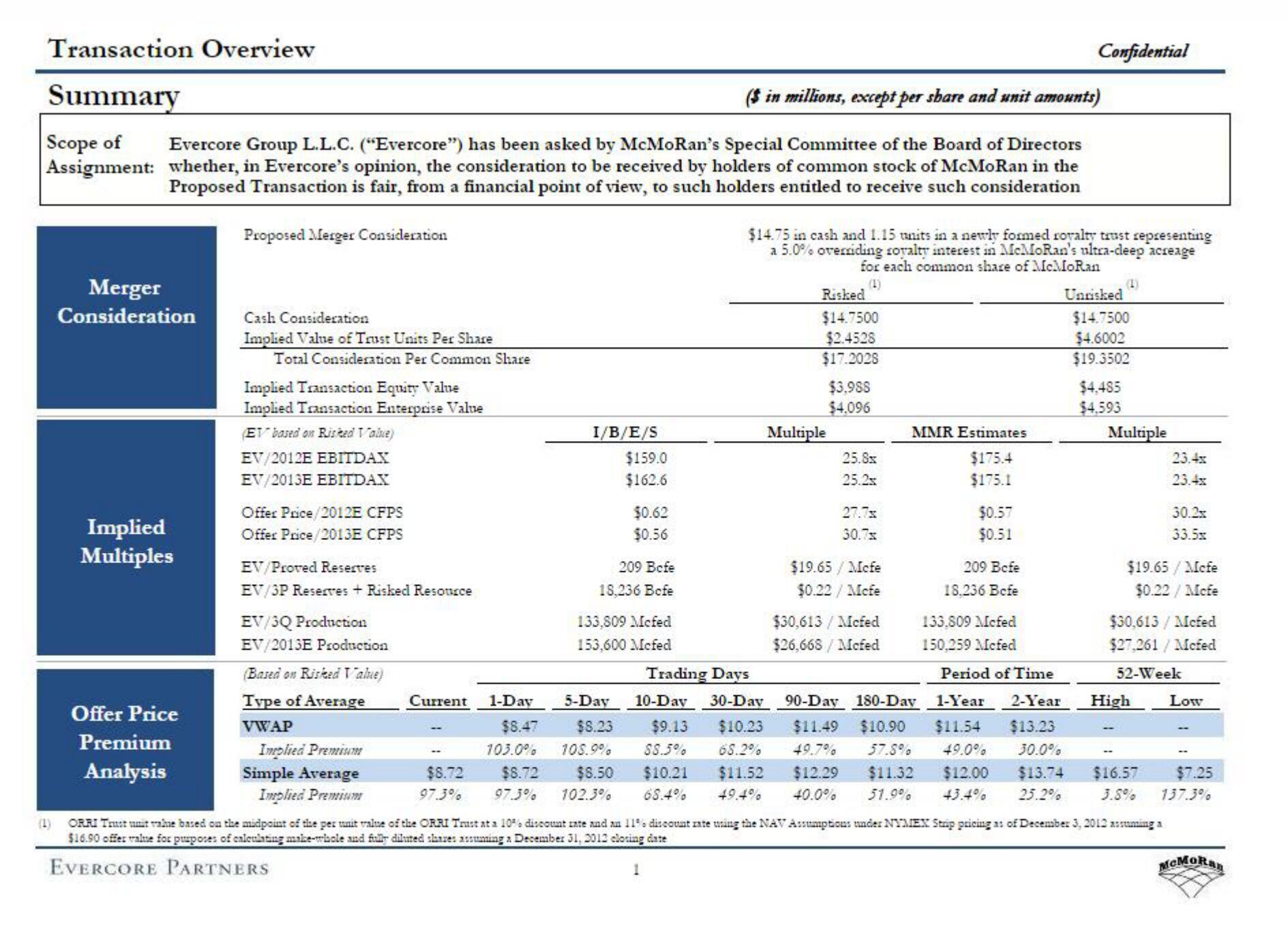

Summary

Scope of

Assignment:

($ in millions, except per share and unit amounts)

Evercore Group L.L.C. ("Evercore") has been asked by McMoRan's Special Committee of the Board of Directors

whether, in Evercore's opinion, the consideration to be received by holders of common stock of McMoRan in the

Proposed Transaction is fair, from a financial point of view, to such holders entitled to receive such consideration

Merger

Consideration

Implied

Multiples

Offer Price

Premium

Analysis

Proposed Merger Consideration

Cash Consideration

Implied Value of Trust Units Per Share

Total Consideration Per Common Share

Implied Transaction Equity Value

Implied Transaction Enterprise Value

(EV based on Risked Value)

EV/2012E EBITDAX

EV/2013E EBITDAX

Offer Price/2012E CFPS

Offer Price/2013E CFPS

EV/Proved Reserves

EV/3P Reserves + Risked Resource

EV/3Q Production

EV/2013E Production

(Based on Risked Value)

Type of Average

VWAP

Implied Premium

Simple Average

Implied Premium

I/B/E/S

$8.72

97.3%

$159.0

$162.6

$0.62

$0.56

209 Befe

18,236 Bofe

133,809 Mcfed

153,600 Mcfed

$14.75 in cash and 1.15 units in a newly formed royalty trust representing

a 5.0% overriding royalty interest in McMoRan's ultra-cleep acreage

for each common share of McMoRan

(1)

Risked

$14.7500

$2.4528

$17.2028

Multiple

$3,988

$4.096

25.8x

25.2%

27.7x

30.7x

209 Befe

18.236 Befe

133.809 Mcfed

150,259 Mcfed

Period of Time

Current 1-Day

5-Day

$8.23

Trading Days

10-Day 30-Day

$9.13

$8.47

90-Day 180-Day 1-Year 2-Year

$10.23 $11.49 $10.90 $11.54 $13.23

103.0%

68.2% 49.7% 57.8% 49.0% 30.0%

$8.72 $8.50 $10.21 $11.52 $12.29 $11.32 $12.00

97.3% 102.3% 68.4% 49.4% 40.0% 51.9% 43.4%

105.9%

$8.5%

MMR Estimates

$175.4

$175.1

$19.65 / Mcfe

$0.22 / Mefe

$30,613/ Mcfed

$26,668/Mcfed

Confidential

$0.57

$0.51

Untisked

$14.7500

$4.6002

$19.3502

$4,485

$4,593

Multiple

High

$19.65/Mcfe

$0.22/Mcfe

$30,613/ Mcfed

$27,261/Mcfed

52-Week

$13.74 $16.57

25.2%

23.4x

23.4x

30.2x

55.52

(1) ORRI Trust uit vahe based on the midpoint of the per unit value of the ORRI Trust at a 10% discount rate and an 11% discount rate using the NAV Assumptions under NYMEX Strip pricing as of December 3, 2012 assuming a

$16.90 offer value for purposes of calculating make-whole and fully diluted shares assuming a December 31, 2012 closing date

EVERCORE PARTNERS

1

$7.25

3.8% 137.3%

Low

MCMoRanView entire presentation