NVIDIA Investor Presentation Deck

Revenue

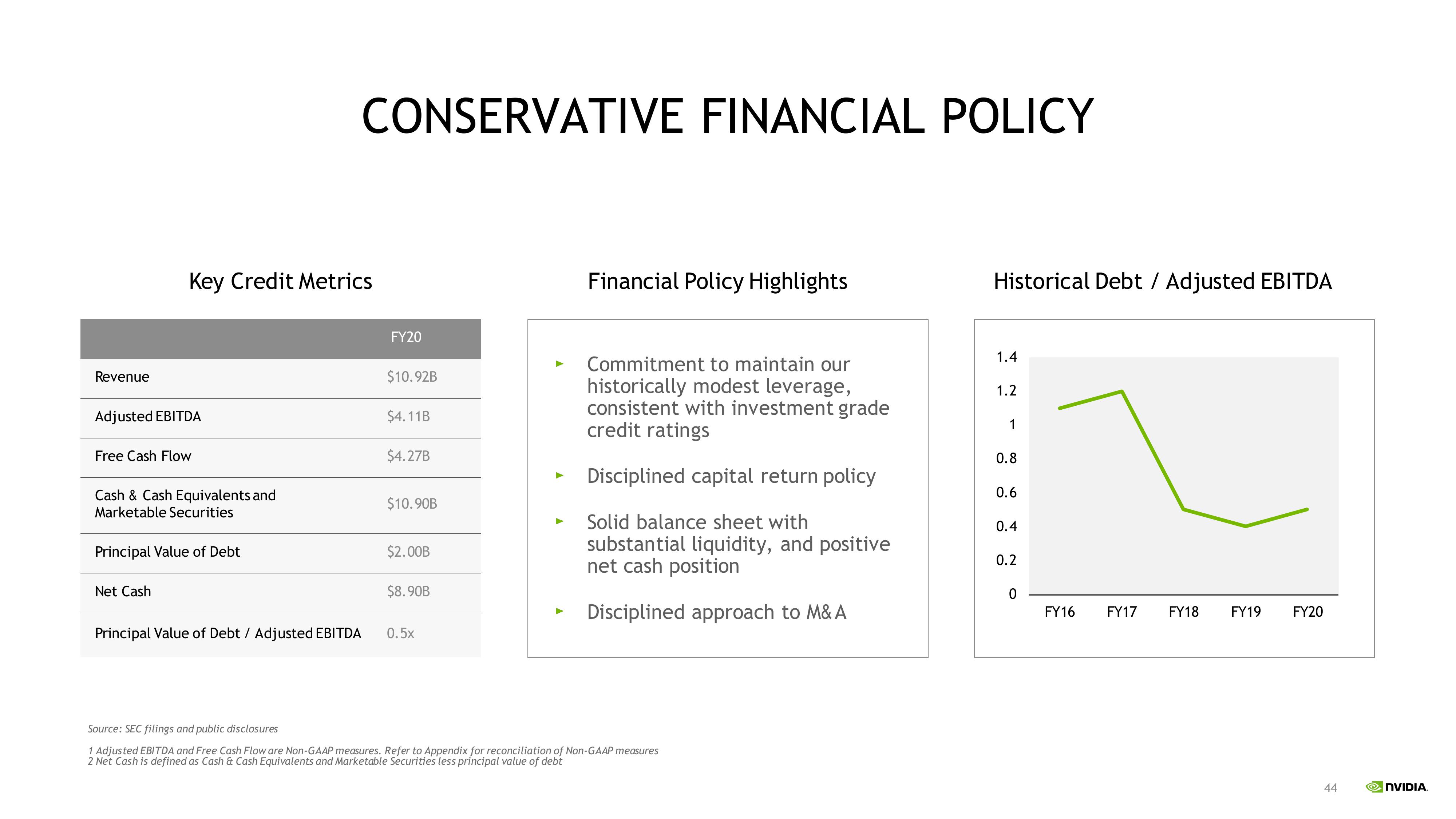

Adjusted EBITDA

Key Credit Metrics

Free Cash Flow

Cash & Cash Equivalents and

Marketable Securities

Principal Value of Debt

Net Cash

CONSERVATIVE FINANCIAL POLICY

Principal Value of Debt / Adjusted EBITDA

FY20

$10.92B

$4.11B

$4.27B

$10.90B

$2.00B

$8.90B

0.5x

Financial Policy Highlights

Commitment to maintain our

historically modest leverage,

consistent with investment grade

credit ratings

Disciplined capital return policy

Solid balance sheet with

substantial liquidity, and positive

net cash position

Disciplined approach to M&A

Source: SEC filings and public disclosures

1 Adjusted EBITDA and Free Cash Flow are Non-GAAP measures. Refer to Appendix for reconciliation of Non-GAAP measures

2 Net Cash is defined as Cash & Cash Equivalents and Marketable Securities less principal value of debt

Historical Debt / Adjusted EBITDA

1.4

1.2

1

0.8

0.6

0.4

0.2

0

FY16 FY17 FY18

FY19

FY20

44

NVIDIAView entire presentation