Silicon Valley Bank Results Presentation Deck

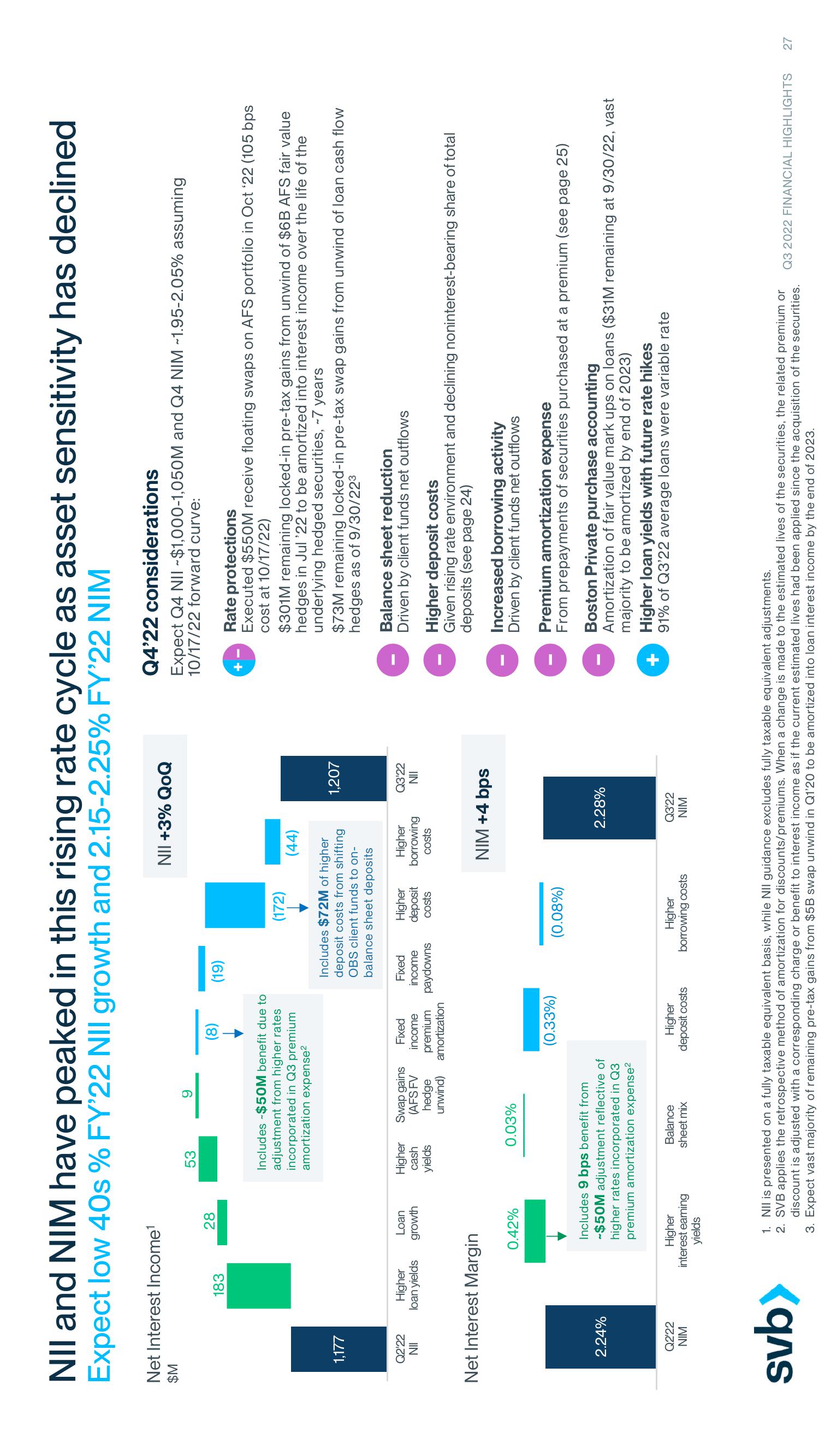

NII and NIM have peaked in this rising rate cycle as asset sensitivity has declined

Expect low 40s % FY'22 NII growth and 2.15-2.25% FY'22 NIM

Net Interest Income¹

$M

1,177

Q2'22

NII

2.24%

183

Q2'22

NIM

Higher

loan yields

Net Interest Margin

svb>

28

Loan

growth

0.42%

53

Higher

interest eaming

yields

9

Includes $50M benefit due to

adjustment from higher rates

incorporated in Q3 premium

amortization expense²

Higher Swap gains

cash

(AFS FV

hedge

yields

unwind)

0.03%

Includes 9 bps benefit from

-$50M adjustment reflective of

higher rates incorporated in Q3

premium amortization expense²

Balance

sheet mix

(8)

Fixed

Fixed

income income

premium paydowns

amortization

(0.33%)

(19)

Higher

deposit costs

(172)

(44)

Includes $72M of higher

deposit costs from shifting

OBS client funds to on-

balance sheet deposits

Higher

deposit

costs

(0.08%)

NII +3% QOQ

Higher

borrowing costs

Higher

borrowing

costs

1,207

Q3'22

NII

NIM +4 bps

2.28%

Q3'22

NIM

Q4'22 considerations

Expect Q4 NII ~$1,000-1,050M and Q4 NIM ~1.95-2.05% assuming

10/17/22 forward curve:

Rate protections

Executed $550M receive floating swaps on AFS portfolio in Oct 22 (105 bps

cost at 10/17/22)

$301M remaining locked-in pre-tax gains from unwind of $6B AFS fair value

hedges in Jul '22 to be amortized into interest income over the life of the

underlying hedged securities, ~7 years

$73M remaining locked-in pre-tax swap gains from unwind of loan cash flow

hedges as of 9/30/22³

Balance sheet reduction

Driven by client funds net outflows

Higher deposit costs

Given rising rate environment and declining noninterest-bearing share of total

deposits (see page 24)

Increased borrowing activity

Driven by client funds net outflows

Premium amortization expense

From prepayments of securities purchased at a premium (see page 25)

Boston Private purchase accounting

Amortization of fair value mark ups on loans ($31M remaining at 9/30/22, vast

majority to be amortized by end of 2023)

Higher loan yields with future rate hikes

91% of Q3'22 average loans were variable rate

1. NII is presented on a fully taxable equivalent basis, while NII guidance excludes fully taxable equivalent adjustments.

2. SVB applies the retrospective method of amortization for discounts/premiums. When a change is made to the estimated lives of the securities, the related premium or

discount is adjusted with a corresponding charge or benefit to interest income as if the current estimated lives had been applied since the acquisition of the securities.

3. Expect vast majority of remaining pre-tax gains from $5B swap unwind in Q1'20 to be amortized into loan interest income by the end of 2023.

Q3 2022 FINANCIAL HIGHLIGHTS 27View entire presentation