Oatly IPO Presentation Deck

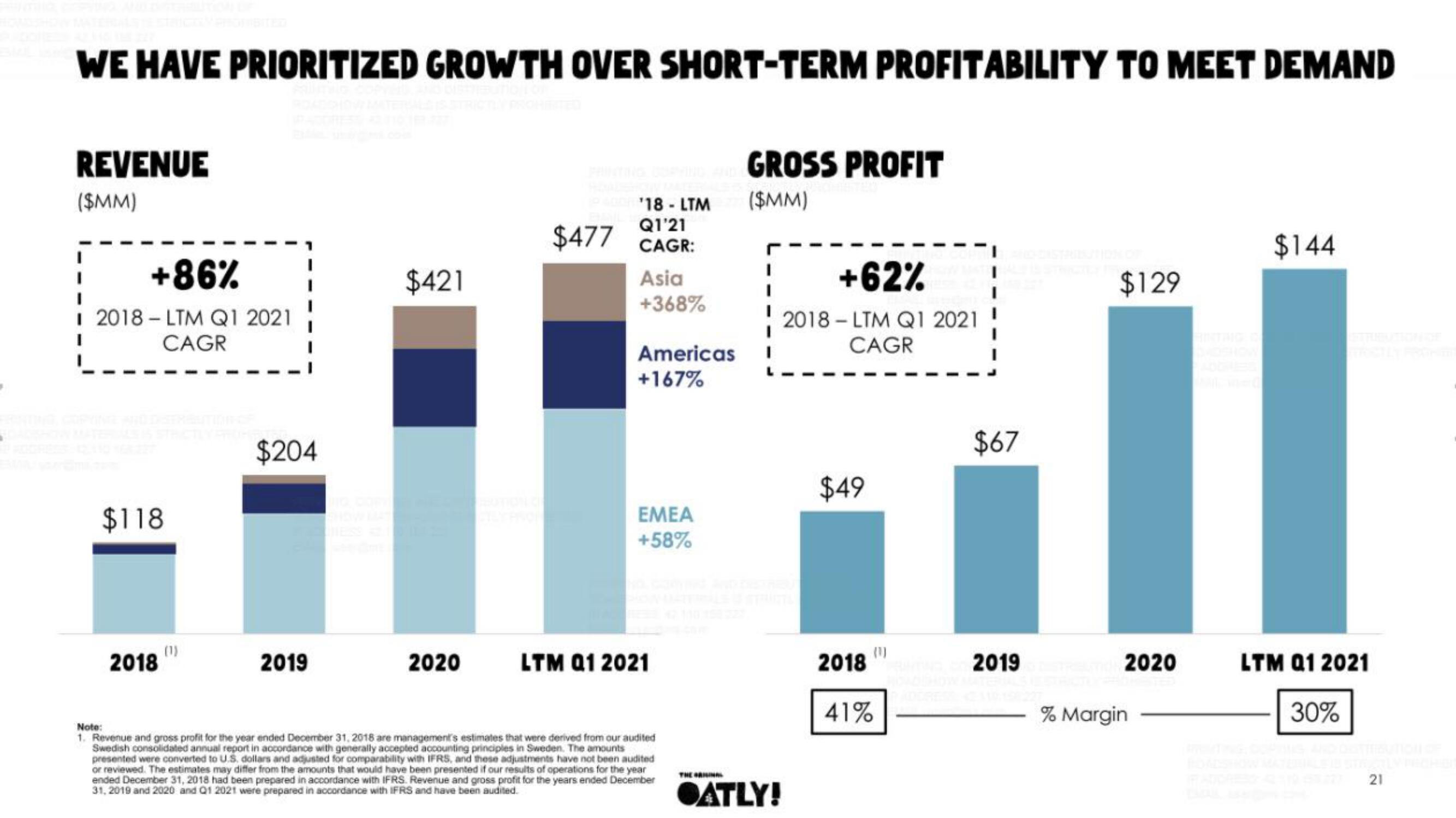

WE HAVE PRIORITIZED GROWTH OVER SHORT-TERM PROFITABILITY TO MEET DEMAND

REVENUE

($MM)

+86%

i 2018-LTM Q1 2021

CAGR

$118

2018

$204

2019

$421

2020

PA18-LTM

Q1'21

$477 CAGR:

Asia

+368%

Americas

+167%

EMEA

+58%

LTM 01 2021

Note:

1. Revenue and gross profit for the year ended December 31, 2018 are management's estimates that were derived from our audited

Swedish consolidated annual report in accordance with generally accepted accounting principles in Sweden. The amounts

presented were converted to U.S. dollars and adjusted for comparability with IFRS, and these adjustments have not been audited

or reviewed. The estimates may differ from the amounts that would have been presented if our results of operations for the year

ended December 31, 2018 had been prepared in accordance with IFRS. Revenue and gross profit for the years ended December

31, 2019 and 2020 and Q1 2021 were prepared in accordance with IFRS and have been audited.

THE ORIGINAL

GROSS PROFIT

($MM)

I

I

I

I

OATLY!

+62%

I

2018 - LTM Q1 2021!

CAGR

$49

2018

41%

$67

2019

$129

2020

% Margin

$144

LTM 01 2021

30%

21View entire presentation