Allwyn Results Presentation Deck

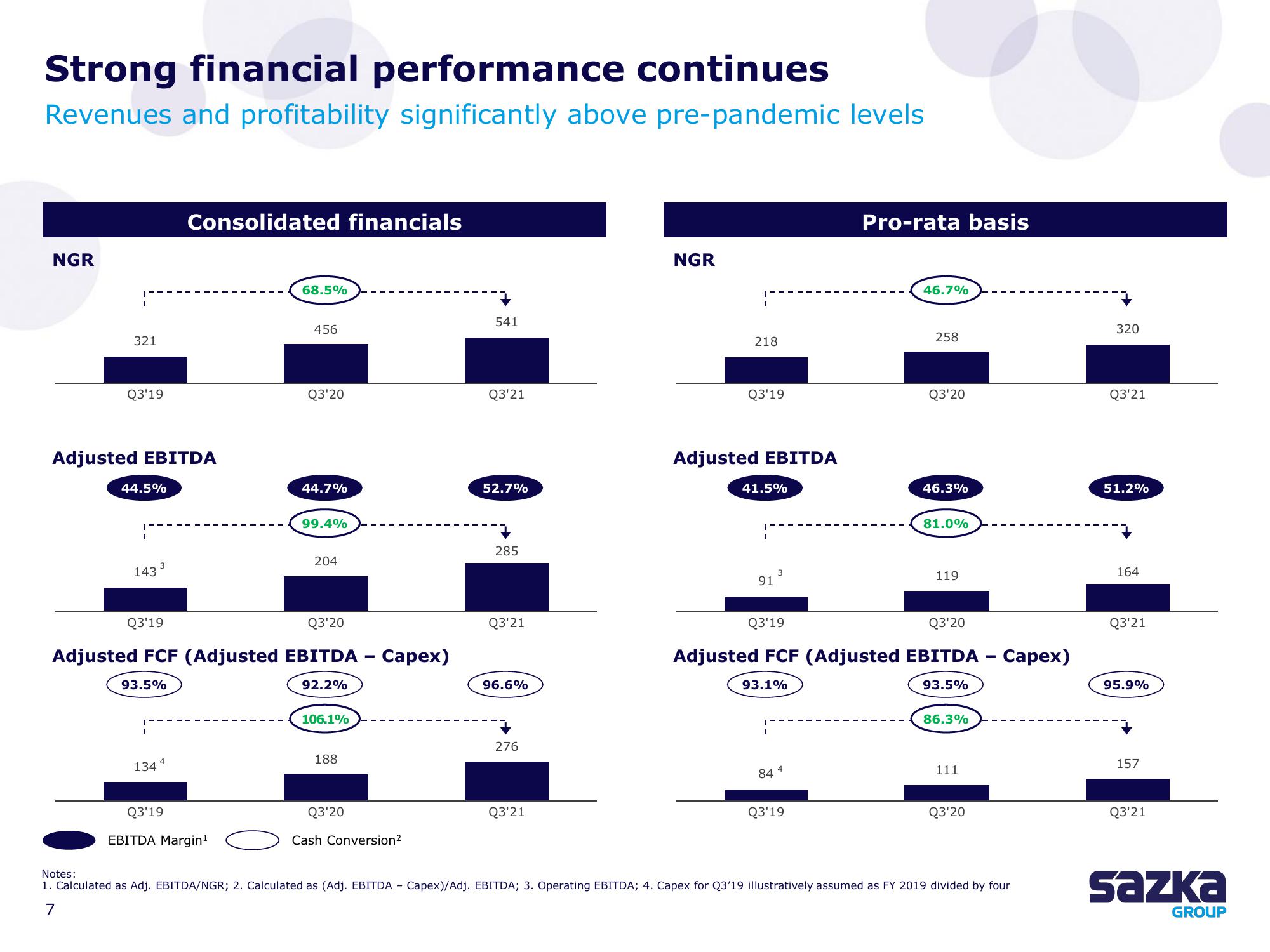

Strong financial performance continues

Revenues and profitability significantly above pre-pandemic levels

NGR

321

Q3'19

Adjusted EBITDA

44.5%

143

3

Q3'19

93.5%

I

Consolidated financials

1344

68.5%

Q3'19

EBITDA Margin¹

456

Q3'20

Q3'20

Adjusted FCF (Adjusted EBITDA - Capex)

92.2%

44.7%

99.4%

204

106.1%

188

Q3'20

Cash Conversion²

541

Q3'21

52.7%

285

Q3'21

96.6%

276

Q3'21

NGR

218

Q3'19

Adjusted EBITDA

41.5%

91

Q3'19

3

93.1%

I

84

4

Pro-rata basis

Q3'19

46.7%

Q3'20

Adjusted FCF (Adjusted EBITDA - Capex)

93.5%

258

Q3'20

46.3%

81.0%

119

86.3%

111

Q3'20

Notes:

1. Calculated as Adj. EBITDA/NGR; 2. Calculated as (Adj. EBITDA - Capex)/Adj. EBITDA; 3. Operating EBITDA; 4. Capex for Q3'19 illustratively assumed as FY 2019 divided by four

7

320

Q3'21

51.2%

164

Q3'21

95.9%

157

Q3'21

Sazka

GROUPView entire presentation