Affirm Investor Presentation Deck

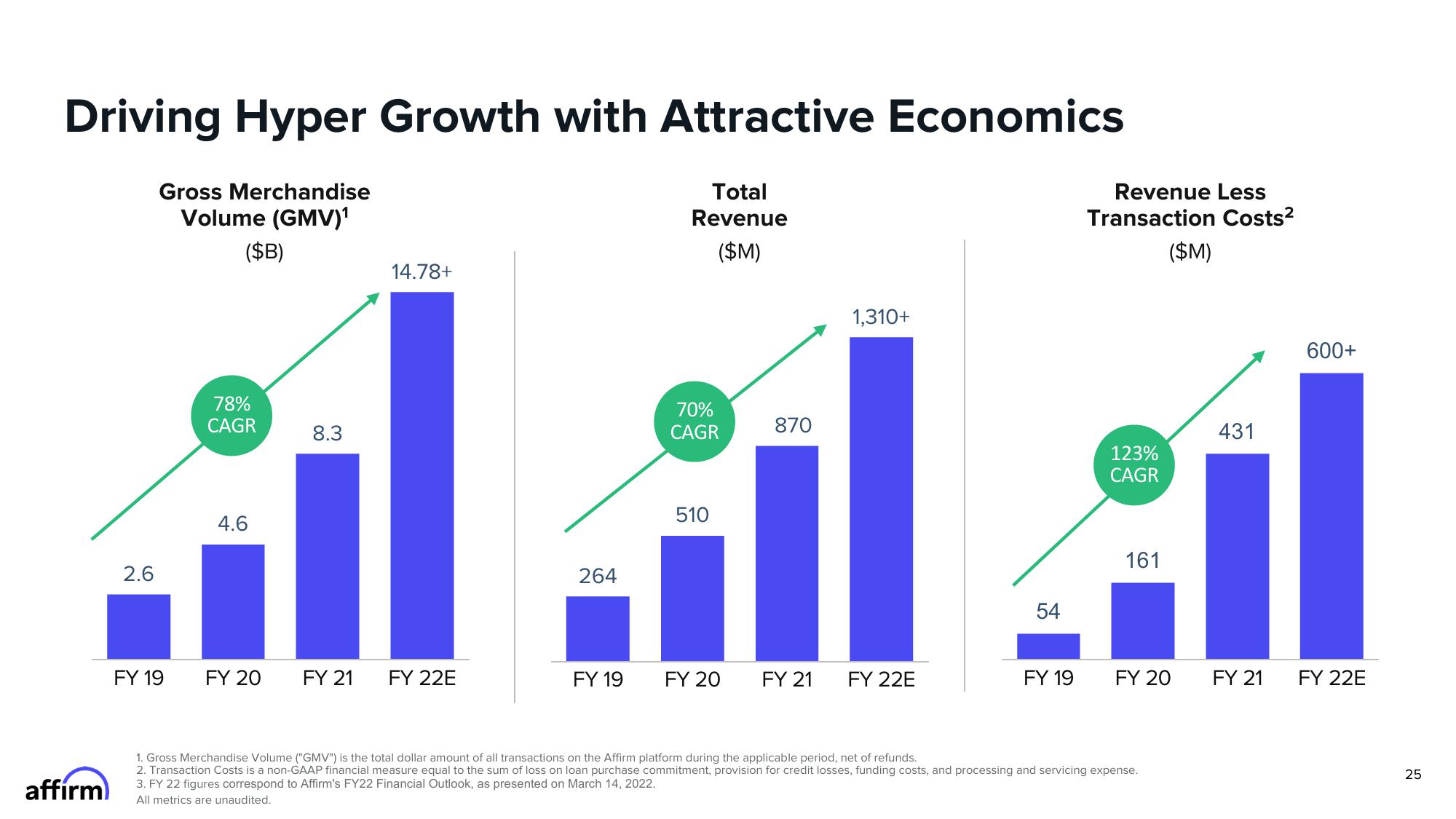

Driving Hyper Growth with Attractive Economics

Gross Merchandise

Volume (GMV)¹

($B)

affirm

2.6

78%

CAGR

4.6

FY 19 FY 20

8.3

FY 21

14.78+

FY 22E

264

FY 19

Total

Revenue

($M)

70%

CAGR

510

FY 20

870

FY 21

1,310+

FY 22E

54

FY 19

Revenue Less

Transaction Costs²

($M)

123%

CAGR

161

FY 20

1. Gross Merchandise Volume ("GMV") is the total dollar amount of all transactions on the Affirm platform during the applicable period, net of refunds.

2. Transaction Costs is a non-GAAP financial measure equal to the sum of loss on loan purchase commitment, provision for credit losses, funding costs, and processing and servicing expense.

3. FY 22 figures correspond to Affirm's FY22 Financial Outlook, as presented on March 14, 2022.

All metrics are unaudited.

431

FY 21

600+

FY 22E

25View entire presentation