Antero Midstream Partners Mergers and Acquisitions Presentation Deck

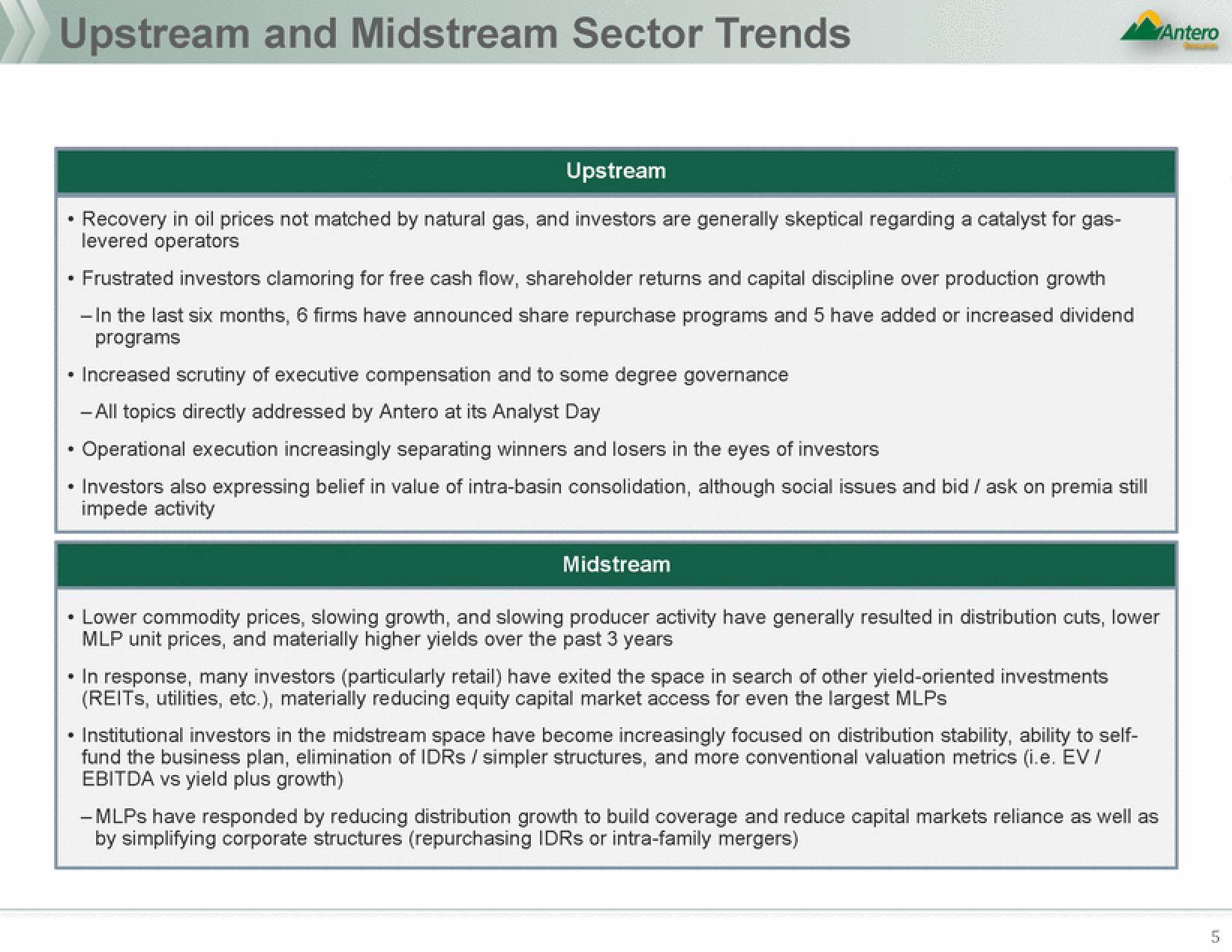

Upstream and Midstream Sector Trends

.

Upstream

Recovery in oil prices not matched by natural gas, and investors are generally skeptical regarding a catalyst for gas-

levered operators

.

Frustrated investors clamoring for free cash flow, shareholder returns and capital discipline over production growth

- In the last six months, 6 firms have announced share repurchase programs and 5 have added or increased dividend

programs

Increased scrutiny of executive compensation and to some degree governance

-All topics directly addressed by Antero at its Analyst Day

• Operational execution increasingly separating winners and losers in the eyes of investors

• Investors also expressing belief in value of intra-basin consolidation, although social issues and bid / ask on premia still

impede activity

Midstream

Lower commodity prices, slowing growth, and slowing producer activity have generally resulted in distribution cuts, lower

MLP unit prices, and materially higher yields over the past 3 years

• In response, many investors (particularly retail) have exited the space in search of other yield-oriented investments

(REITS, utilities, etc.), materially reducing equity capital market access for even the largest MLPs

Antero

• Institutional investors in the midstream space have become increasingly focused on distribution stability, ability to self-

fund the business plan, elimination of IDRs / simpler structures, and more conventional valuation metrics (i.e. EV /

EBITDA vs yield plus growth)

-MLPs have responded by reducing distribution growth to build coverage and reduce capital markets reliance as well as

by simplifying corporate structures (repurchasing IDRs or intra-family mergers)

5View entire presentation