Arrival SPAC Presentation Deck

INVESTOR PRESENTATION

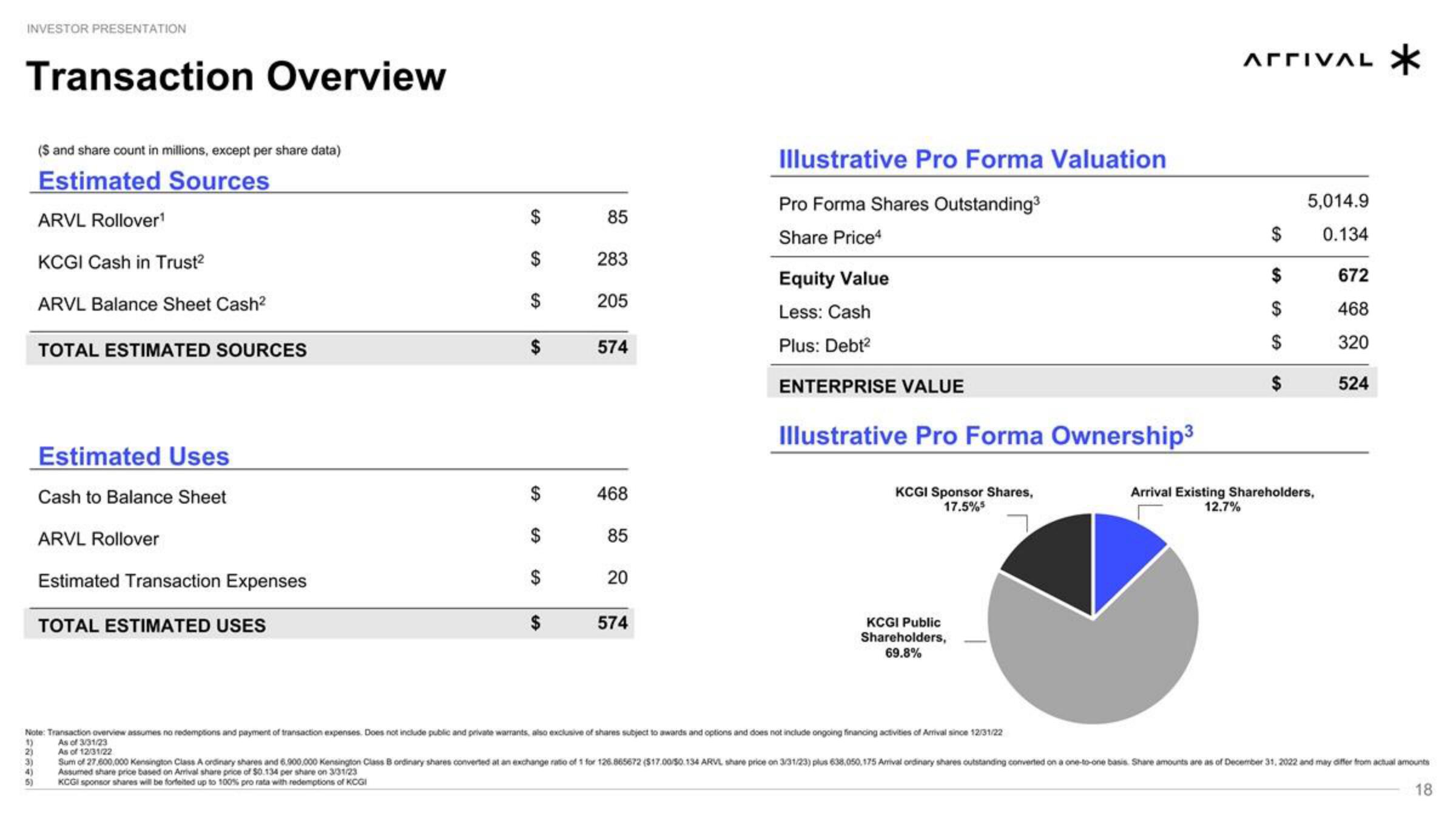

Transaction Overview

($ and share count in millions, except per share data)

Estimated Sources

3)

4)

5)

ARVL Rollover¹

KCGI Cash in Trust²

ARVL Balance Sheet Cash²

TOTAL ESTIMATED SOURCES

Estimated Uses

Cash to Balance Sheet

ARVL Rollover

Estimated Transaction Expenses

TOTAL ESTIMATED USES

S

$

$

$

$

$

$

$

85

283

205

574

468

85

20

574

Illustrative Pro Forma Valuation

Pro Forma Shares Outstanding³

Share Price4

Equity Value

Less: Cash

Plus: Debt²

ENTERPRISE VALUE

Illustrative Pro Forma Ownership³

KCGI Sponsor Shares,

17.5%5

KCGI Public

Shareholders,

69.8%

ΑΓΓΙVAL

$

$

5,014.9

0.134

Arrival Existing Shareholders,

12.7%

672

468

320

524

Note: Transaction overview assumes no redemptions and payment of transaction expenses. Does not include public and private warrants, also exclusive of shares subject to awards and options and does not include ongoing financing activities of Arrival since 12/31/22

As of 3/31/23

1)

2)

As of 12/31/22

Sum of 27,600,000 Kensington Class A ordinary shares and 6.900,000 Kensington Class B ordinary shares converted at an exchange ratio of 1 for 126.865672 ($17.00/50.134 ARVL share price on 3/31/23) plus 638,050,175 Anival ordinary shares outstanding converted on a one-to-one basis. Share amounts are as of December 31, 2022 and may differ from actual amounts

Assumed share price based on Arrival share price of $0.134 per share on 3/31/23

KCGI sponsor shares will be forfeited up to 100% pro rata with redemptions of KCGI

18View entire presentation