Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

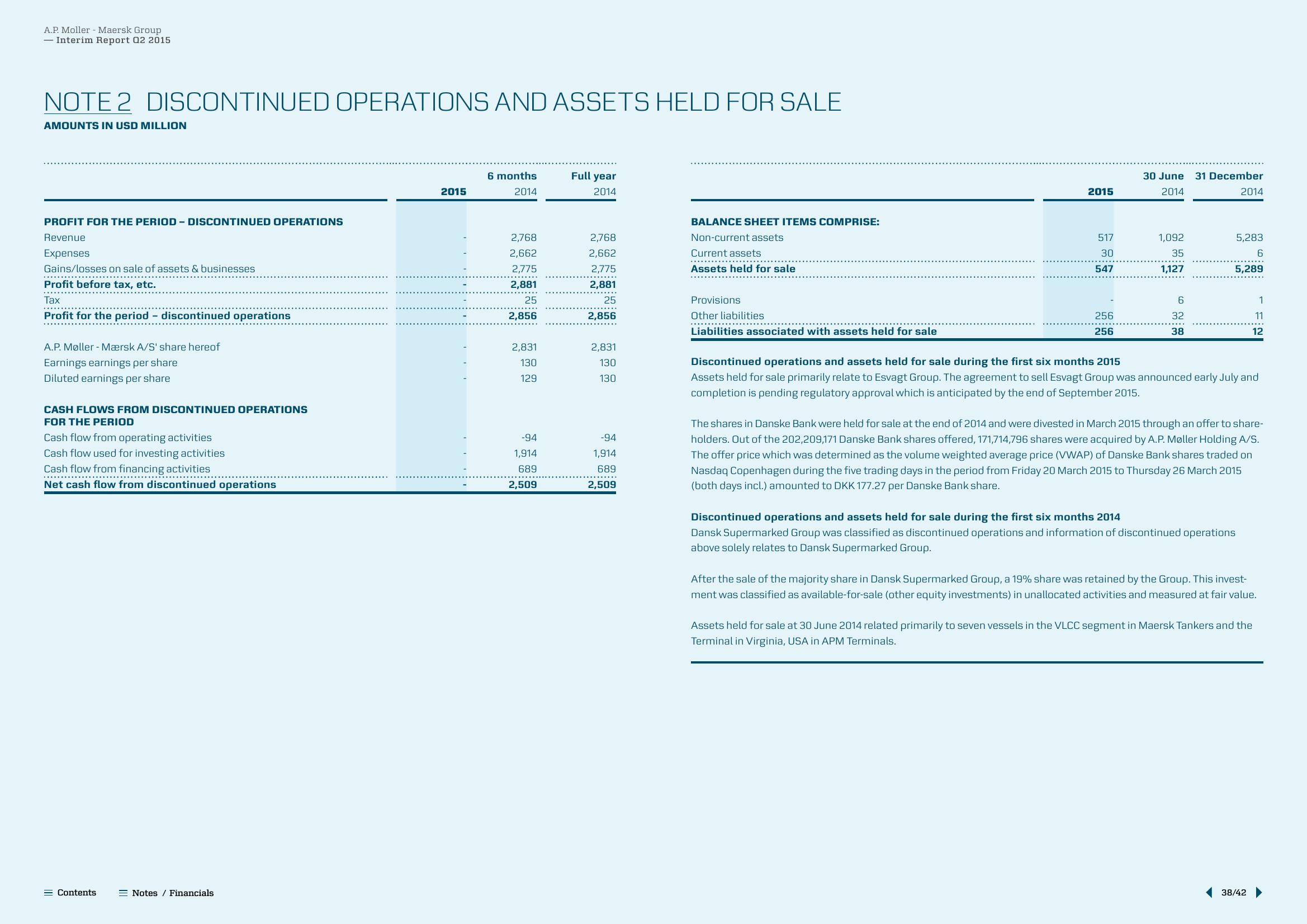

NOTE 2 DISCONTINUED OPERATIONS AND ASSETS HELD FOR SALE

AMOUNTS IN USD MILLION

PROFIT FOR THE PERIOD- DISCONTINUED OPERATIONS

Revenue

Expenses

Gains/losses on sale of assets & businesses

Profit before tax, etc.

Tax

Profit for the period - discontinued operations

........

A.P. Møller-Mærsk A/S' share hereof

Earnings earnings per share

Diluted earnings per share

CASH FLOWS FROM DISCONTINUED OPERATIONS

FOR THE PERIOD

Cash flow from operating activities

Cash flow used for investing activities

Cash flow from financing activities

Net cash flow from discontinued operations

= Contents

Notes / Financials

2015

6 months

2014

2,768

2,662

2,775

2,881

25

2,856

2,831

130

129

-94

1,914

689

2,509

Full year

2014

2,768

2,662

2,775

2,881

25

2,856

2,831

130

130

-94

1,914

689

2,509

BALANCE SHEET ITEMS COMPRISE:

Non-current assets

Current assets

..….….......

Assets held for sale

Provisions

Other liabilities

Liabilities associated with assets held for sale

2015

517

30

547

256

256

30 June

2014

1,092

35

1,127

6

32

38

31 December

2014

5,283

6

5,289

Discontinued operations and assets held for sale during the first six months 2015

Assets held for sale primarily relate to Esvagt Group. The agreement to sell Esvagt Group was announced early July and

completion is pending regulatory approval which is anticipated by the end of September 2015.

Discontinued operations and assets held for sale during the first six months 2014

Dansk Supermarked Group was classified as discontinued operations and information of discontinued operations

above solely relates to Dansk Supermarked Group.

The shares in Danske Bank were held for sale at the end of 2014 and were divested in March 2015 through an offer to share-

holders. Out of the 202,209,171 Danske Bank shares offered, 171,714,796 shares were acquired by A.P. Møller Holding A/S.

The offer price which was determined as the volume weighted average price (VWAP) of Danske Bank shares traded on

Nasdaq Copenhagen during the five trading days in the period from Friday 20 March 2015 to Thursday 26 March 2015

(both days incl.) amounted to DKK 177.27 per Danske Bank share.

1:12

After the sale of the majority share in Dansk Supermarked Group, a 19% share was retained by the Group. This invest-

ment was classified as available-for-sale (other equity investments) in unallocated activities and measured at fair value.

Assets held for sale at 30 June 2014 related primarily to seven vessels in the VLCC segment in Maersk Tankers and the

Terminal in Virginia, USA in APM Terminals.

38/42View entire presentation