Evercore Investment Banking Pitch Book

Preliminary Financial Analysis

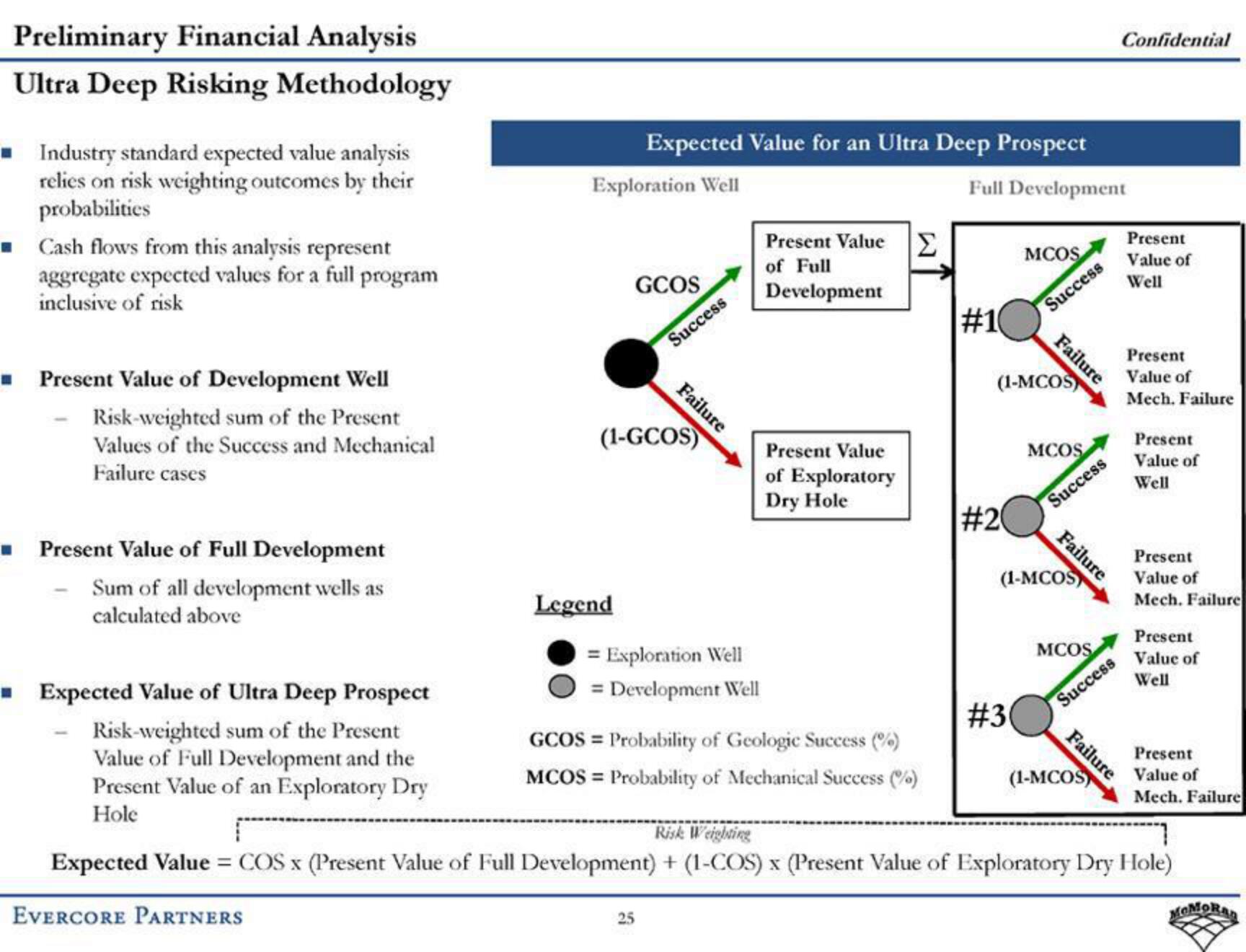

Ultra Deep Risking Methodology

■ Industry standard expected value analysis

relies on risk weighting outcomes by their

probabilities

■ Cash flows from this analysis represent

aggregate expected values for a full program

inclusive of risk

■ Present Value of Development Well

Risk-weighted sum of the Present

Values of the Success and Mechanical

Failure cases

■ Present Value of Full Development

Sum of all development wells as

calculated above

Exploration Well

Legend

Expected Value for an Ultra Deep Prospect

Full Development

GCOS

Success

(1-GCOS)

Failure

= Exploration Well

= Development Well

25

Present Value Σ

of Full

Development

Present Value

of Exploratory

Dry Hole

GCOS Probability of Geologic Success (%)

MCOS = Probability of Mechanical Success (%)

#1

#20

MCOS

Success

(1-MCOS)

#30

Failure

MCOS

Success

Failure

(1-MCOS)

MCOS

Confidential

Success

Failure

Expected Value of Ultra Deep Prospect

Risk-weighted sum of the Present

Value of Full Development and the

Present Value of an Exploratory Dry

Hole

Risk Weighting

Expected Value = COS x (Present Value of Full Development) + (1-COS) x (Present Value of Exploratory Dry Hole)

EVERCORE PARTNERS

(1-MCOS)

Present

Value of

Well

Present

Value of

Mech. Failure

Present

Value of

Well

Present

Value of

Mech. Failure

Present

Value of

Well

Present

Value of

Mech. Failure

MOMORANView entire presentation