Kinnevik Results Presentation Deck

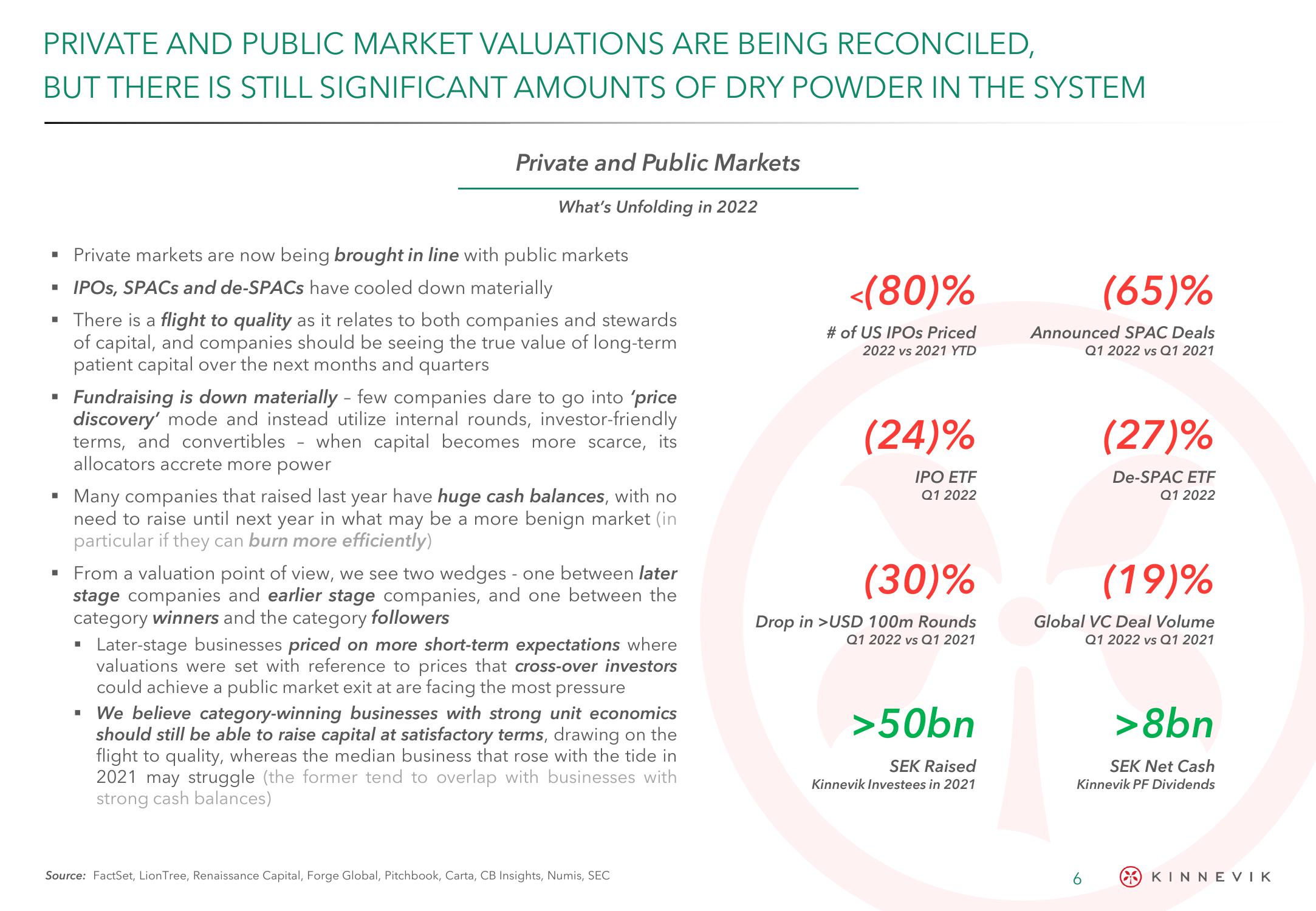

PRIVATE AND PUBLIC MARKET VALUATIONS ARE BEING RECONCILED,

BUT THERE IS STILL SIGNIFICANT AMOUNTS OF DRY POWDER IN THE SYSTEM

■

Private markets are now being brought in line with public markets

▪ IPOS, SPACs and de-SPACs have cooled down materially

There is a flight to quality as it relates to both companies and stewards

of capital, and companies should be seeing the true value of long-term

patient capital over the next months and quarters

■

■

■

Private and Public Markets

What's Unfolding in 2022

Fundraising is down materially - few companies dare to go into 'price

discovery' mode and instead utilize internal rounds, investor-friendly

terms, and convertibles when capital becomes more scarce, its

allocators accrete more power

Many companies that raised last year have huge cash balances, with no

need to raise until next year in what may be a more benign market (in

particular if they can burn more efficiently)

■

From a valuation point of view, we see two wedges - one between later

stage companies and earlier stage companies, and one between the

category winners and the category followers

Later-stage businesses priced on more short-term expectations where

valuations were set with reference to prices that cross-over investors

could achieve a public market exit at are facing the most pressure

▪ We believe category-winning businesses with strong unit economics

should still be able to raise capital at satisfactory terms, drawing on the

flight to quality, whereas the median business that rose with the tide in

2021 may struggle (the former tend to overlap with businesses with

strong cash balances)

Source: FactSet, LionTree, Renaissance Capital, Forge Global, Pitchbook, Carta, CB Insights, Numis, SEC

<(80)%

# of US IPOs Priced

2022 vs 2021 YTD

(24)%

IPO ETF

Q1 2022

(30)%

Drop in >USD 100m Rounds

Q1 2022 vs Q1 2021

>50bn

SEK Raised

Kinnevik Investees in 2021

(65)%

Announced SPAC Deals

Q1 2022 vs Q1 2021

(27)%

De-SPAC ETF

Q1 2022

(19)%

Global VC Deal Volume

Q1 2022 vs Q1 2021

>8bn

SEK Net Cash

Kinnevik PF Dividends

6

KINNEVIKView entire presentation