Sale Leaseback of 38 Bowling Entertainment Centers with Bowlero Corp.

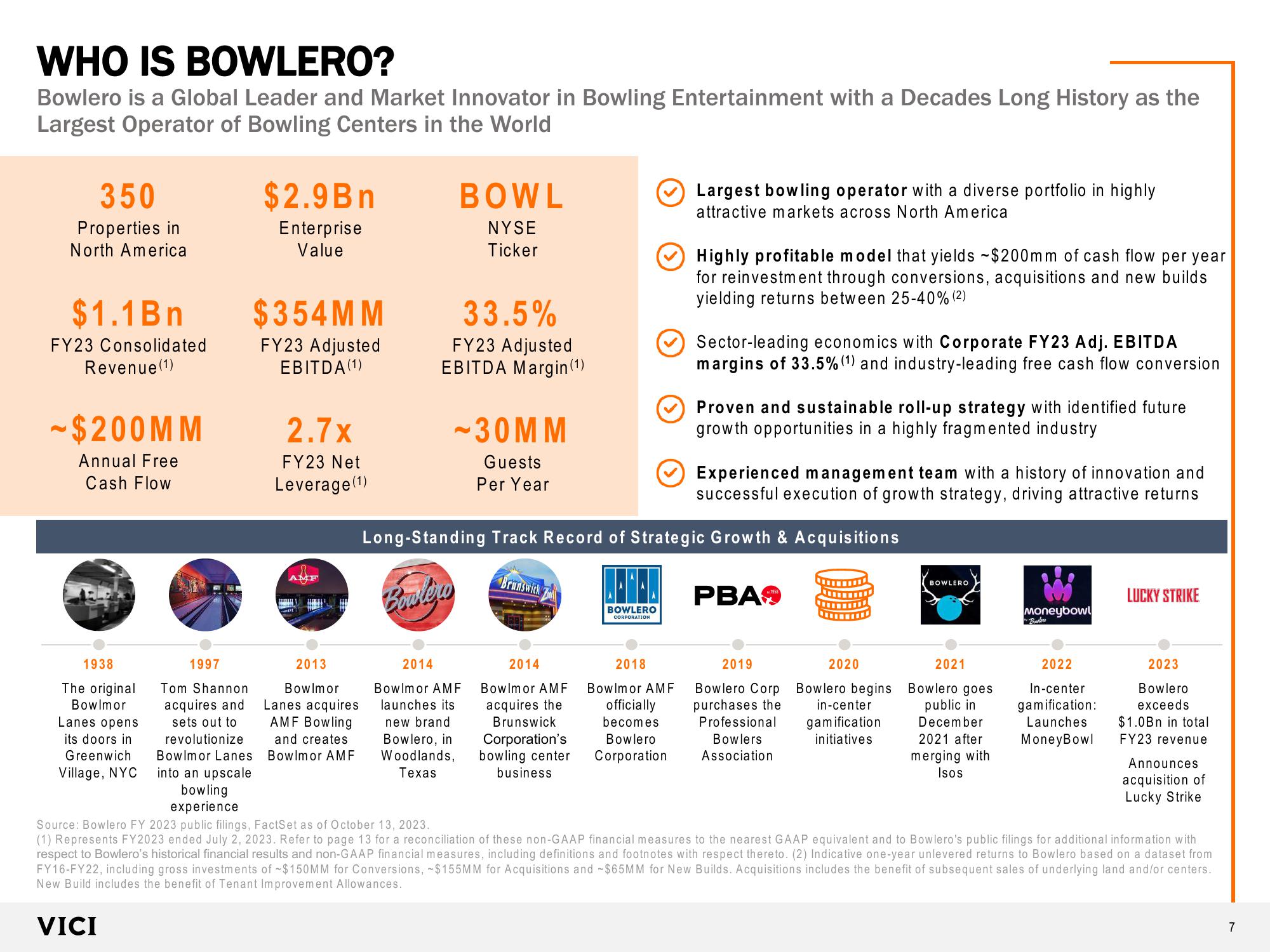

WHO IS BOWLERO?

Bowlero is a Global Leader and Market Innovator in Bowling Entertainment with a Decades Long History as the

Largest Operator of Bowling Centers in the World

350

Properties in

North America

$1.1 Bn

FY23 Consolidated

Revenue (1)

-$200MM

Annual Free

Cash Flow

1938

The original

Bowlmor

Lanes opens

its doors in

Greenwich

Village, NYC

$2.9Bn

Enterprise

Value

$354MM

FY23 Adjusted

EBITDA (1)

2.7x

FY23 Net

Leverage (¹)

R

AMF

2013

Bowlmor

Lanes acquires

AMF Bowling

and creates

Bowlmor AMF

BOWL

NYSE

Ticker

33.5%

FY23 Adjusted

EBITDA Margin(1)

Boulgu

2014

-30MM

Guests

Per Year

2014

Bowlmor AMF

launches its

new brand

Bowlero, in

Woodlands,

Texas

Long-Standing Track Record of Strategic Growth & Acquisitions

BOWLERO

CORPORATION

2018

Largest bowling operator with a diverse portfolio in highly

attractive markets across North America

Highly profitable model that yields -$200mm of cash flow per year

for reinvestment through conversions, acquisitions and new builds

yielding returns between 25-40% (2)

Bowlmor AMF Bowlmor AMF

acquires the officially

Brunswick

becomes

Corporation's Bowlero

bowling center Corporation

business

Sector-leading economics with Corporate FY23 Adj. EBITDA

margins of 33.5% (1) and industry-leading free cash flow conversion

Proven and sustainable roll-up strategy with identified future

growth opportunities in a highly fragmented industry

Experienced management team with a history of innovation and

successful execution of growth strategy, driving attractive returns

PBAS

2019

Bowlero Corp

purchases the

Professional

Bowlers

Association

1997

Tom Shannon

acquires and

sets out to

revolutionize

Bowlmor Lanes

into an upscale

bowling

experience

Source: Bowlero FY 2023 public filings, FactSet as of October 13, 2023.

(1) Represents FY2023 ended July 2, 2023. Refer to page 13 for a reconciliation of these non-GAAP financial measures to the nearest GAAP equivalent and to Bowlero's public filings for additional information with

respect to Bowlero's historical financial results and non-GAAP financial measures, including definitions and footnotes with respect thereto. (2) Indicative one-year unlevered returns to Bowlero based on a dataset from

FY16-FY22, including gross investments of $150MM for Conversions, ~$155MM for Acquisitions and ~$65MM for New Builds. Acquisitions includes the benefit of subsequent sales of underlying land and/or centers.

New Build includes the benefit of Tenant Improvement Allowances.

VICI

2020

BOWLERO

Bowlero begins

in-center

gamification

initiatives

2021

Moneybowl

Bowlero goes

public in

December

2021 after

merging with

Isos

Bowlers

2022

In-center

gamification:

Launches

MoneyBowl

LUCKY STRIKE

2023

Bowlero

exceeds

$1.0Bn in total

FY23 revenue

Announces

acquisition of

Lucky Strike

7View entire presentation