AngloAmerican Results Presentation Deck

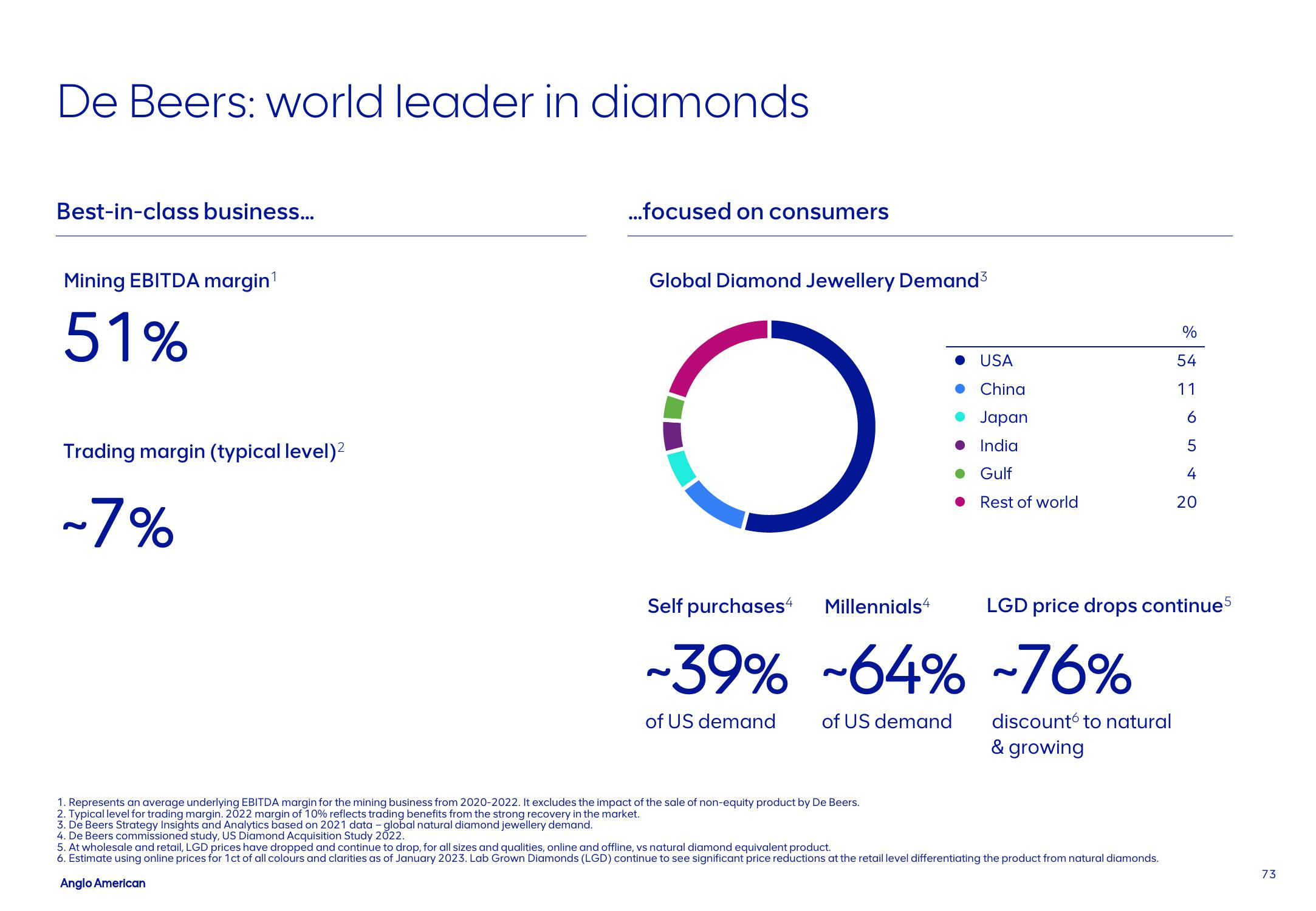

De Beers: world leader in diamonds

Best-in-class business...

Mining EBITDA margin¹

51%

Trading margin (typical level)²

~7%

...focused on consumers

Global Diamond Jewellery Demand³

O

USA

China

Japan

India

Gulf

Rest of world

Self purchases4 Millennials4

~39% ~64% ~76%

of US demand

of US demand

1. Represents an average underlying EBITDA margin for the mining business from 2020-2022. It excludes the impact of the sale of non-equity product by De Beers.

2. Typical level for trading margin. 2022 margin of 10% reflects trading benefits from the strong recovery in the market.

3. De Beers Strategy Insights and Analytics based on 2021 data - global natural diamond jewellery demand.

4. De Beers commissioned study, US Diamond Acquisition Study 2022.

LGD price drops continue5

discount to natural

& growing

%

54

11

6

5

4

20

5. At wholesale and retail, LGD prices have dropped and continue to drop, for all sizes and qualities, online and offline, vs natural diamond equivalent product.

6. Estimate using online prices for 1 ct of all colours and clarities as of January 2023. Lab Grown Diamonds (LGD) continue to see significant price reductions at the retail level differentiating the product from natural diamonds.

Anglo American

73View entire presentation