Kinnevik Results Presentation Deck

Intro

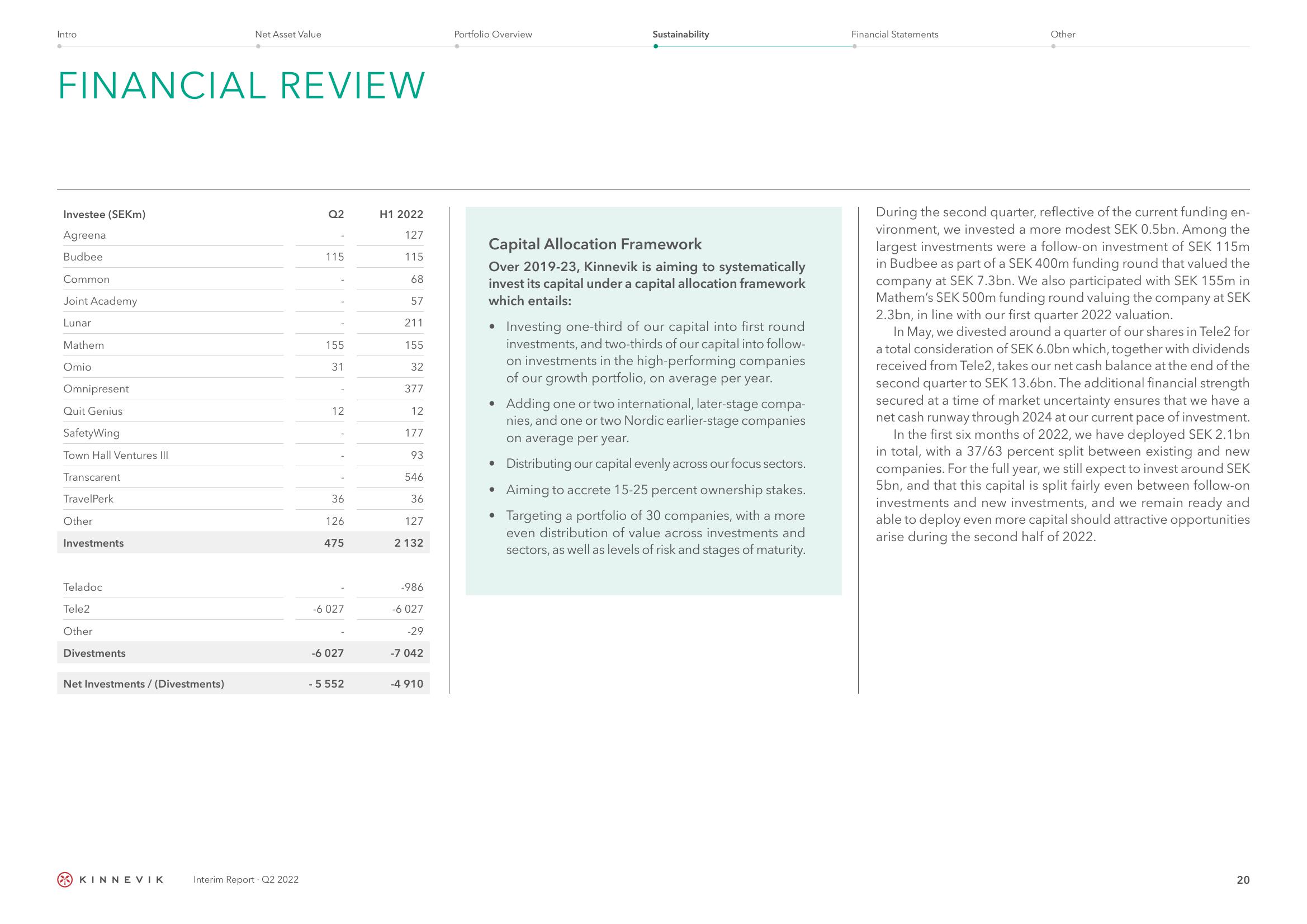

FINANCIAL REVIEW

Investee (SEKm)

Agreena

Budbee

Common

Joint Academy

Lunar

Mathem

Omio

Omnipresent

Quit Genius

SafetyWing

Town Hall Ventures III

Transcarent

TravelPerk

Other

Investments

Teladoc

Tele2

Other

Divestments

Net Investments / (Divestments)

Net Asset Value

KINNEVIK

Interim Report. Q2 2022

Q2

115

155

31]

12

36

126

475

-6 027

-6 027

- 5 552

H1 2022

127

115

68

57

211

155

32

377

12

177

93

546

36

127

2 132

-986

-6 027

-29

-7 042

-4910

Portfolio Overview

Sustainability

Capital Allocation Framework

Over 2019-23, Kinnevik is aiming to systematically

invest its capital under a capital allocation framework

which entails:

• Investing one-third of our capital into first round

investments, and two-thirds of our capital into follow-

on investments in the high-performing companies

of our growth portfolio, on average per year.

• Adding one or two international, later-stage compa-

nies, and one or two Nordic earlier-stage companies

on average per year.

Distributing our capital evenly across our focus sectors.

• Aiming to accrete 15-25 percent ownership stakes.

• Targeting a portfolio of 30 companies, with a more

even distribution of value across investments and

sectors, as well as levels of risk and stages of maturity.

●

Financial Statements

Other

During the second quarter, reflective of the current funding en-

vironment, we invested a more modest SEK 0.5bn. Among the

largest investments were a follow-on investment of SEK 115m

in Budbee as part of a SEK 400m funding round that valued the

company at SEK 7.3bn. We also participated with SEK 155m in

Mathem's SEK 500m funding round valuing the company at SEK

2.3bn, in line with our first quarter 2022 valuation.

In May, we divested around a quarter of our shares in Tele2 for

a total consideration of SEK 6.0bn which, together with dividends

received from Tele2, takes our net cash balance at the end of the

second quarter to SEK 13.6bn. The additional financial strength

secured at a time of market uncertainty ensures that we have a

net cash runway through 2024 at our current pace of investment.

In the first six months of 2022, we have deployed SEK 2.1bn

in total, with a 37/63 percent split between existing and new

companies. For the full year, we still expect to invest around SEK

5bn, and that this capital is split fairly even between follow-on

investments and new investments, and we remain ready and

able to deploy even more capital should attractive opportunities

arise during the second half of 2022.

20View entire presentation