Pershing Square Activist Presentation Deck

III. Pershing's Proposal to McDonald's:

McOpCo IPO

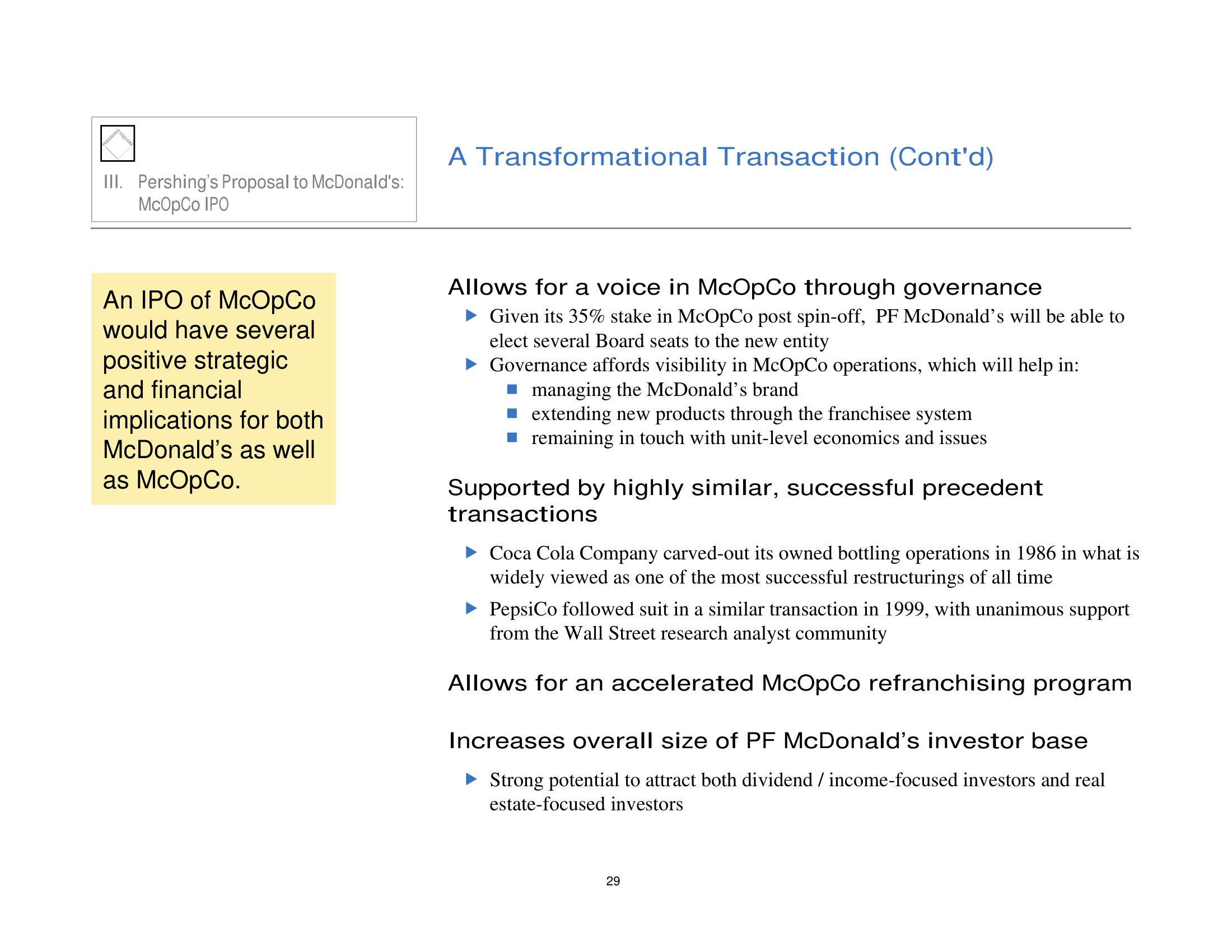

An IPO of McOpCo

would have several

positive strategic

and financial

implications for both

McDonald's as well

as McOpCo.

A Transformational Transaction (Cont'd)

Allows for a voice in McOpCo through governance

Given its 35% stake in McOpCo post spin-off, PF McDonald's will be able to

elect several Board seats to the new entity

Governance affords visibility in McOpCo operations, which will help in:

managing the McDonald's brand

extending new products through the franchisee system

remaining in touch with unit-level economics and issues

Supported by highly similar, successful precedent

transactions

► Coca Cola Company carved-out its owned bottling operations in 1986 in what is

widely viewed as one of the most successful restructurings of all time

PepsiCo followed suit in a similar transaction in 1999, with unanimous support

from the Wall Street research analyst community

Allows for an accelerated McOpCo refranchising program

Increases overall size of PF McDonald's investor base

Strong potential to attract both dividend / income-focused investors and real

estate-focused investors

29View entire presentation