Cannae SPAC Presentation Deck

optimalblue

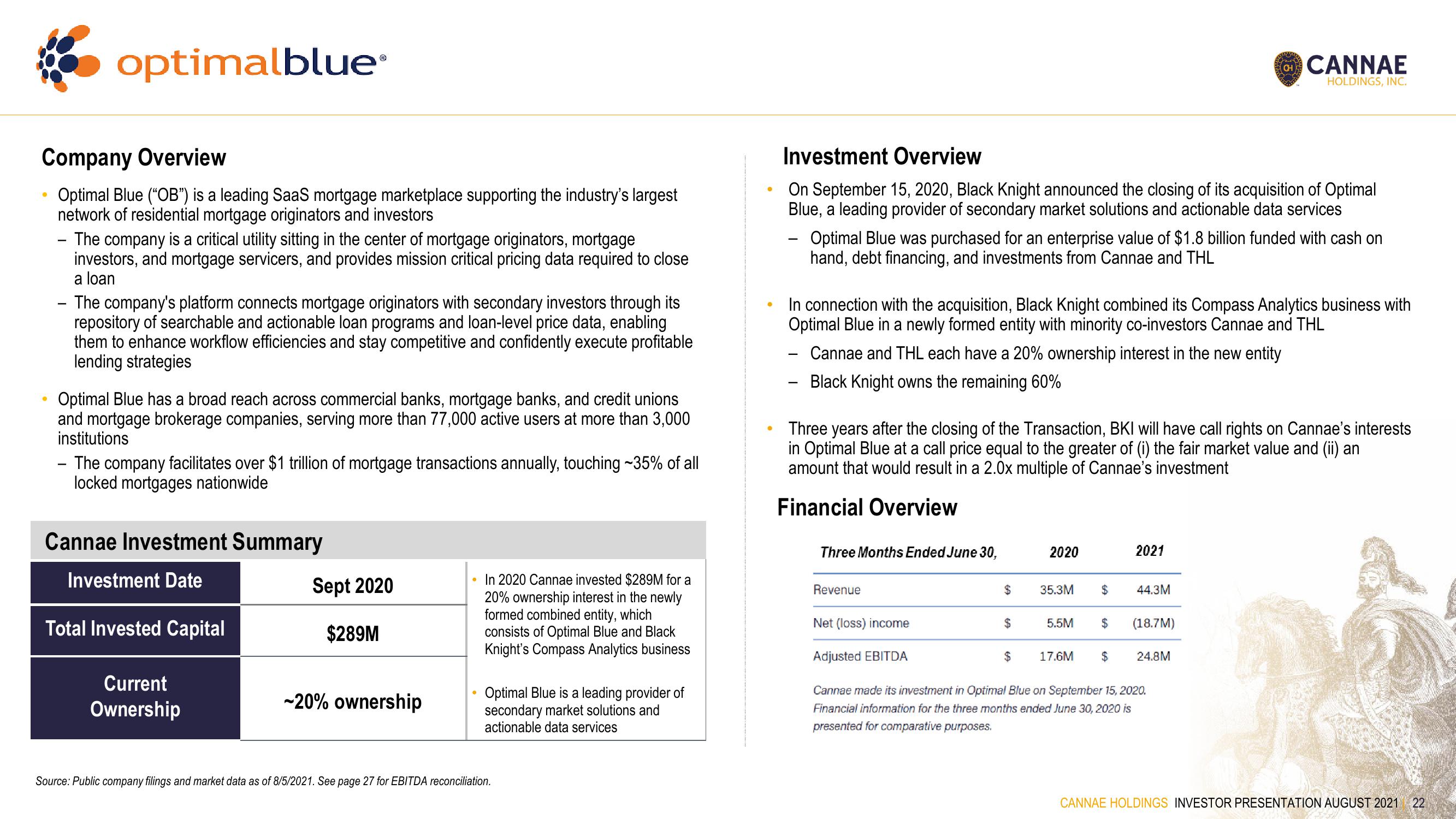

Company Overview

Optimal Blue ("OB") is a leading SaaS mortgage marketplace supporting the industry's largest

network of residential mortgage originators and investors

- The company is a critical utility sitting in the center of mortgage originators, mortgage

investors, and mortgage servicers, and provides mission critical pricing data required to close

a loan

Ⓡ

- The company's platform connects mortgage originators with secondary investors through its

repository of searchable and actionable loan programs and loan-level price data, enabling

them to enhance workflow efficiencies and stay competitive and confidently execute profitable

lending strategies

Optimal Blue has a broad reach across commercial banks, mortgage banks, and credit unions

and mortgage brokerage companies, serving more than 77,000 active users at more than 3,000

institutions

- The company facilitates over $1 trillion of mortgage transactions annually, touching -35% of all

locked mortgages nationwide

Cannae Investment Summary

Investment Date

Total Invested Capital

Current

Ownership

Sept 2020

$289M

~20% ownership

• In 2020 Cannae invested $289M for a

20% ownership interest in the newly

formed combined entity, which

consists of Optimal Blue and Black

Knight's Compass Analytics business

Optimal Blue is a leading provider of

secondary market solutions and

actionable data services

Source: Public company filings and market data as of 8/5/2021. See page 27 for EBITDA reconciliation.

●

Investment Overview

On September 15, 2020, Black Knight announced the closing of its acquisition of Optimal

Blue, a leading provider of secondary market solutions and actionable data services

Optimal Blue was purchased for an enterprise value of $1.8 billion funded with cash on

hand, debt financing, and investments from Cannae and THL

In connection with the acquisition, Black Knight combined its Compass Analytics business with

Optimal Blue in a newly formed entity with minority co-investors Cannae and THL

Cannae and THL each have a 20% ownership interest in the new entity

Black Knight owns the remaining 60%

Three Months Ended June 30,

Three years after the closing of the Transaction, BKI will have call rights on Cannae's interests

in Optimal Blue at a call price equal to the greater of (i) the fair market value and (ii) an

amount that would result in a 2.0x multiple of Cannae's investment

Financial Overview

Revenue

$

$

2020

$

35.3M $

Net (loss) income

Adjusted EBITDA

Cannae made its investment in Optimal Blue on September 15, 2020.

Financial information for the three months ended June 30, 2020 is

presented for comparative purposes.

5.5M

17.6M

$

2021

$

CH

44.3M

CANNAE

HOLDINGS, INC.

(18.7M)

24.8M

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 22View entire presentation