Sisecam Resources Investor Presentation Deck

Debt Position

EUR

31%

17,695

9M¹22

TRY RUB

1% 3%

USD

65%

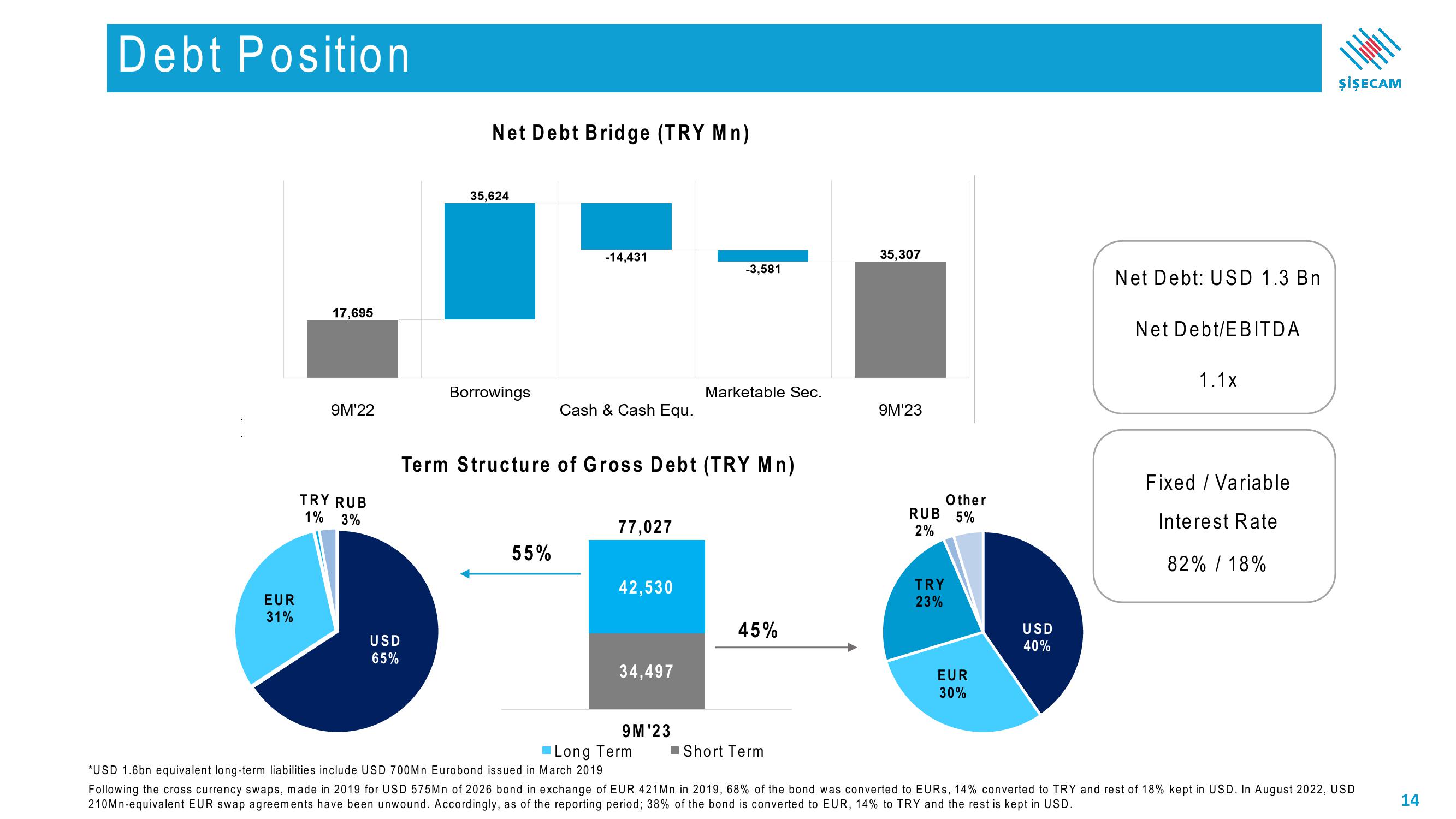

Net Debt Bridge (TRY Mn)

35,624

Borrowings

-14,431

55%

Cash & Cash Equ.

Term Structure of Gross Debt (TRY Mn)

77,027

42,530

34,497

-3,581

9M¹23

Marketable Sec.

45%

■ Short Term

35,307

9M¹23

Other

RUB 5%

2%

TRY

23%

EUR

30%

USD

40%

Net Debt: USD 1.3 Bn

Net Debt/EBITDA

1.1x

Fixed / Variable

Interest Rate

82% / 18%

I

ŞİŞECAM

Long Term

*USD 1.6bn equivalent long-term liabilities include USD 700Mn Eurobond issued in March 2019

Following the cross currency swaps, made in 2019 for USD 575Mn of 2026 bond in exchange of EUR 421Mn in 2019, 68% of the bond was converted to EURs, 14% converted to TRY and rest of 18% kept in USD. In August 2022, USD

210Mn-equivalent EUR swap agreements have been unwound. Accordingly, as of the reporting period; 38% of the bond is converted to EUR, 14% to TRY and the rest is kept in USD.

14View entire presentation