Antero Midstream Partners Investor Presentation Deck

Millions

Oil and Gas Price

Assumptions

0

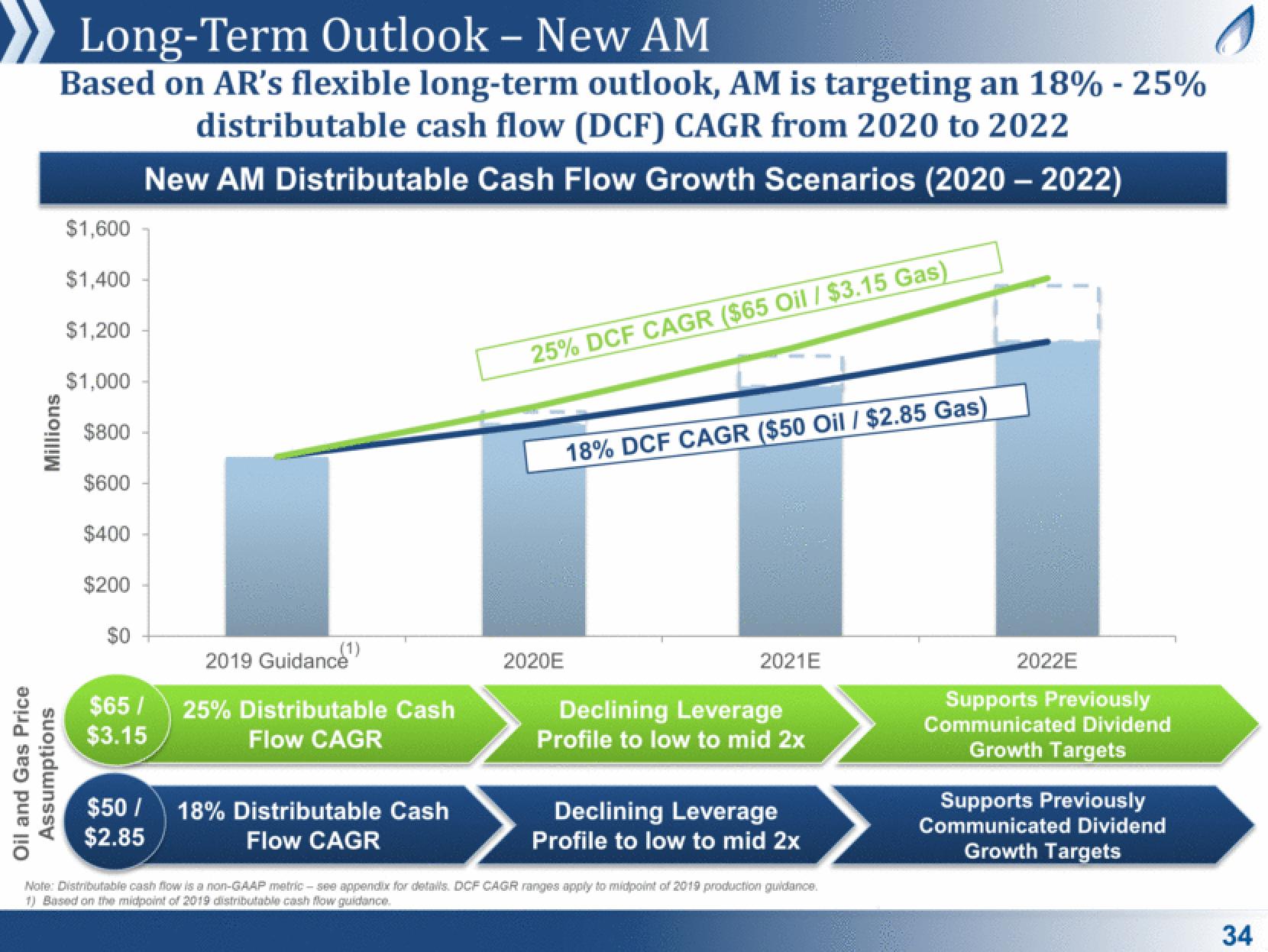

Long-Term Outlook - New AM

Based on AR's flexible long-term outlook, AM is targeting an 18% - 25%

distributable cash flow (DCF) CAGR from 2020 to 2022

New AM Distributable Cash Flow Growth Scenarios (2020-2022)

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

$65/

$3.15

2019 Guidance¹)

25% Distributable Cash

Flow CAGR

$50/ 18% Distributable Cash

$2.85

Flow CAGR

25% DCF CAGR ($65 Oil / $3.15 Gas)

2020E

18% DCF CAGR ($50 Oil / $2.85 Gas)

2021E

Declining Leverage

Profile to low to mid 2x

Declining Leverage

Profile to low to mid 2x

Note: Distributable cash flow is a non-GAAP metric-see appendix for details. DCF CAGR ranges apply to midpoint of 2019 production guidance.

1) Based on the midpoint of 2019 distributable cash flow guidance.

2022E

Supports Previously

Communicated Dividend

Growth Targets

Supports Previously

Communicated Dividend

Growth Targets

34View entire presentation