FY 2017 Second Quarter Earnings Call

Cash flow & debt 1

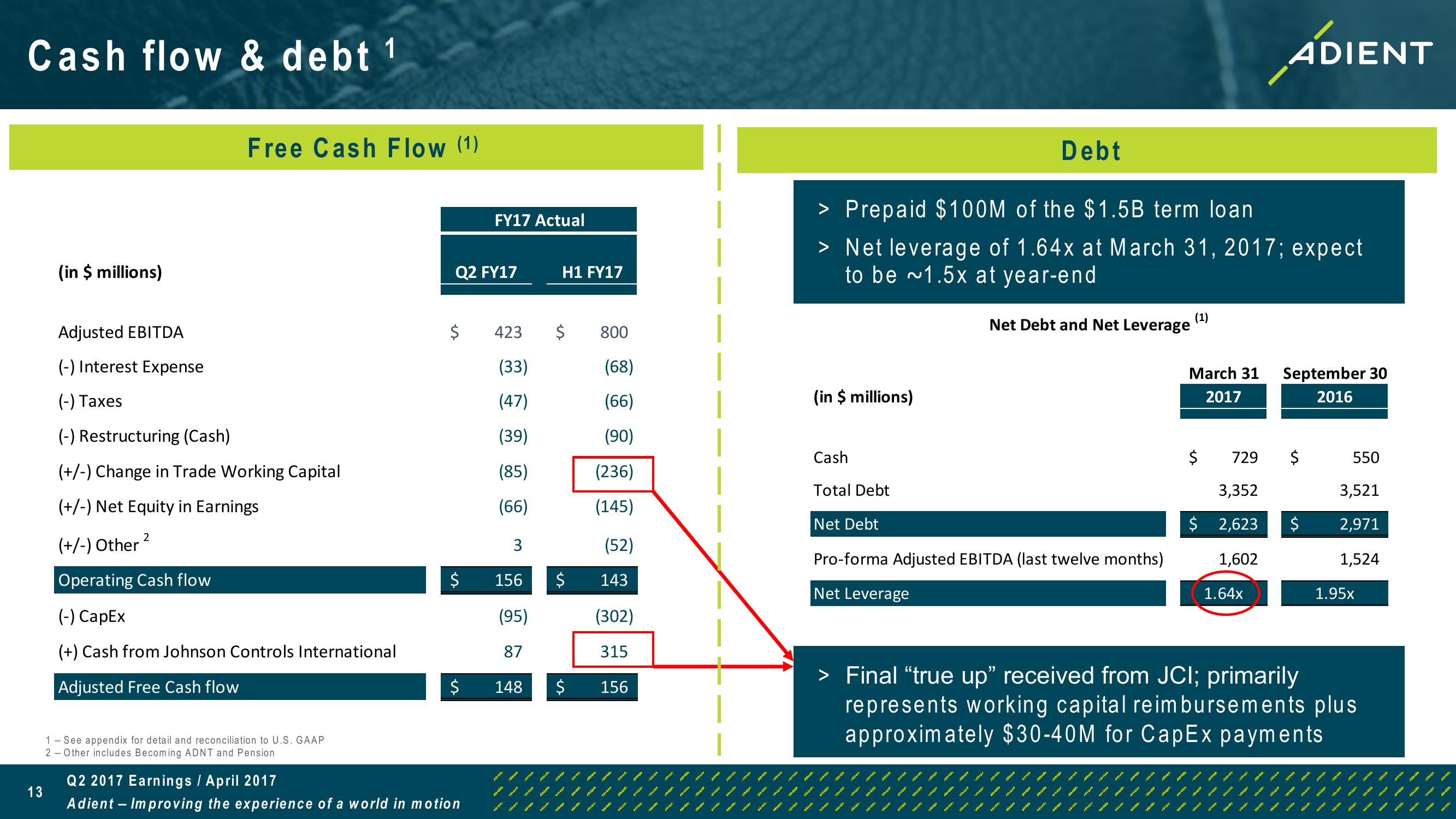

Free Cash Flow (1)

(in $ millions)

FY17 Actual

Q2 FY17

H1 FY17

ADIENT

Debt

> Prepaid $100M of the $1.5B term loan

> Net leverage of 1.64x at March 31, 2017; expect

to be ~1.5x at year-end

Adjusted EBITDA

(1)

Net Debt and Net Leverage

423

800

(-) Interest Expense

(33)

(68)

(-) Taxes

(47)

(66)

(in $ millions)

March 31

2017

September 30

2016

(-) Restructuring (Cash)

(39)

(90)

Cash

$

729 $

550

(+/-) Change in Trade Working Capital

(85)

(236)

Total Debt

3,352

3,521

(+/-) Net Equity in Earnings

(66)

(145)

Net Debt

$ 2,623

$

2,971

2

(+/-) Other

3

(52)

Pro-forma Adjusted EBITDA (last twelve months)

1,602

1,524

Operating Cash flow

$

156

ՄՌ

$

143

Net Leverage

1.64x

1.95x

(-) CapEx

(95)

(302)

(+) Cash from Johnson Controls International

Adjusted Free Cash flow

87

315

$

148

$

156

> Final "true up" received from JCI; primarily

represents working capital reimbursements plus

approximately $30-40M for CapEx payments

2

1 - See appendix for detail and reconciliation to U.S. GAAP

Other includes Becoming ADNT and Pension

Q2 2017 Earnings / April 2017

13

Adient - Improving the experience of a world in motionView entire presentation