Asos Results Presentation Deck

2023 asos

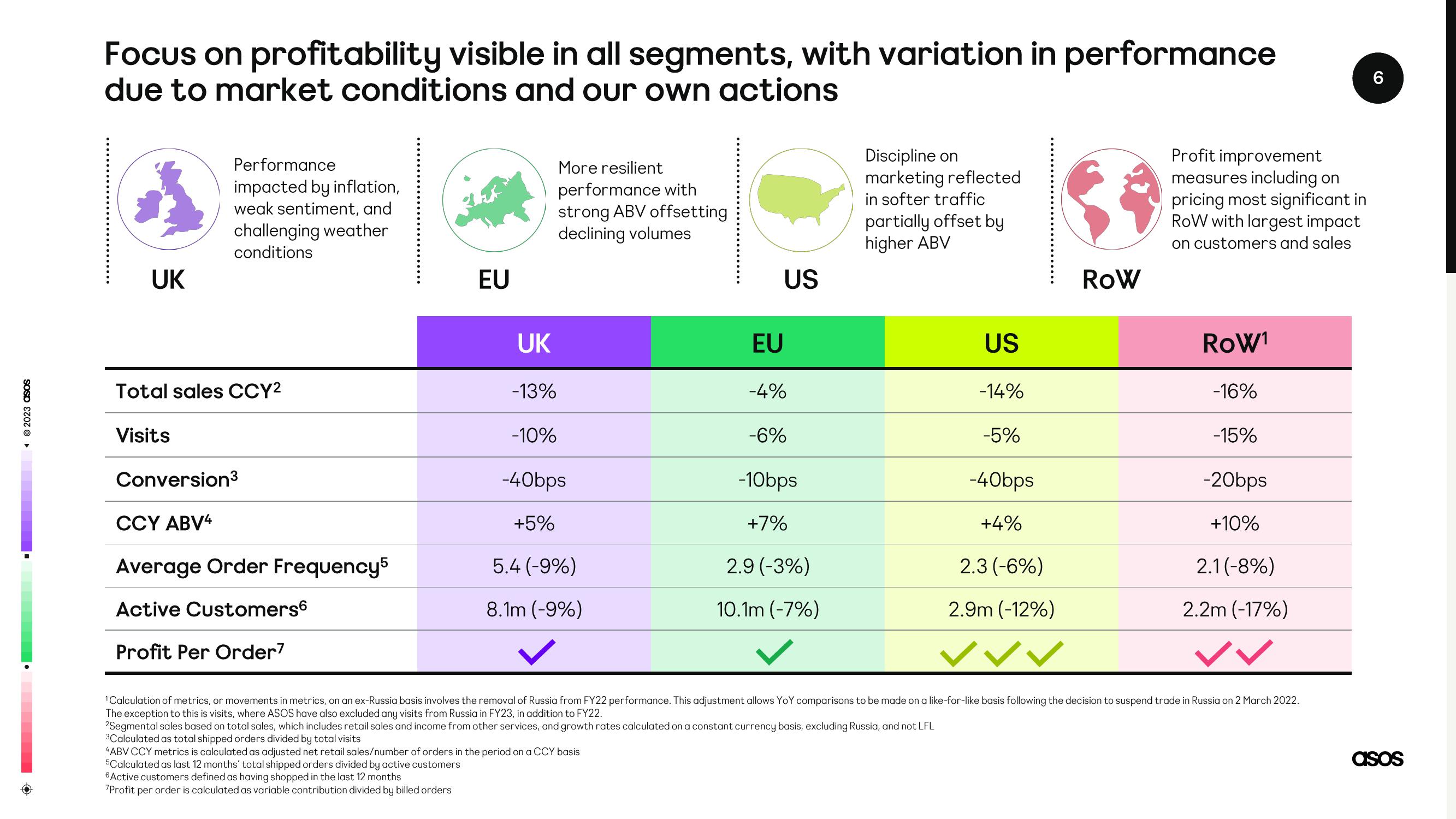

Focus on profitability visible in all segments, with variation in performance

due to market conditions and our own actions

UK

Performance

impacted by inflation,

weak sentiment, and

challenging weather

conditions

Total sales CCY²

Visits

Conversion³

CCY ABV4

Average Order Frequency5

Active Customers6

Profit Per Order7

EU

UK

-13%

-10%

More resilient

performance with

strong ABV offsetting

declining volumes

-40bps

+5%

5.4 (-9%)

8.1m (-9%)

EU

US

-4%

-6%

-10bps

+7%

2.9 (-3%)

10.1m (-7%)

Discipline on

marketing reflected

in softer traffic

partially offset by

higher ABV

US

-14%

-5%

-40bps

+4%

2.3 (-6%)

2.9m (-12%)

✓✓

ROW

Profit improvement

measures including on

pricing most significant in

ROW with largest impact

on customers and sales

ROW¹

-16%

-15%

-20bps

+10%

2.1 (-8%)

2.2m (-17%)

¹Calculation of metrics, or movements in metrics, on an ex-Russia basis involves the removal of Russia from FY22 performance. This adjustment allows YoY comparisons to be made on a like-for-like basis following the decision to suspend trade in Russia on 2 March 2022.

The exception to this is visits, where ASOS have also excluded any visits from Russia in FY23, in addition to FY22.

2Segmental sales based on total sales, which includes retail sales and income from other services, and growth rates calculated on a constant currency basis, excluding Russia, and not LFL

³Calculated as total shipped orders divided by total visits

"ABV CCY metrics is calculated as adjusted net retail sales/number of orders in the period on a CCY basis

5Calculated as last 12 months' total shipped orders divided by active customers

6Active customers defined as having shopped in the last 12 months

7Profit per order is calculated as variable contribution divided by billed orders

6

asosView entire presentation