Paya SPAC Presentation Deck

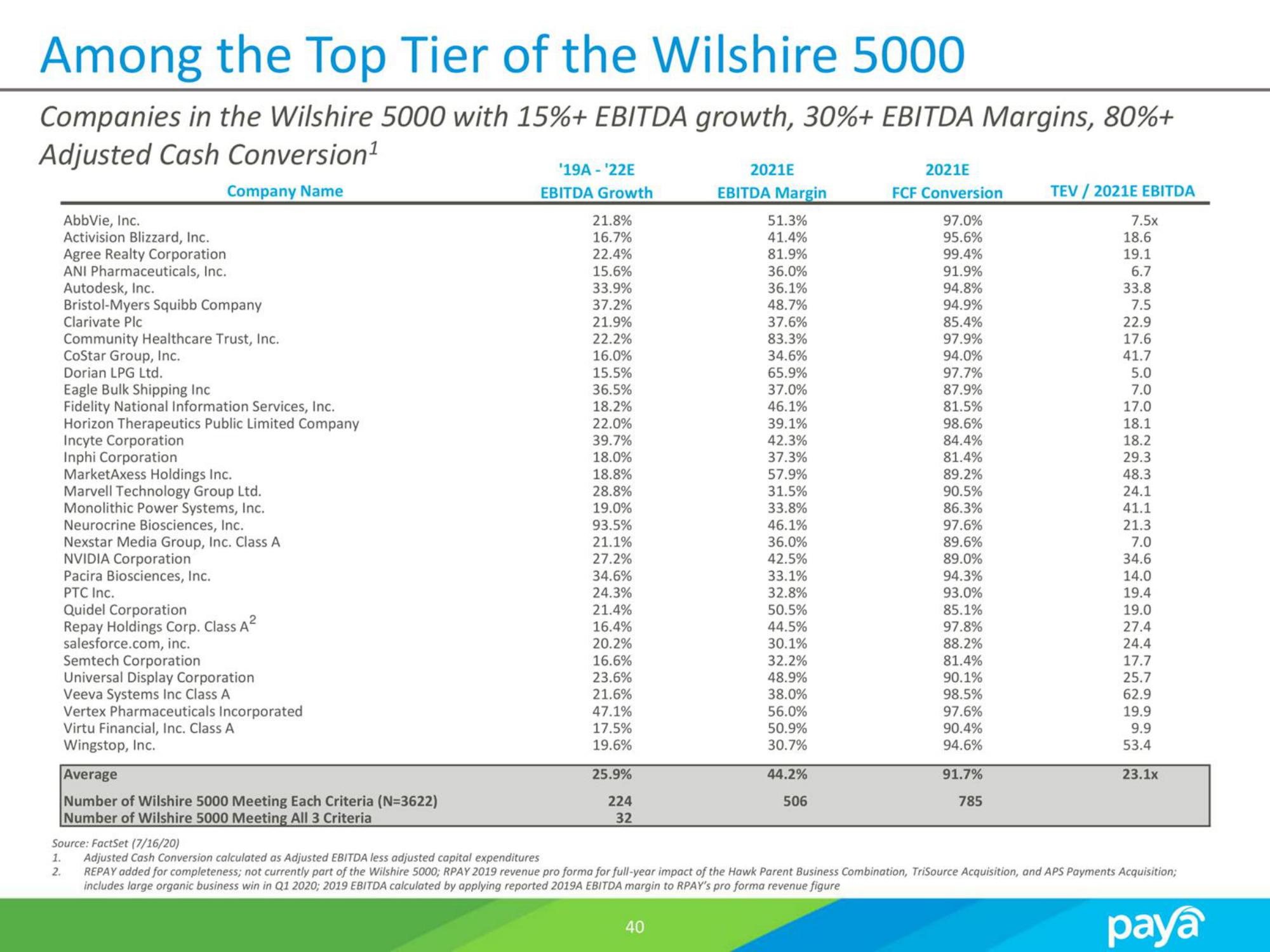

Among the Top Tier of the Wilshire 5000

Companies in the Wilshire 5000 with 15%+ EBITDA growth, 30%+ EBITDA Margins, 80%+

Adjusted Cash Conversion¹

Company Name

AbbVie, Inc.

Activision Blizzard, Inc.

Agree Realty Corporation

ANI Pharmaceuticals, Inc.

Autodesk, Inc.

Bristol-Myers Squibb Company

Clarivate Plc

Community Healthcare Trust, Inc.

CoStar Group, Inc.

Dorian LPG Ltd.

1.

2.

Eagle Bulk Shipping Inc

Fidelity National Information Services, Inc.

Horizon Therapeutics Public Limited Company

Incyte Corporation

Inphi Corporation

MarketAxess Holdings Inc.

Marvell Technology Group Ltd.

Monolithic Power Systems, Inc.

Neurocrine Biosciences, Inc.

Nexstar Media Group, Inc. Class A

NVIDIA Corporation

Pacira Biosciences, Inc.

PTC Inc.

Quidel Corporation

Repay Holdings Corp. Class A²

salesforce.com, inc.

Semtech Corporation

Universal Display Corporation

Veeva Systems Inc Class A

Vertex Pharmaceuticals Incorporated

Virtu Financial, Inc. Class A

Wingstop, Inc.

Average

Number of Wilshire 5000 Meeting Each Criteria (N=3622)

Number of Wilshire 5000 Meeting All 3 Criteria

'19A-¹22E

EBITDA Growth

21.8%

16.7%

22.4%

15.6%

33.9%

37.2%

21.9%

22.2%

16.0%

15.5%

36.5%

18.2%

22.0%

39.7%

18.0%

18.8%

28.8%

19.0%

93.5%

21.1%

27.2%

34.6%

24.3%

21.4%

16.4%

20.2%

16.6%

23.6%

21.6%

47.1%

17.5%

19.6%

25.9%

224

32

2021E

40

EBITDA Margin

51.3%

41.4%

81.9%

36.0%

36.1%

48.7%

37.6%

83.3%

34.6%

65.9%

37.0%

46.1%

39.1%

42.3%

37.3%

57.9%

31.5%

33.8%

46.1%

36.0%

42.5%

33.1%

32.8%

50.5%

44.5%

30.1%

32.2%

48.9%

38.0%

56.0%

50.9%

30.7%

44.2%

506

2021E

FCF Conversion

97.0%

95.6%

99.4%

91.9%

94.8%

94.9%

85.4%

97.9%

94.0%

97.7%

87.9%

81.5%

98.6%

84.4%

81.4%

89.2%

90.5%

86.3%

97.6%

89.6%

89.0%

94.3%

93.0%

85.1%

97.8%

88.2%

81.4%

90.1%

98.5%

97.6%

90.4%

94.6%

91.7%

785

TEV / 2021E EBITDA

7.5x

18.6

19.1

6.7

33.8

7.5

22.9

17.6

41.7

5.0

7.0

17.0

18.1

18.2

29.3

48.3

24.1

41.1

21.3

7.0

34.6

14.0

19.4

19.0

27.4

24.4

17.7

25.7

62.9

19.9

9.9

53.4

Source: FactSet (7/16/20)

Adjusted Cash Conversion calculated as Adjusted EBITDA less adjusted capital expenditures

REPAY added for completeness; not currently part of the Wilshire 5000; RPAY 2019 revenue pro forma for full-year impact of the Hawk Parent Business Combination, TriSource Acquisition, and APS Payments Acquisition;

includes large organic business win in Q1 2020; 2019 EBITDA calculated by applying reported 2019A EBITDA margin to RPAY's pro forma revenue figure

paya

23.1xView entire presentation