ironSource SPAC

BUSINESS MODEL & FINANCIAL OVERVIEW

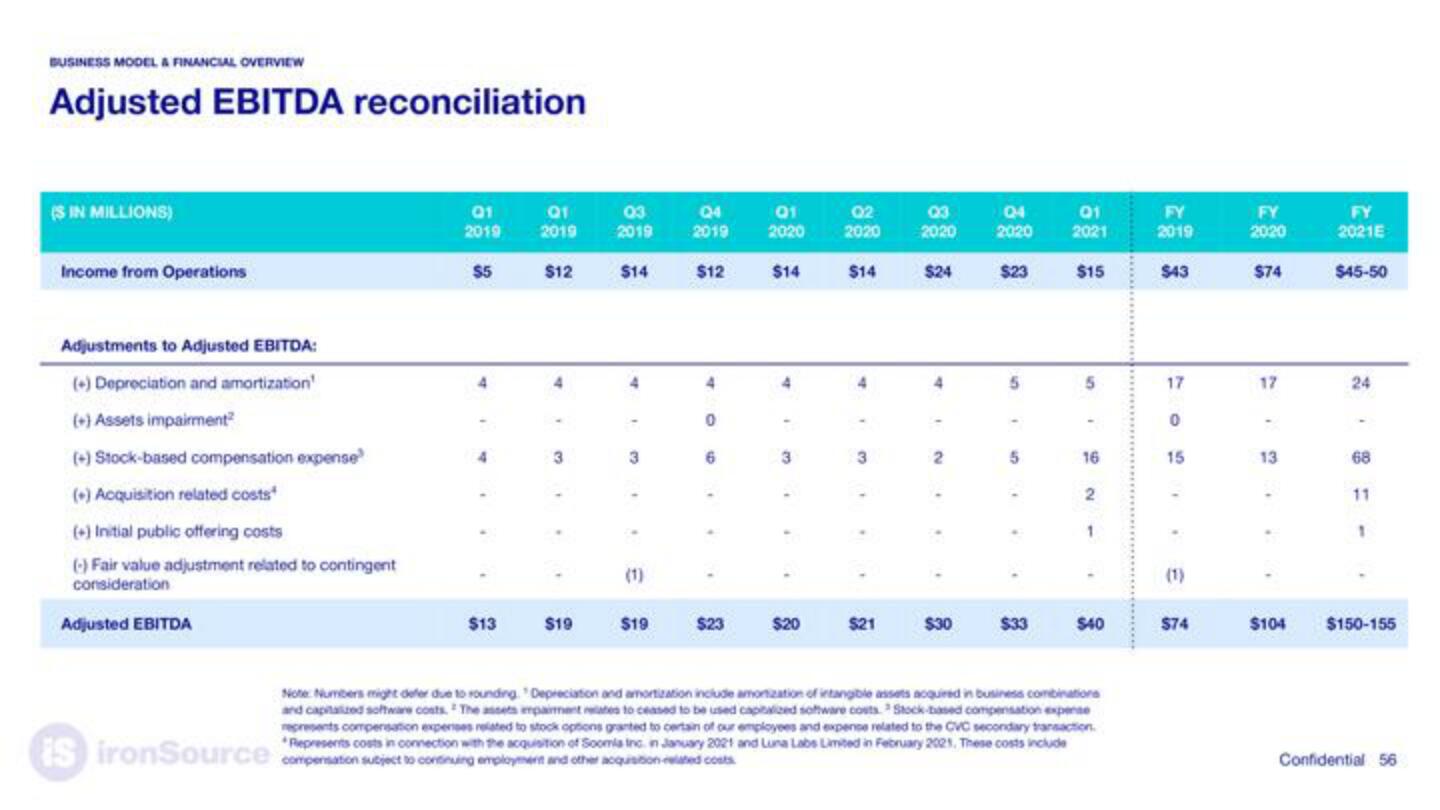

Adjusted EBITDA reconciliation

(S IN MILLIONS)

Income from Operations

Adjustments to Adjusted EBITDA:

(+) Depreciation and amortization

(+) Assets impairment

(+) Stock-based compensation expense

(+) Acquisition related costs

(+) Initial public offering costs

(-) Fair value adjustment related to contingent

consideration

Adjusted EBITDA

01

2019

$5

4

$13

01

2019

$12

3

$19

03

2019

$14

3

(1)

$19

Q4

01

2019 2020

$12

4

0

6

$23

$14

is ironSource compensation subject to continuing employment and other acquisition related costs

4

3

$20

02

2020

$14

3

$21

Q3

2020

$24

2

$30

Q4

2020

$23

5

5

$33

01

2021

$15

5

16

2

1

$40

Note: Numbers might defer due to rounding. "Depreciation and amortization include amortization of intangible assets acquired in business combinations

and capitalized software costs. The assets impaiment relates to ceased to be used capitalized software costs Stock-based compensation expense

represents compensation expenses related to stock options granted to certain of our employees and expence related to the CVC secondary transaction.

*Represents costs in connection with the acquisition of Soomla Inc. in January 2021 and Luna Labs Limited in February 2021. These costs include

FY

2019

$43

17

0

15

(1)

$74

FY

2020

$74

17

13

$104

FY

2021E

$45-50

24

68

11

1

.

$150-155

Confidential 56View entire presentation