Baird Investment Banking Pitch Book

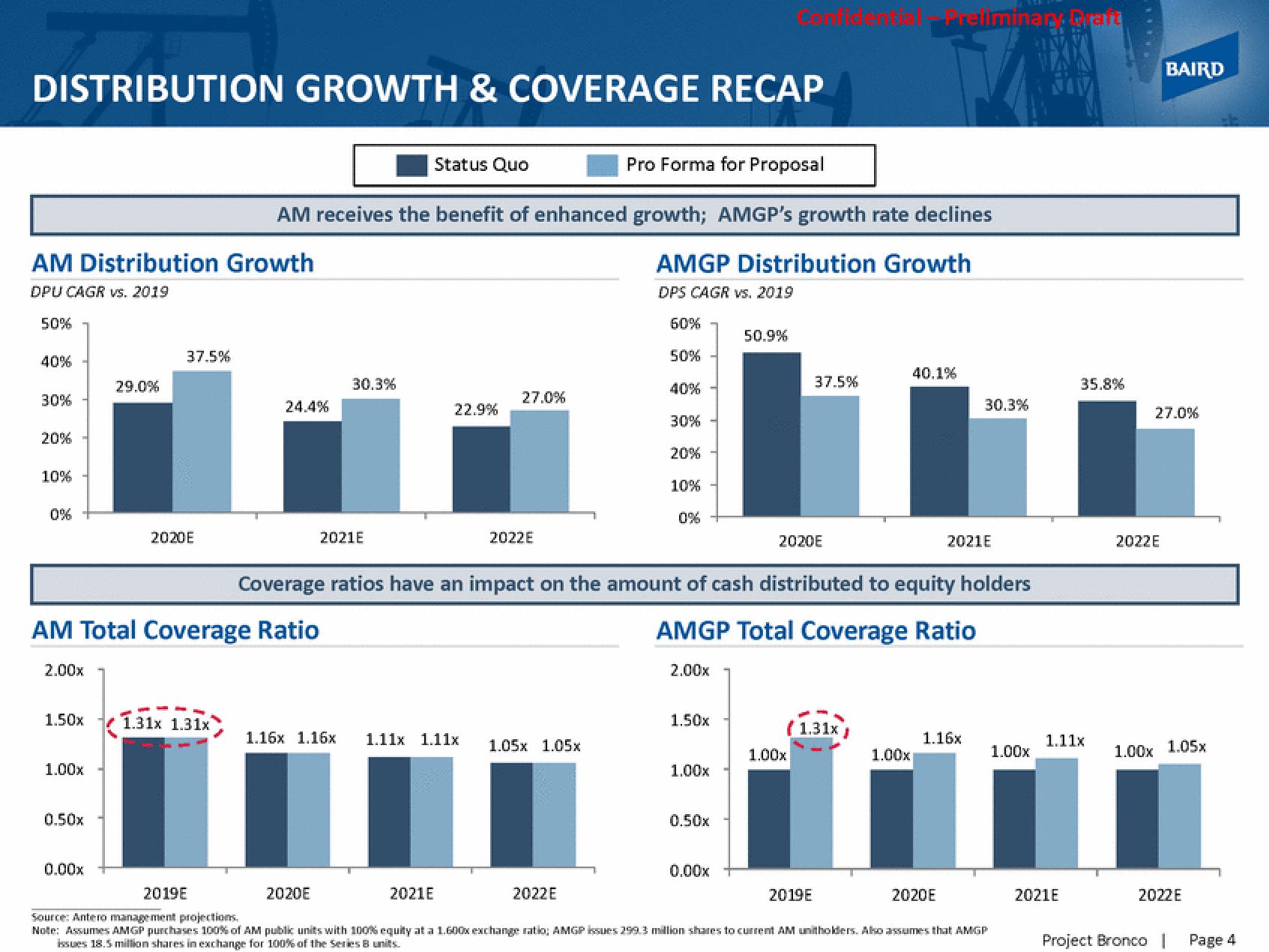

DISTRIBUTION GROWTH & COVERAGE RECAP

AM Distribution Growth

DPU CAGR vs. 2019

50%

40%

30%

20%

10%

2.00x

1.50x

1.00x

0.50x

29.0%

0.00x

37.5%

AM Total Coverage Ratio

2020E

Pro Forma for Proposal

AM receives the benefit of enhanced growth; AMGP's growth rate declines

AMGP Distribution Growth

DPS CAGR vs. 2019

1.31x 1.31x

24.4%

30.3%

2021E

Status Quo

2020E

22.9%

1.16x 1.16x 1.11x 1.11x

27.0%

2021E

2022E

1.05x 1.05x

60%

50%

40%

30%

20%

2022E

10%

0%

Coverage ratios have an impact on the amount of cash distributed to equity holders

AMGP Total Coverage Ratio

2.00x

1.50x

1.00x

0.50x

50.9%

0.00x

2020E

37.5%

(1.31x)

1.00x

2019E

Treliminary Grant

1.00x

40.1%

2019E

Source: Antero management projections.

Note: Assumes AMGP purchases 100% of AM public units with 100% equity at a 1.600x exchange ratio; AMGP issues 299.3 million shares to current AM unitholders. Also assumes that AMGP

issues 18.5 million shares in exchange for 100% of the Series 8 units.

30.3%

2021E

1.16x

2020E

1.00x

35.8%

1.11x

2021E

**********

2022E

BAIRD

27.0%

1.00x 1.05x

Project Bronco

2022E

Page 4View entire presentation