First Quarter 2017 Financial Review

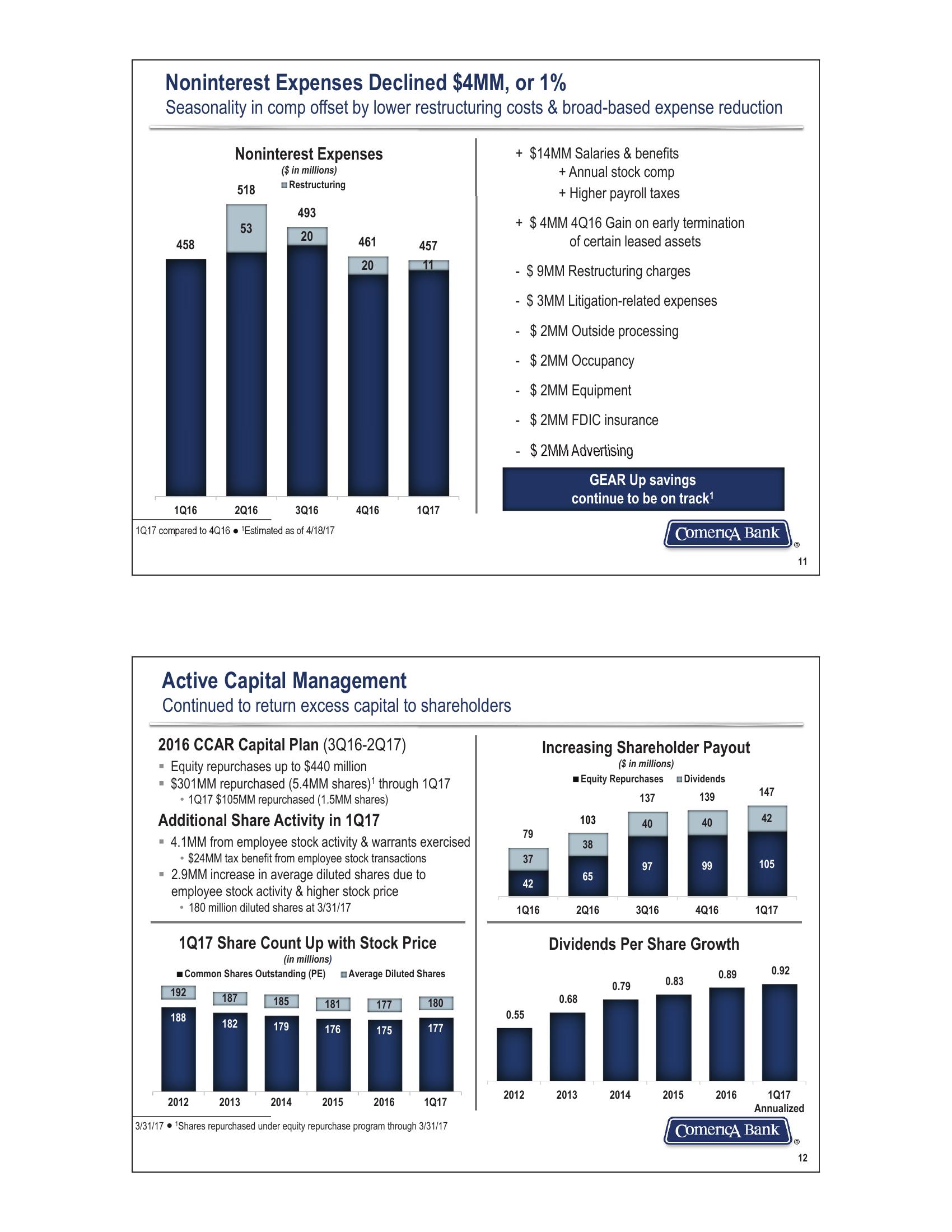

Noninterest Expenses Declined $4MM, or 1%

Seasonality in comp offset by lower restructuring costs & broad-based expense reduction

Noninterest Expenses

518

($ in millions)

Restructuring

493

53

20

458

461

457

20

11

+ $14MM Salaries & benefits

+ Annual stock comp

+ Higher payroll taxes

+ $4MM 4Q16 Gain on early termination

of certain leased assets

-

-

- $ 9MM Restructuring charges

- $3MM Litigation-related expenses

$2MM Outside processing

$2MM Occupancy

1Q16

2Q16

3Q16

1Q17 compared to 4Q16 Estimated as of 4/18/17

4Q16

1Q17

-

$ 2MM Equipment

-

$2MM FDIC insurance

$2MM Advertising

GEAR Up savings

continue to be on track¹

Comerica Bank

Active Capital Management

Continued to return excess capital to shareholders

2016 CCAR Capital Plan (3Q16-2017)

Increasing Shareholder Payout

Equity repurchases up to $440 million

($ in millions)

$301MM repurchased (5.4MM shares)1 through 1Q17

■Equity Repurchases

Dividends

147

⚫1Q17 $105MM repurchased (1.5MM shares)

137

139

Additional Share Activity in 1Q17

103

42

40

40

79

■ 4.1MM from employee stock activity & warrants exercised

38

•

$24MM tax benefit from employee stock transactions

37

97

99

105

105

■ 2.9MM increase in average diluted shares due to

65

42

employee stock activity & higher stock price

180 million diluted shares at 3/31/17

1Q17 Share Count Up with Stock Price

1Q16

2Q16

3Q16

4Q16 1Q17

Dividends Per Share Growth

(in millions)

■Common Shares Outstanding (PE)

Average Diluted Shares

0.89

0.92

0.83

0.79

192

187

185

0.68

181

177

180

188

0.55

182

179

176

175

177

11

T

2012

2013

2014

2015

2016

2012

2013

2014

2015

2016

1Q17

1Q17

Annualized

3/31/17 1Shares repurchased under equity repurchase program through 3/31/17

Comerica Bank

12View entire presentation