J.P.Morgan Results Presentation Deck

Asset & Wealth Management¹

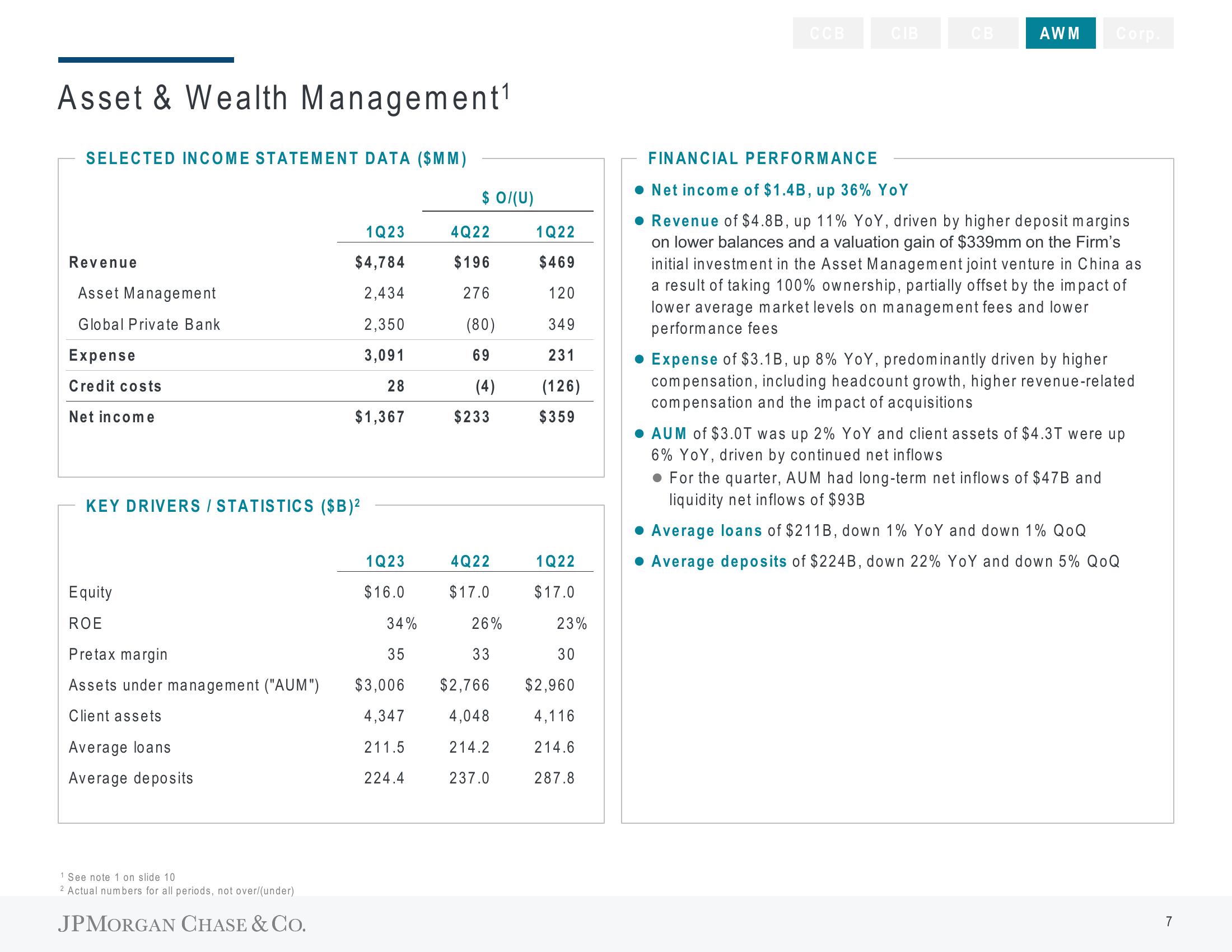

SELECTED INCOME STATEMENT DATA ($MM)

Revenue

Asset Management

Global Private Bank

Expense

Credit costs

Net income

KEY DRIVERS / STATISTICS ($B)²

Equity

ROE

Pretax margin

Assets under management ("AUM")

Client assets

Average loans

Average deposits

1Q23

$4,784

2,434

2,350

3,091

28

$1,367

1 See note 1 on slide 10

2 Actual numbers for all periods, not over/(under)

JPMORGAN CHASE & CO.

1Q23

$16.0

34%

35

$3,006

4,347

211.5

224.4

$ 0/(U)

4Q22

$196

276

(80)

69

(4)

$233

4Q22

$17.0

26%

33

$2,766

4,048

214.2

237.0

1Q22

$469

120

349

231

(126)

$359

1Q22

$17.0

23%

30

$2,960

4,116

214.6

287.8

CCB

CIB

AWM Corp.

FINANCIAL PERFORMANCE

• Net income of $1.4B, up 36% YoY

• Revenue of $4.8B, up 11% YoY, driven by higher deposit margins

on lower balances and a valuation gain of $339mm on the Firm's

initial investment in the Asset Management joint venture in China as

a result of taking 100% ownership, partially offset by the impact of

lower average market levels on management fees and lower

performance fees

• Expense of $3.1B, up 8% YoY, predominantly driven by higher

compensation, including headcount growth, higher revenue-related

compensation and the impact of acquisitions

• AUM of $3.0T was up 2% YoY and client assets of $4.3T were up

6% YOY, driven by continued net inflows

. For the quarter, AUM had long-term net inflows of $47B and

liquidity net inflows of $93B

Average loans of $211B, down 1% YoY and down 1% QOQ

Average deposits of $224B, down 22% YoY and down 5% QOQ

7View entire presentation