Pathward Financial Results Presentation Deck

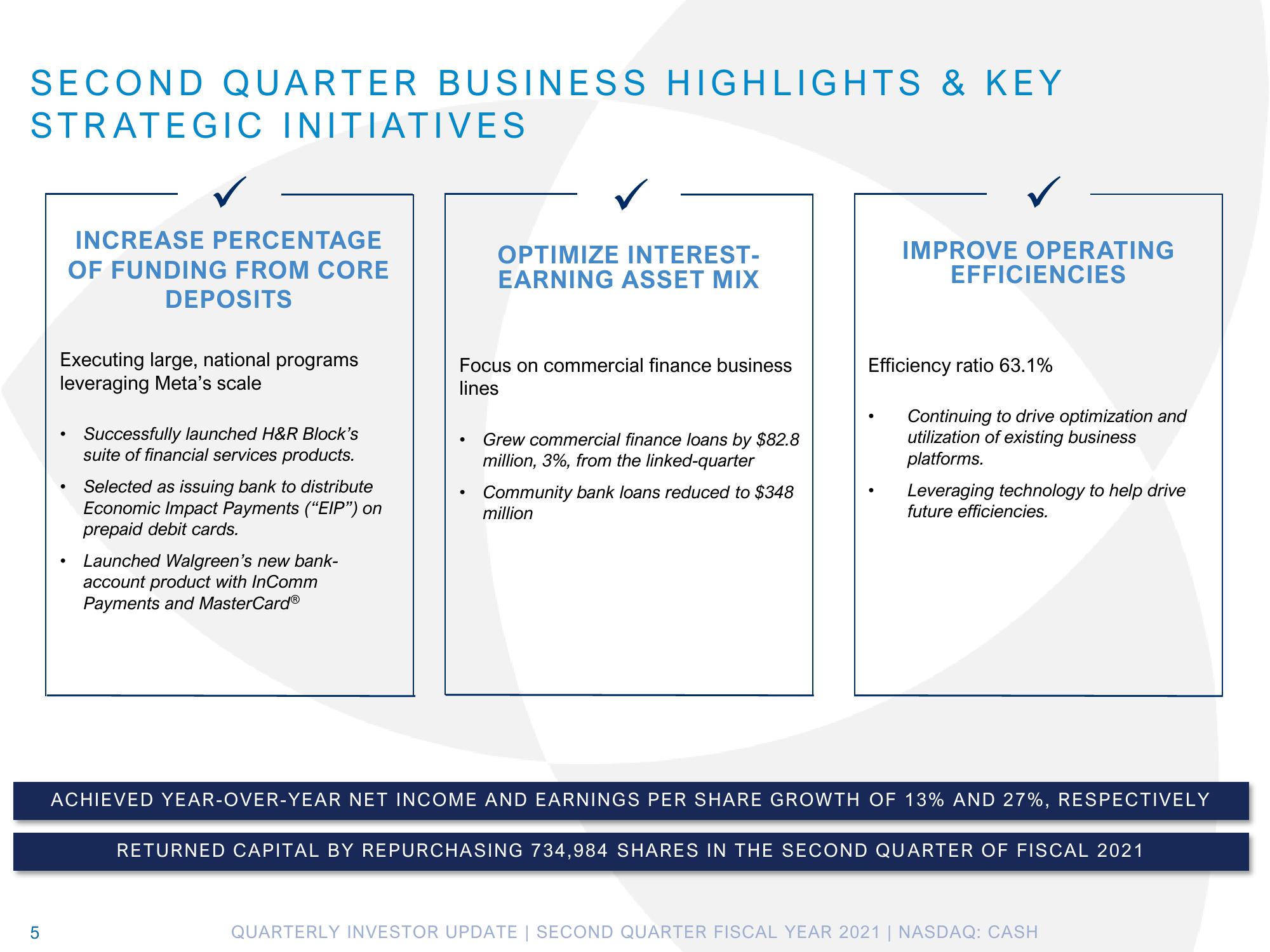

SECOND QUARTER BUSINESS HIGHLIGHTS & KEY

STRATEGIC INITIATIVES

LO

5

Executing large, national programs

leveraging Meta's scale

●

INCREASE PERCENTAGE

OF FUNDING FROM CORE

DEPOSITS

●

Successfully launched H&R Block's

suite of financial services products.

Selected as issuing bank to distribute

Economic Impact Payments ("EIP”) on

prepaid debit cards.

Launched Walgreen's new bank-

account product with InComm

Payments and MasterCard®

OPTIMIZE INTEREST-

EARNING ASSET MIX

Focus on commercial finance business

lines

●

Grew commercial finance loans by $82.8

million, 3%, from the linked-quarter

Community bank loans reduced to $348

million

IMPROVE OPERATING

EFFICIENCIES

Efficiency ratio 63.1%

Continuing to drive optimization and

utilization of existing business

platforms.

Leveraging technology to help drive

future efficiencies.

ACHIEVED YEAR-OVER-YEAR NET INCOME AND EARNINGS PER SHARE GROWTH OF 13% AND 27%, RESPECTIVELY

RETURNED CAPITAL BY REPURCHASING 734,984 SHARES IN THE SECOND QUARTER OF FISCAL 2021

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASHView entire presentation