Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

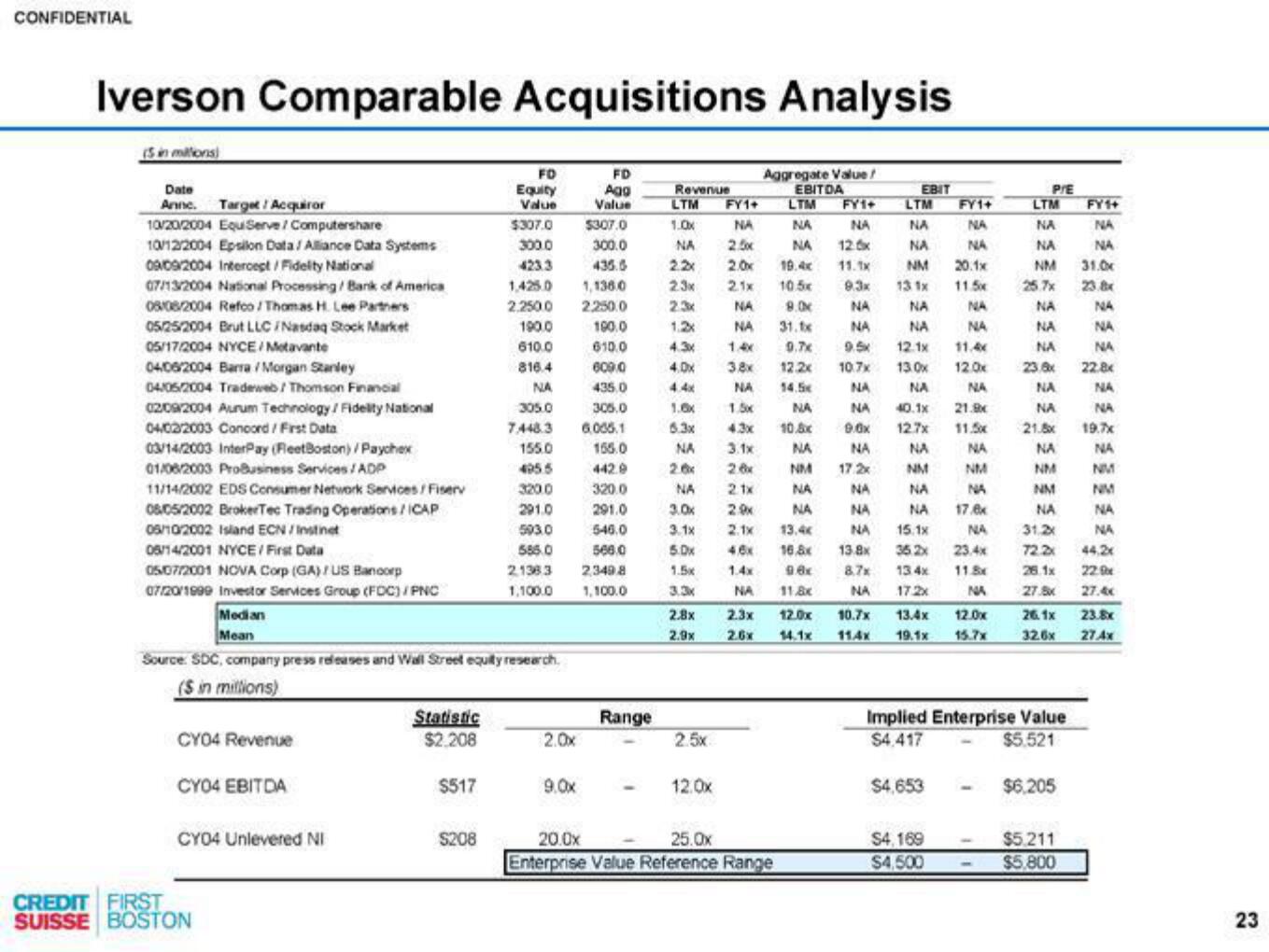

Iverson Comparable Acquisitions Analysis

(Sin millions)

Date

Anne. Target /Acquiror

10/20/2004 Equi Serve/ Computershare

10/12/2004 Epsilon Data / Alliance Data Systems

09/09/2004 Intercept/Fidelity National

07/13/2004 National Processing/ Bank of America

08/06/2004 Refco /Thomas H. Lee Partners

05/25/2004 Brut LLC/Nasdaq Stock Market

05/17/2004 NYCE/Motavante

04/06/2004 Barra/Morgan Stanley

04/05/2004 Tradeweb/Thomson Financial

02/09/2004 Aurum Technology/Fidelity National

04/02/2003 Concord / First Data

03/14/2003 InterPay (ReetBoston)/Paychex

01/06/2003 ProBusiness Services/ADP

11/14/2002 EDS Consumer Network Services / Fiserv

08/05/2002 BrokerTec Trading Operations/ICAP

05/10/2002 Island ECN / Instinet

05/14/2001 NYCE/First Data

05/07/2001 NOVA Corp (GA) US Banoorp

07/20/1999 Investor Services Group (FOC)/PNC

Median

Mean

CY04 Revenue

CY04 EBITDA

CY04 Unlevered NI

Source: SDC, company press releases and Wall Street equity research.

($ in millions)

CREDIT FIRST

SUISSE BOSTON

Statistic

$2.208

$517

FO

Equity

Value

$208

$307.0

300.0

423.3

1.425.0

2.250.0

190.0

610.0

816.4

NA

305.0

7.448.3

155.0

495.5

320.0

291.0

593.0

555.0

2.0x

FD

Agg

Value

9.0x

$307.0

300.0

435.6

1,136.0

2.250.0

2.138.3

2,349.8

1,100.0 1,100.0

190.0

610.0

609.0

435.0

305.0

6.005.1

155.0

442.9

320.0

291.0

546.0

566.0

Range

Revenue

LTM

1.0x NA

NA 2.5x

22x 2.0x

2.3x

2.3x

1.2x

4.3x

4.0x

6.3x

NA

26x

NA

3.0x

3.1x

5.0x

1.5x

3.3x

2.8x

2.9x

2.5x

Aggregate Value!

EBITDA

FY1+ LTM FY1+

EBIT

LTM FY1+

NA

NA NA

NA 12.0x

19.4x 11.1x

21x 105, 9.3x

NA

NA

NM

13 1x

NA

20.1x

115

NA

NA 9.0k

NA

NA

NA 31.tx NA NA

NA

1.4x 9.7x 9.5x 12.1x 11.4x

38x 12.2x 10.7x 13.0x 12.0x

NA 14.5

1.5x

NA

NA

9.0x

NA

NA

40.1x

12.7x

NA

21.9x

11.50

NA

4.3x 10.8x

3.1x NA

28x

NA

NA

NM 17.2x

NM

NM

2.1x

NA

NA

NA

NA

2.9x

NA

NA

NA 17.8x

2.1x

13.4x NA 15.1x NA

4.6x 16,8x 13.8x 35.2x 23.4x

1.4x 9.6x 8.7x 13.4x 11.8x

NA 11.8x

NA 17.2x NA

2.3x 12.0x 10.7x 13.4x 12.0x

2.6x 14.1x

19.1x 15.7x

114x

12.0x

20.0x

25.0x

Enterprise Value Reference Range

$4,653

Implied Enterprise Value

$4.417

$5.521

$4,169

$4,500

P/E

LTM FY1+

NA

NA

NA

NM

25.7x

NA

31.0x

23.8x

NA

NA

NA

NA

NA

NA

23.8x

22.8x

NA

NA

NA

NA

21.8x 19.7x

NA

NA

NM

NM

NM

NM

NA

NA

NA

44,2x

22.9x

27.4x

-

31.2x

72.2x

26.1x

27.8x

26.1x

32.6x 27.Ax

23.8x

$6,205

$5,211

$5.800

23View entire presentation