Navitas SPAC Presentation Deck

Transaction Summary

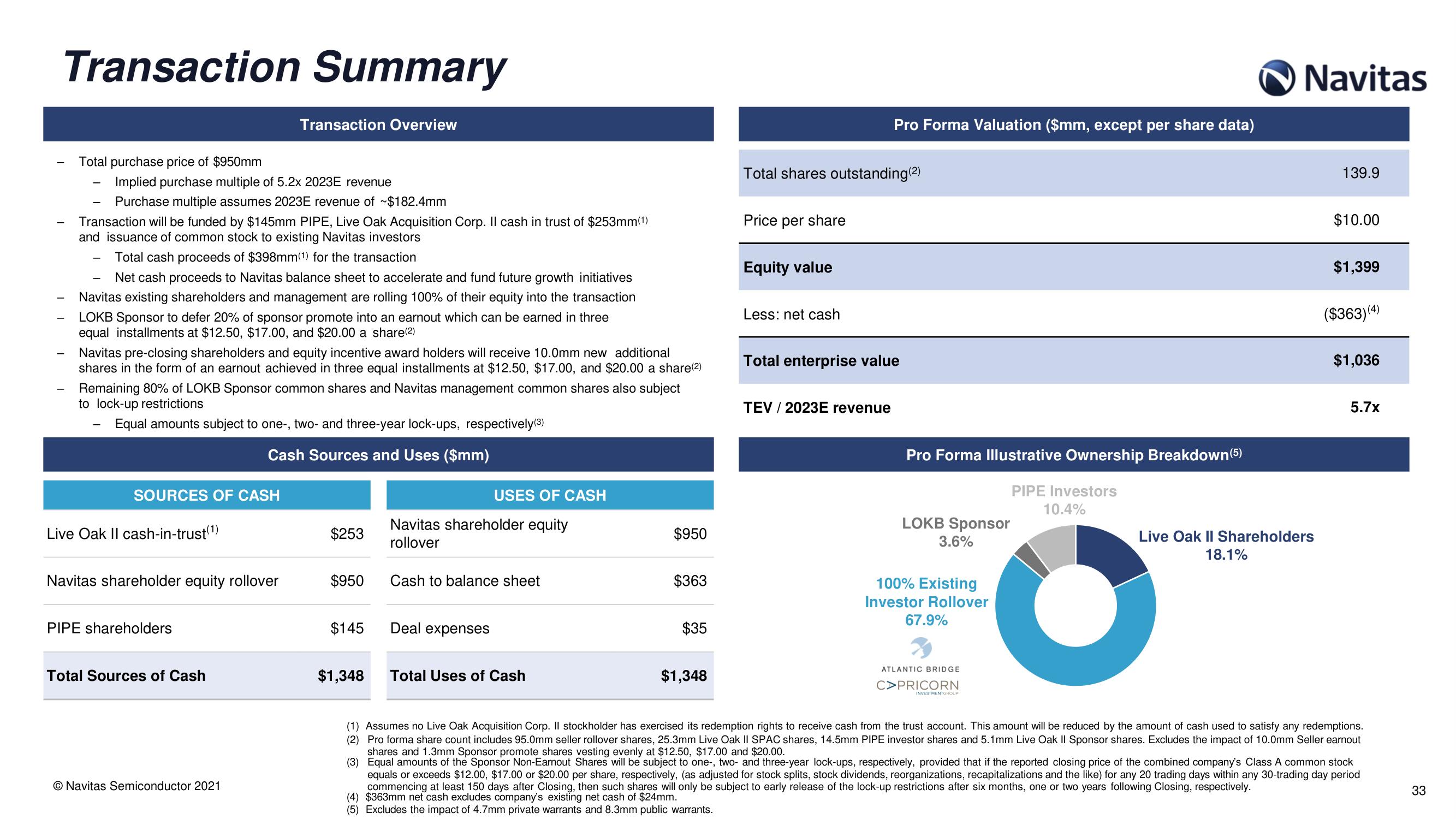

Total purchase price of $950mm

Implied purchase multiple of 5.2x 2023E revenue

Purchase multiple assumes 2023E revenue of ~$182.4mm

Transaction will be funded by $145mm PIPE, Live Oak Acquisition Corp. Il cash in trust of $253mm(1)

and issuance of common stock to existing Navitas investors

Total cash proceeds of $398mm(1) for the transaction

Net cash proceeds to Navitas balance sheet to accelerate and fund future growth initiatives

Navitas existing shareholders and management are rolling 100% of their equity into the transaction

LOKB Sponsor to defer 20% of sponsor promote into an earnout which can be earned in three

equal installments at $12.50, $17.00, and $20.00 a share(²)

Navitas pre-closing shareholders and equity incentive award holders will receive 10.0mm new additional

shares in the form of an earnout achieved in three equal installments at $12.50, $17.00, and $20.00 a share(²)

Remaining 80% of LOKB Sponsor common shares and Navitas management common shares also subject

to lock-up restrictions

Equal amounts subject one-, two- and three-year lock-ups, respectively (3)

Cash Sources and Uses ($mm)

SOURCES OF CASH

Live Oak II cash-in-trust(¹)

Navitas shareholder equity rollover

PIPE shareholders

Transaction Overview

Total Sources of Cash

O Navitas Semiconductor 2021

$253

$950

$145

USES OF CASH

Navitas shareholder equity

rollover

Cash to balance sheet

Deal expenses

$1,348 Total Uses of Cash

$950

$363

$35

$1,348

Total shares outstanding (2)

Price per share

Equity value

Less: net cash

Pro Forma Valuation ($mm, except per share data)

Total enterprise value

TEV / 2023E revenue

Pro Forma Illustrative Ownership Breakdown (5)

PIPE Investors

10.4%

LOKB Sponsor

3.6%

100% Existing

Investor Rollover

67.9%

7

ATLANTIC BRIDGE

C>PRICORN

INVESTMENTGROUP

Navitas

Live Oak II Shareholders

18.1%

139.9

$10.00

$1,399

($363) (4)

$1,036

5.7x

(1) Assumes no Live Oak Acquisition Corp. Il stockholder has exercised its redemption rights to receive cash from the trust account. This amount will be reduced by the amount of cash used to satisfy any redemptions.

(2) Pro forma share count includes 95.0mm seller rollover shares, 25.3mm Live Oak II SPAC shares, 14.5mm PIPE investor shares and 5.1 mm Live Oak II Sponsor shares. Excludes the impact of 10.0mm Seller earnout

shares and 1.3mm Sponsor promote shares vesting evenly at $12.50, $17.00 and $20.00.

(3) Equal amounts of the Sponsor Non-Earnout Shares will be subject to one-, two- and three-year lock-ups, respectively, provided that if the reported closing price of the combined company's Class A common stock

equals or exceeds $12.00, $17.00 or $20.00 per share, respectively, (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within any 30-trading day period

commencing at least 150 days after Closing, then such shares will only be subject to early release of the lock-up restrictions after six months, one or two years following Closing, respectively.

(4) $363mm net cash excludes company's existing net cash of $24mm.

(5) Excludes the impact of 4.7mm private warrants and 8.3mm public warrants.

33View entire presentation