Vale Investor Conference Presentation Deck

2022 BofA Securities Global Metals, Mining & Steel Conference

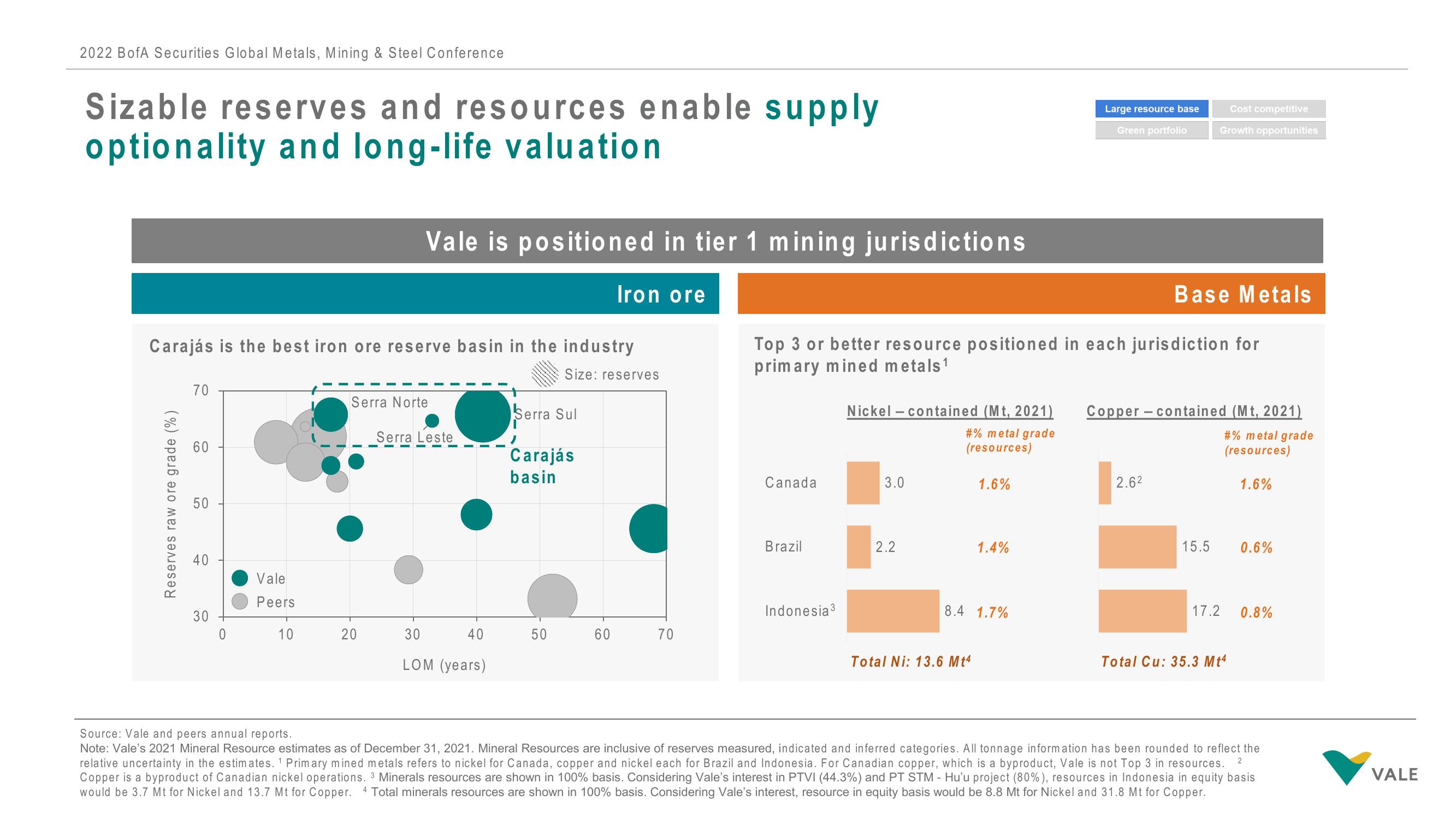

Sizable reserves and resources enable supply

optionality and long-life valuation

Carajás is the best iron ore reserve basin in the industry

Size: reserves

Reserves raw ore grade (%)

70

60

50

40

30

0

Vale

Peers

10

Vale is positioned in tier 1 mining jurisdictions

Iron ore

Serra Norte

20

Serra Leste

40

30

LOM (years)

Serra Sul

Carajás

basin

50

60

70

Canada

Brazil

Top 3 or better resource positioned in each jurisdiction for

primary mined metals ¹

Indonesia ³

Nickel-contained (Mt, 2021)

#% metal grade

(resources)

3.0

2.2

1.6%

Total Ni: 13.6 Mt4

1.4%

8.4 1.7%

Large resource base

Green portfolio

Cost competitive

Growth opportunities

Base Metals

2.62

Copper-contained (Mt, 2021)

#% metal grade

(resources)

15.5

17.2

Total Cu: 35.3 Mt4

1.6%

0.6%

0.8%

Source: Vale and peers annual reports.

Note: Vale's 2021 Mineral Resource estimates as of December 31, 2021. Mineral Resources are inclusive of reserves measured, indicated and inferred categories. All tonnage information has been rounded to reflect the

relative uncertainty in the estimates. 1 Primary mined metals refers to nickel for Canada, copper and nickel each for Brazil and Indonesia. For Canadian copper, which is a byproduct, Vale is not Top 3 in resources.

Copper is a byproduct of Canadian nickel operations. 3 Minerals resources are shown in 100% basis. Considering Vale's interest in PTVI (44.3%) and PT STM - Hu'u project (80%), resources in Indonesia in equity basis

would be 3.7 Mt for Nickel and 13.7 Mt for Copper. 4 Total minerals resources are shown in 100% basis. Considering Vale's interest, resource in equity basis would be 8.8 Mt for Nickel and 31.8 Mt for Copper.

2

VALEView entire presentation