Citi Investment Banking Pitch Book

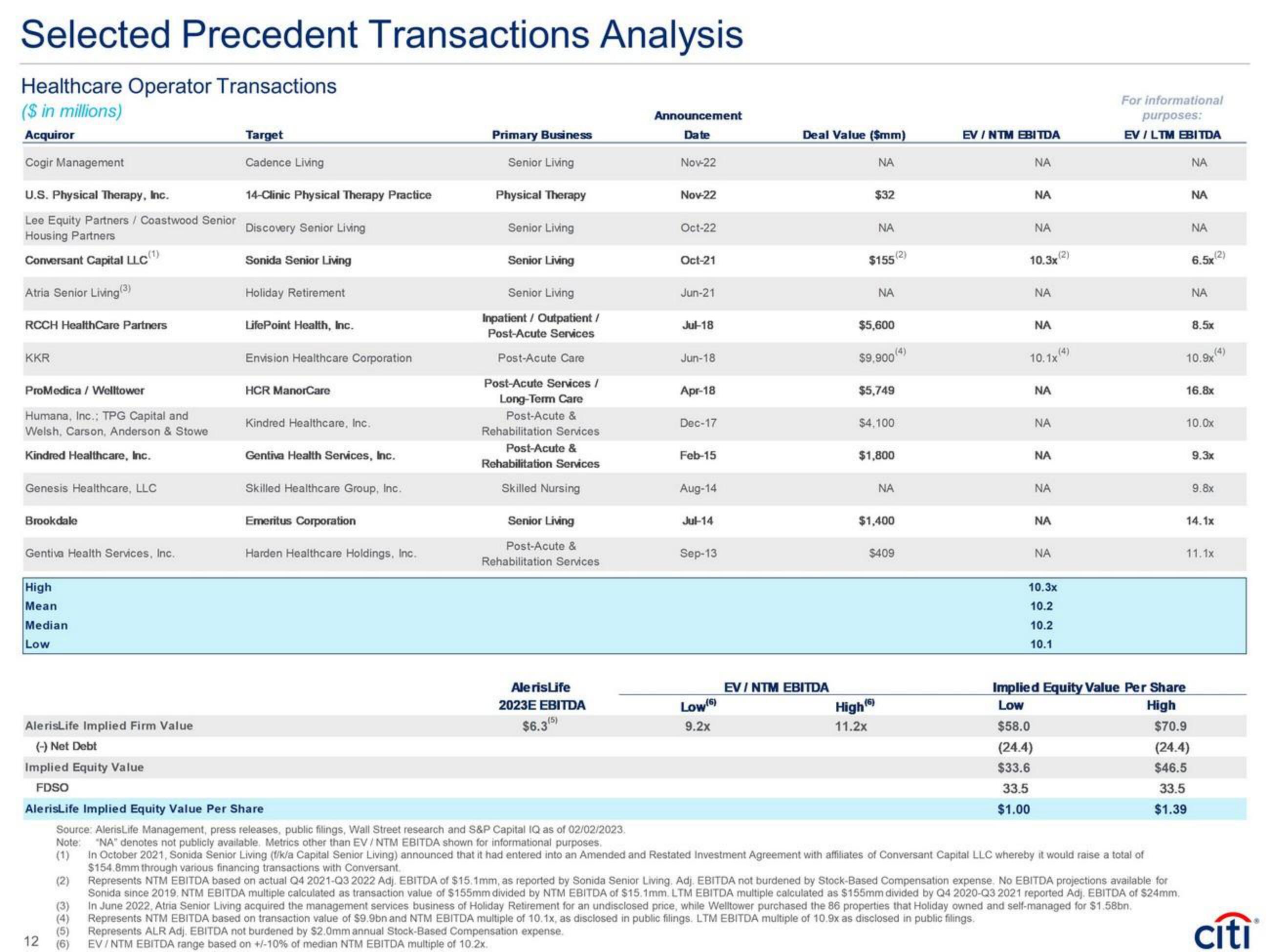

Selected Precedent Transactions Analysis

Healthcare Operator Transactions

($ in millions)

Acquiror

Cogir Management

U.S. Physical Therapy, Inc.

Lee Equity Partners / Coastwood Senior Discovery Senior Living

Housing Partners

Conversant Capital LLC(¹)

Sonida Senior Living

Atria Senior Living (3)

Holiday Retirement

RCCH HealthCare Partners

KKR

ProMedica / Welltower

Humana, Inc.; TPG Capital and

Welsh, Carson, Anderson & Stowe

Kindred Healthcare, Inc.

Genesis Healthcare, LLC

Brookdale

Gentiva Health Services, Inc.

High

Mean

Median

Low

Target

Cadence Living

14-Clinic Physical Therapy Practice

12

LifePoint Health, Inc.

Envision Healthcare Corporation

HCR ManorCare

Kindred Healthcare, Inc.

Gentiva Health Services, Inc.

Skilled Healthcare Group, Inc.

Emeritus Corporation

Harden Healthcare Holdings, Inc.

Primary Business

Senior Living

Physical Therapy

Senior Living

Senior Living

Senior Living

Inpatient / Outpatient/

Post-Acute Services

Post-Acute Care

Post-Acute Services /

Long-Term Care

Post-Acute &

Rehabilitation Services

Post-Acute &

Rehabilitation Services

Skilled Nursing

Senior Living

Post-Acute &

Rehabilitation Services

Ale risLife

2023E EBITDA

$6.3(5)

Announcement

Date

Nov-22

Nov-22

Oct-22

Oct-21

Jun-21

Jul-18

Jun-18

Apr-18

Dec-17

Feb-15

Aug-14

Jul-14

Sep-13

Low (6)

9.2x

Deal Value ($mm)

ΝΑ

EV / NTM EBITDA

$32

ΝΑ

$155(2)

ΝΑ

$5,600

$9,9004)

$5,749

$4,100

$1,800

High (6)

11.2x

ΝΑ

$1,400

$409

EV / NTM EBITDA

NA

ΝΑ

ΝΑ

10.3x(2)

ΝΑ

ΝΑ

$58.0

(24.4)

$33.6

33.5

$1.00

10.1x4

NA

ΝΑ

ΝΑ

ΝΑ

ΝΑ

ΝΑ

(4)

10.3x

10.2

10.2

10.1

For informational

purposes:

EV / LTM EBITDA

NA

ΝΑ

NA

6.5x(2)

Implied Equity Value Per Share

Low

High

ΝΑ

8.5x

10.9x

(4)

16.8x

$70.9

(24.4)

$46.5

33.5

$1.39

10.0x

9.3x

14.1x

9.8x

11.1x

AlerisLife Implied Firm Value

(-) Net Debt

Implied Equity Value

FDSO

AlerisLife Implied Equity Value Per Share

Source: AlerisLife Management, press releases, public filings, Wall Street research and S&P Capital IQ as of 02/02/2023.

Note: "NA" denotes not publicly available. Metrics other than EV/NTM EBITDA shown for informational purposes.

(1)

(2)

In October 2021, Sonida Senior Living (f/k/a Capital Senior Living) announced that it had entered into an Amended and Restated Investment Agreement with affiliates of Conversant Capital LLC whereby it would raise a total of

$154.8mm through various financing transactions with Conversant.

Represents NTM EBITDA based on actual Q4 2021-Q3 2022 Adj. EBITDA of $15.1mm, as reported by Sonida Senior Living. Adj. EBITDA not burdened by Stock-Based Compensation expense. No EBITDA projections available for

Sonida since 2019, NTM EBITDA multiple calculated as transaction value of $155mm divided by NTM EBITDA of $15.1mm. LTM EBITDA multiple calculated as $155mm divided by Q4 2020-Q3 2021 reported Adj. EBITDA of $24mm.

In June 2022, Atria Senior Living acquired the management services business of Holiday Retirement for an undisclosed price, while Welltower purchased the 86 properties that Holiday owned and self-managed for $1.58bn.

Represents NTM EBITDA based on transaction value of $9.9bn and NTM EBITDA multiple of 10.1x, as disclosed in public filings. LTM EBITDA multiple of 10.9x as disclosed in public filings.

(3)

(4)

(5) Represents ALR Adj. EBITDA not burdened by $2.0mm annual Stock-Based Compensation expense.

cíti

(6)

EV/NTM EBITDA range based on +/-10% of median NTM EBITDA multiple of 10.2x.View entire presentation