Bird SPAC Presentation Deck

Asset financing facility secured to fund future vehicle CapEx

Î

BIRD

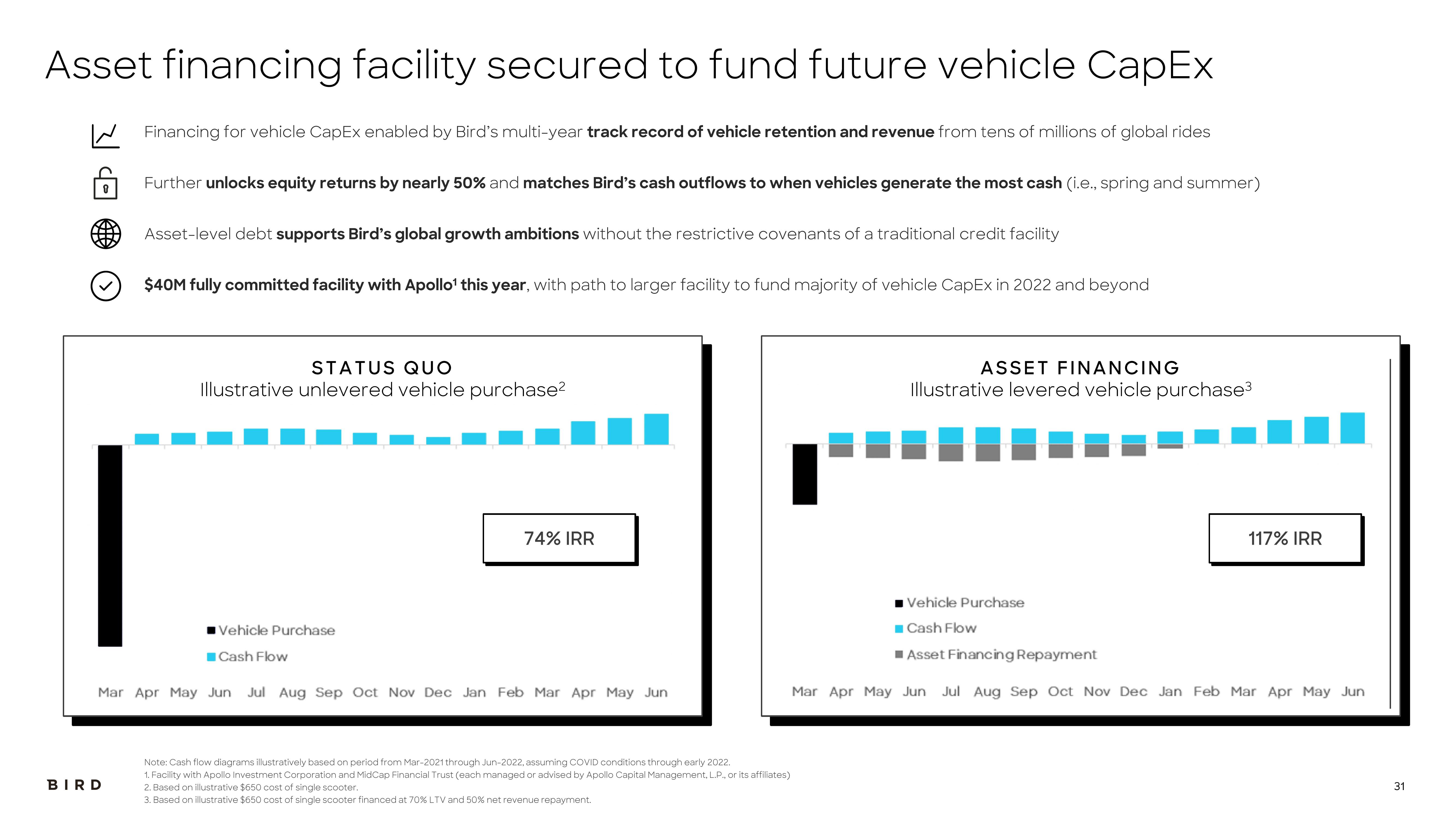

Financing for vehicle CapEx enabled by Bird's multi-year track record of vehicle retention and revenue from tens of millions of global rides

Further unlocks equity returns by nearly 50% and matches Bird's cash outflows to when vehicles generate the most cash (i.e., spring and summer)

Asset-level debt supports Bird's global growth ambitions without the restrictive covenants of a traditional credit facility

$40M fully committed facility with Apollo¹ this year, with path to larger facility to fund majority of vehicle CapEx in 2022 and beyond

STATUS QUO

Illustrative unlevered vehicle purchase²

Vehicle Purchase

Cash Flow

74% IRR

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

Note: Cash flow diagrams illustratively based on period from Mar-2021 through Jun-2022, assuming COVID conditions through early 2022.

1. Facility with Apollo Investment Corporation and MidCap Financial Trust (each managed or advised by Apollo Capital Management, L.P., or its affiliates)

2. Based on illustrative $650 cost of single scooter.

3. Based on illustrative $650 cost of single scooter financed at 70% LTV and 50% net revenue repayment.

ASSET FINANCING

Illustrative levered vehicle purchase³

Vehicle Purchase

117% IRR

■Cash Flow

■Asset Financing Repayment

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

31View entire presentation