Rocket Companies Investor Presentation Deck

Endnotes

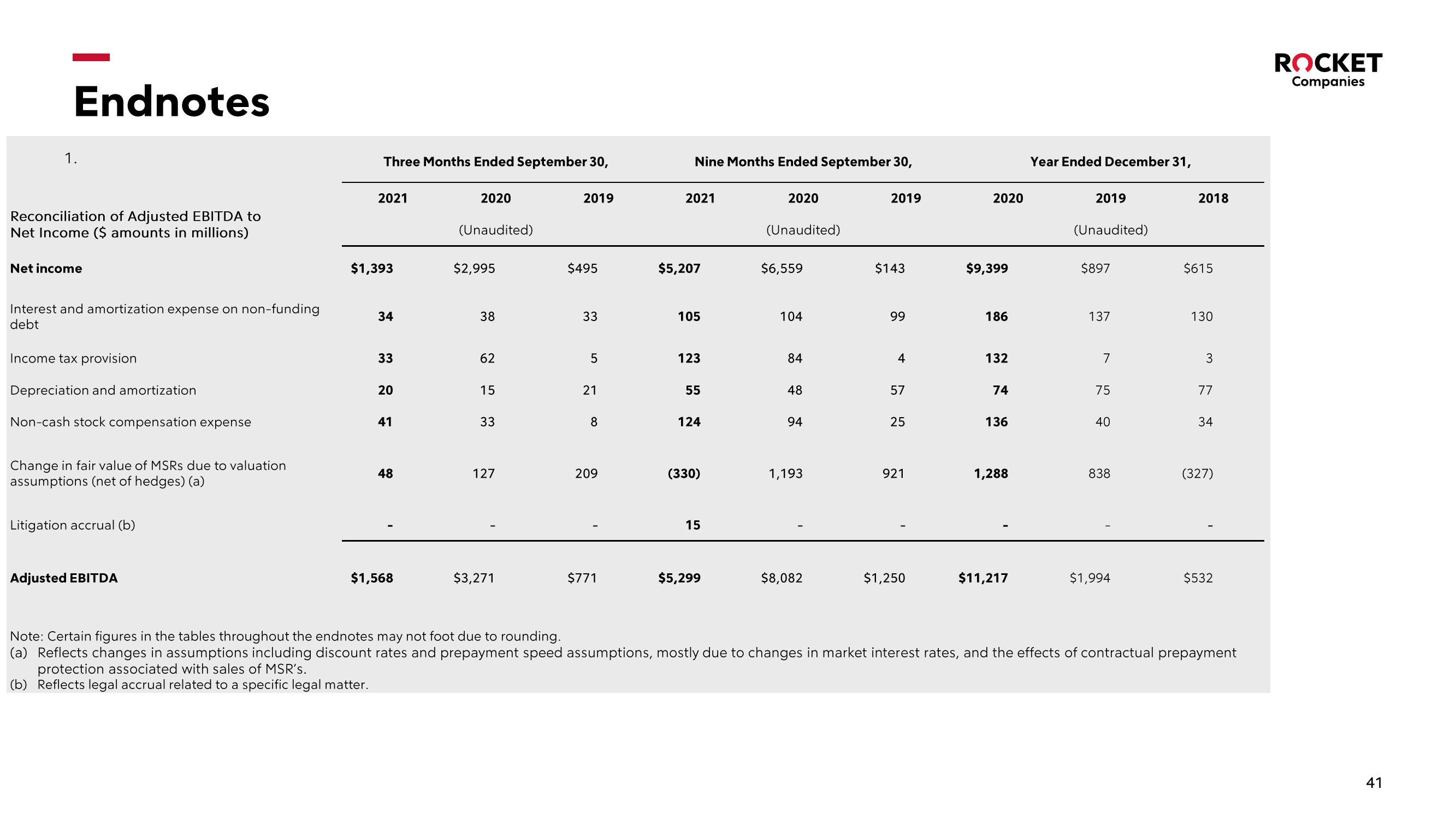

1.

Reconciliation of Adjusted EBITDA to

Net Income ($ amounts in millions)

Net income

Interest and amortization expense on non-funding

debt

Income tax provision

Depreciation and amortization

Non-cash stock compensation expense

Change in fair value of MSRS due to valuation

assumptions (net of hedges) (a)

Litigation accrual (b)

Adjusted EBITDA

Three Months Ended September 30,

2021

$1,393

34

33

20

41

48

$1,568

2020

(Unaudited)

$2,995

38

62

15

33

127

$3,271

2019

$495

33

5

21

8

209

$771

Nine Months Ended September 30,

2021

$5,207

105

123

55

124

(330)

15

$5,299

2020

(Unaudited)

$6,559

104

84

48

94

1,193

$8,082

2019

$143

99

4

57

25

921

$1,250

2020

$9,399

186

132

74

136

1,288

$11,217

Year Ended December 31,

2019

(Unaudited)

$897

137

7

75

40

838

$1,994

2018

$615

130

3

77

34

(327)

$532

Note: Certain figures in the tables throughout the endnotes may not foot due to rounding.

(a) Reflects changes in assumptions including discount rates and prepayment speed assumptions, mostly due to changes in market interest rates, and the effects of contractual prepayment

protection associated with sales of MSR's.

(b) Reflects legal accrual related to a specific legal matter.

ROCKET

Companies

41View entire presentation