Apollo Global Management Investor Day Presentation Deck

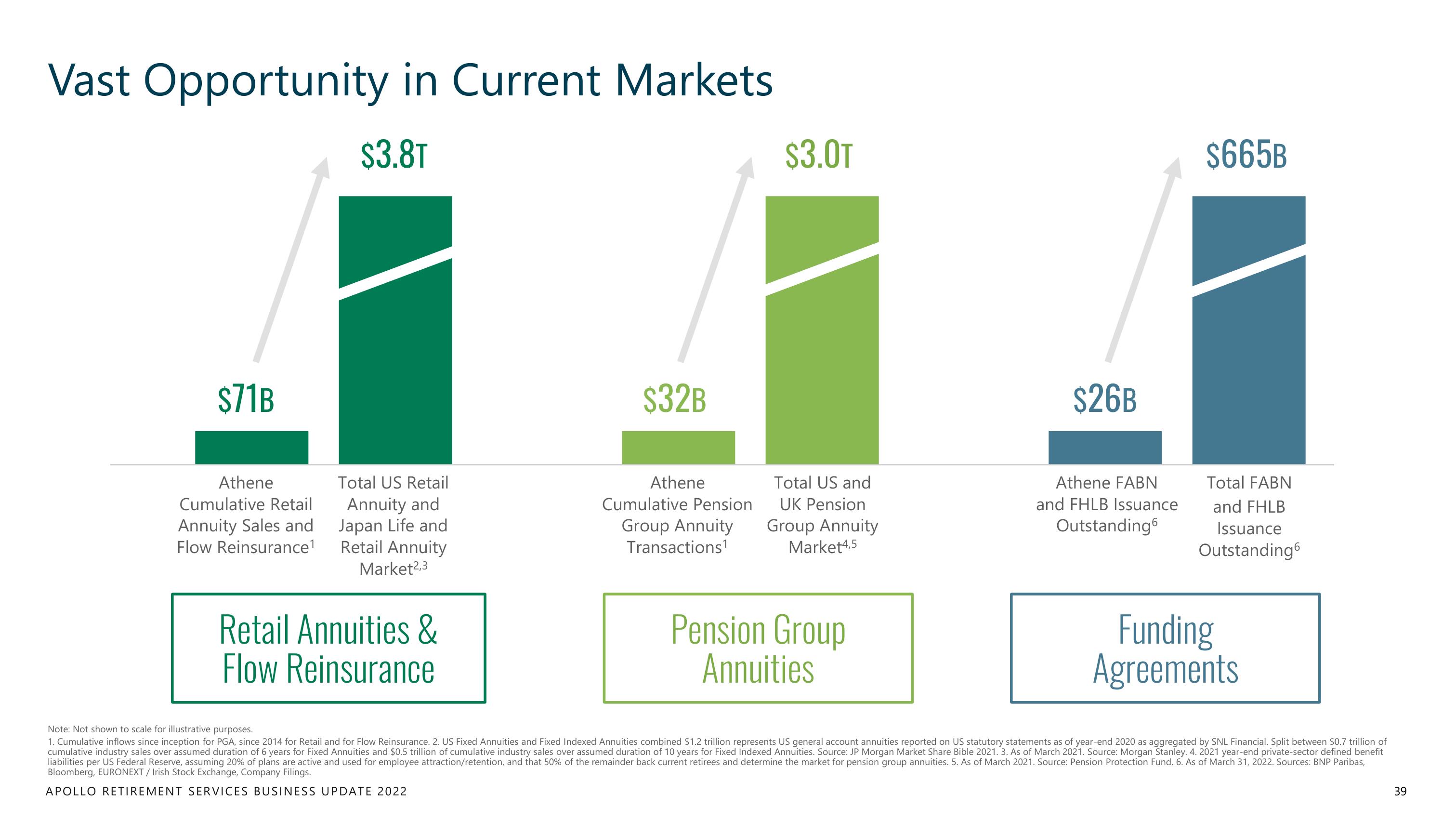

Vast Opportunity in Current Markets

$3.8T

$71B

Athene

Cumulative Retail

Annuity Sales and

Flow Reinsurance¹

Total US Retail

Annuity and

Japan Life and

Retail Annuity

Market2,3

Retail Annuities &

Flow Reinsurance

$32B

Athene

Cumulative Pension

Group Annuity

Transactions¹

$3.0T

Total US and

UK Pension

Group Annuity

Market 4,5

Pension Group

Annuities

$26B

Athene FABN

and FHLB Issuance

Outstanding6

$665B

Total FABN

and FHLB

Issuance

Outstanding

Funding

Agreements

Note: Not shown to scale for illustrative purposes.

1. Cumulative inflows since inception for PGA, since 2014 for Retail and for Flow Reinsurance. 2. US Fixed Annuities and Fixed Indexed Annuities combined $1.2 trillion represents US general account annuities reported on US statutory statements as of year-end 2020 as aggregated by SNL Financial. Split between $0.7 trillion of

cumulative industry sales over assumed duration of 6 years for Fixed Annuities and $0.5 trillion of cumulative industry sales over assumed duration of 10 years for Fixed Indexed Annuities. Source: JP Morgan Market Share Bible 2021. 3. As of March 2021. Source: Morgan Stanley. 4. 2021 year-end private-sector defined benefit

liabilities per US Federal Reserve, assuming 20% of plans are active and used for employee attraction/retention, and that 50% of the remainder back current retirees and determine the market for pension group annuities. 5. As of March 2021. Source: Pension Protection Fund. 6. As of March 31, 2022. Sources: BNP Paribas,

Bloomberg, EURONEXT / Irish Stock Exchange, Company Filings.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

39View entire presentation