Building a Leading P&C Insurer

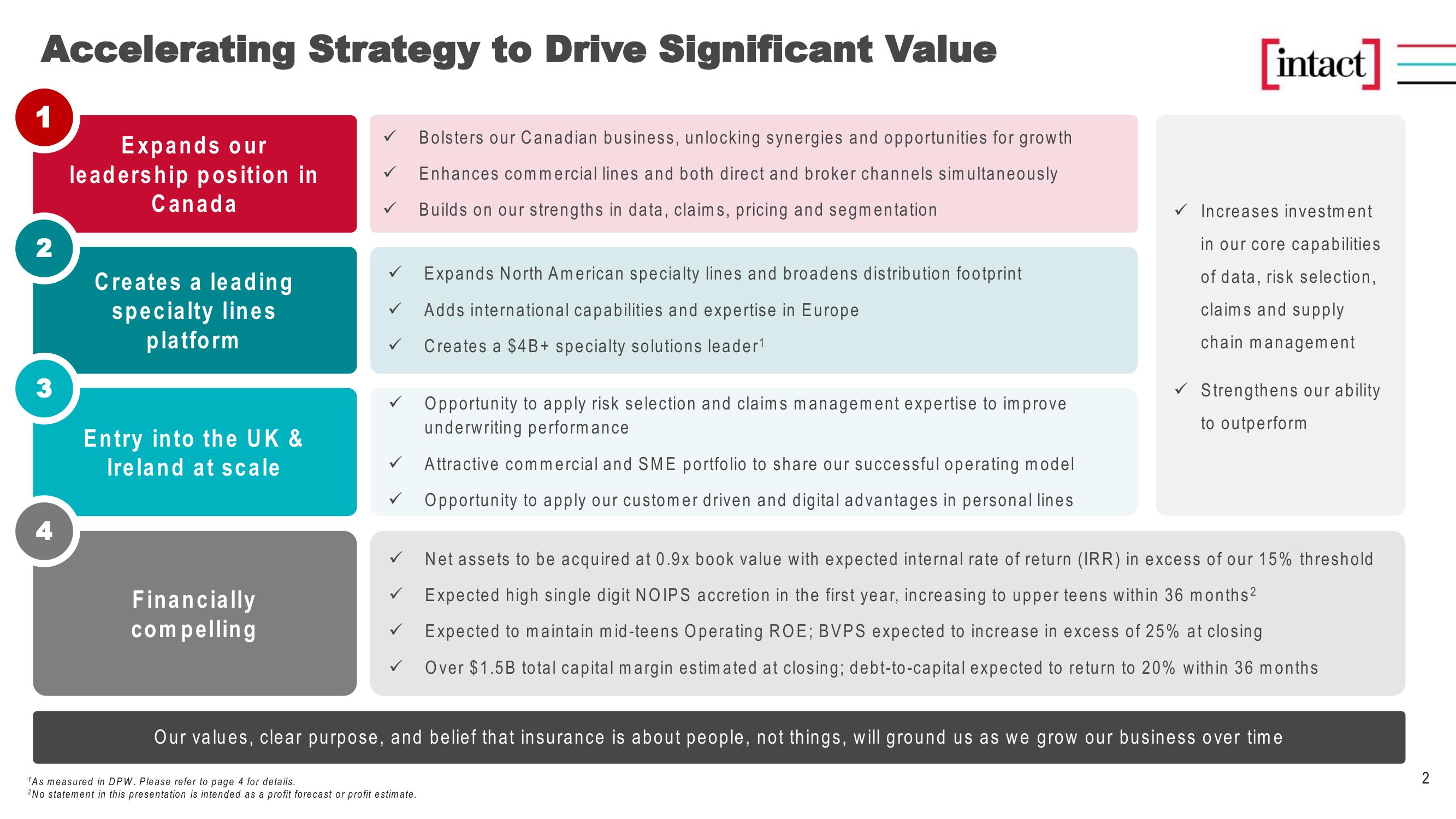

Accelerating Strategy to Drive Significant Value

Bolsters our Canadian business, unlocking synergies and opportunities for growth

Enhances commercial lines and both direct and broker channels simultaneously

Builds on our strengths in data, claims, pricing and segmentation

1

2

3

4

Expands our

leadership position in

Canada

Creates a leading

specialty lines

platform

Entry into the UK &

Ireland at scale

Financially

compelling

✓ Expands North American specialty lines and broadens distribution footprint

Adds international capabilities and expertise in Europe

Creates a $4B+ specialty solutions leader¹

Opportunity to apply risk selection and claims management expertise to improve

underwriting performance

Attractive commercial and SME portfolio to share our successful operating model

Opportunity to apply our customer driven and digital advantages in personal lines

[intact]

¹As measured in DPW. Please refer to page 4 for details.

2No statement in this presentation is intended as a profit forecast or profit estimate.

Increases investment

in our core capabilities

of data, risk selection,

claims and supply

chain management

Strengthens our ability

to outperform

Net assets to be acquired at 0.9x book value with expected internal rate of return (IRR) in excess of our 15% threshold

Expected high single digit NOIPS accretion in the first year, increasing to upper teens within 36 months²

Expected to maintain mid-teens Operating ROE; BVPS expected to increase in excess of 25% at closing

✓ Over $1.5B total capital margin estimated at closing; debt-to-capital expected to return to 20% within 36 months

Our values, clear purpose, and belief that insurance is about people, not things, will ground us as we grow our business over time

2View entire presentation