LSE Mergers and Acquisitions Presentation Deck

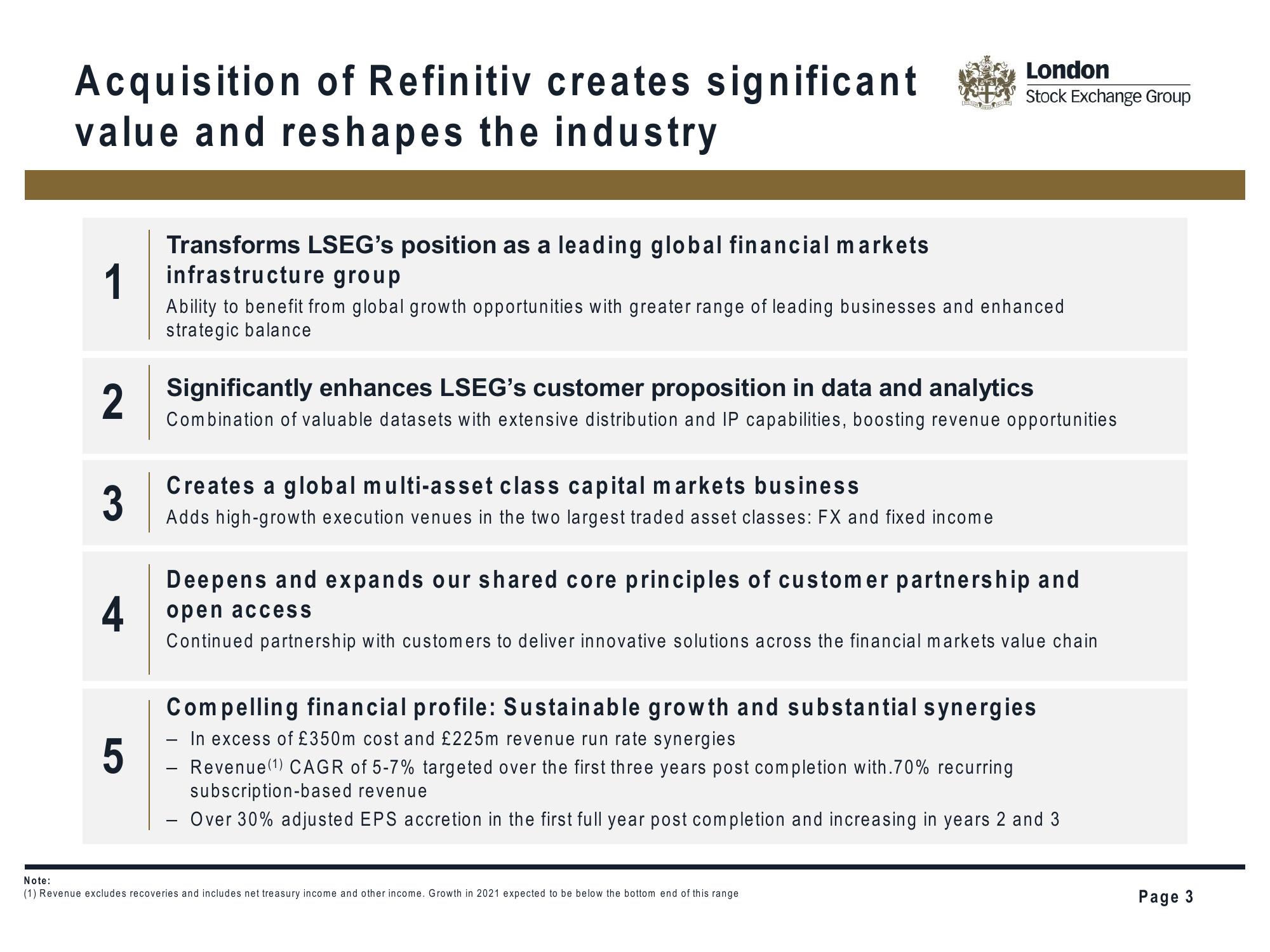

Acquisition of Refinitiv creates significant

value and reshapes the industry

Transforms LSEG's position as a leading global financial markets

infrastructure group

2

3

DEGE ESCUR

1

Ability to benefit from global growth opportunities with greater range of leading businesses and enhanced

strategic balance

London

Stock Exchange Group

Significantly enhances LSEG's customer proposition in data and analytics

Combination of valuable datasets with extensive distribution and IP capabilities, boosting revenue opportunities

Creates a global multi-asset class capital markets business

Adds high-growth execution venues in the two largest traded asset classes: FX and fixed income

Deepens and expands our shared core principles of customer partnership and

open access

4

Continued partnership with customers to deliver innovative solutions across the financial markets value chain

Note:

(1) Revenue excludes recoveries and includes net treasury income and other income. Growth in 2021 expected to be below the bottom end of this range

Compelling financial profile: Sustainable growth and substantial synergies

- In excess of £350m cost and £225m revenue run rate synergies

5

- Revenue (¹) CAGR of 5-7% targeted over the first three years post completion with.70% recurring

subscription-based revenue

Over 30% adjusted EPS accretion in the first full year post completion and increasing in years 2 and 3

Page 3View entire presentation