2nd Quarter 2021 Investor Presentation

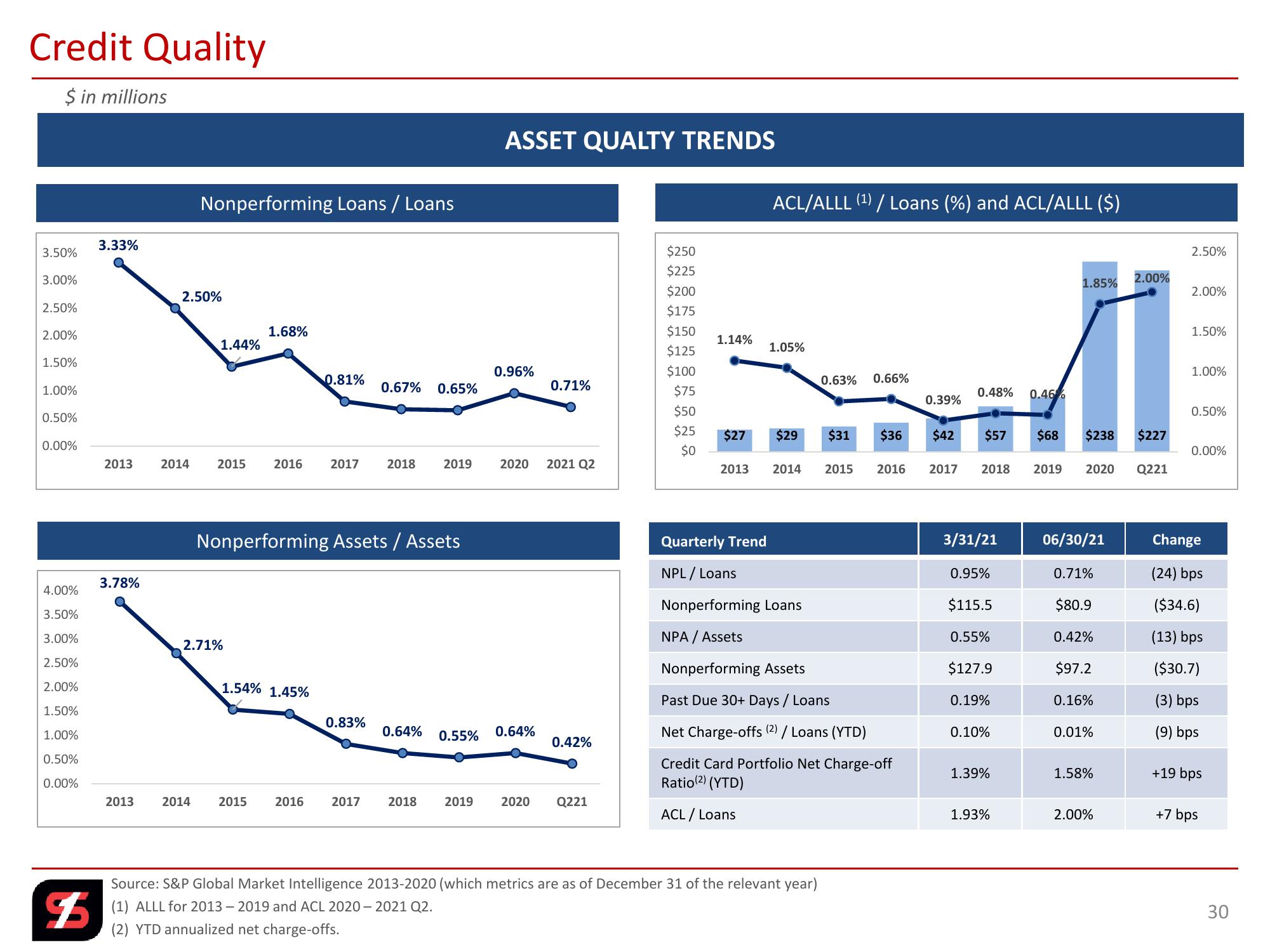

Credit Quality

$ in millions

ASSET QUALTY TRENDS

Nonperforming Loans / Loans

ACL/ALLL (1) / Loans (%) and ACL/ALLL ($)

3.33%

3.50%

$250

$225

3.00%

2.50%

$200

2.50%

1.85%

2.00%

2.00%

2.50%

$175

2.00%

1.68%

$150

1.50%

1.14%

1.44%

$125

1.05%

1.50%

0.96%

$100

1.00%

0.81%

0.63% 0.66%

1.00%

0.67% 0.65%

0.71%

$75

0.48% 0.46%

0.39%

$50

0.50%

0.50%

$25

$27 $29

$31

$36

$42

$57

$68 $238 $227

0.00%

$0

0.00%

2013

2014

2015

2016

2017

2018

2019

2020

2021 Q2

2013 2014

2015

2016 2017 2018

2019 2020 Q221

Nonperforming Assets / Assets

Quarterly Trend

3/31/21

06/30/21

Change

NPL / Loans

0.95%

0.71%

(24) bps

3.78%

4.00%

Nonperforming Loans

$115.5

$80.9

($34.6)

3.50%

3.00%

NPA / Assets

0.55%

0.42%

(13) bps

2.71%

2.50%

Nonperforming Assets

$127.9

$97.2

($30.7)

2.00%

1.54% 1.45%

Past Due 30+ Days / Loans

0.19%

0.16%

(3) bps

1.50%

0.83%

1.00%

0.64% 0.55% 0.64%

Net Charge-offs (2) / Loans (YTD)

0.10%

0.01%

(9) bps

0.42%

0.50%

0.00%

Credit Card Portfolio Net Charge-off

Ratio (2) (YTD)

1.39%

1.58%

+19 bps

2013

2014

2015

2016

2017

2018

2019

2020

Q221

ACL / Loans

1.93%

2.00%

+7 bps

Source: S&P Global Market Intelligence 2013-2020 (which metrics are as of December 31 of the relevant year)

(1) ALLL for 2013 - 2019 and ACL 2020-2021 Q2.

$

(2) YTD annualized net charge-offs.

30View entire presentation