Commercial Metals Company Results Presentation Deck

●

●

●

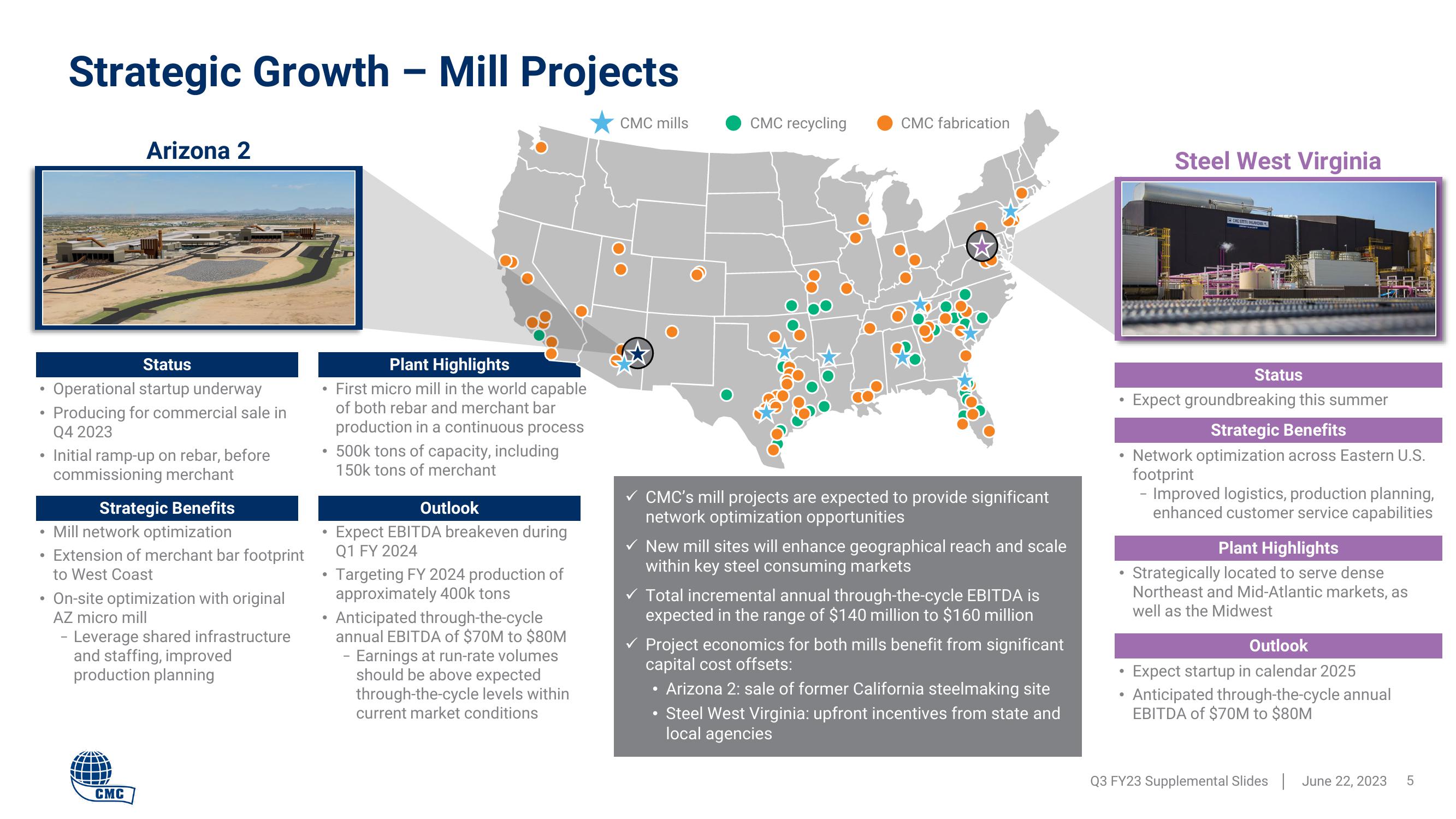

Strategic Growth - Mill Projects

Arizona 2

Status

Operational startup underway

Producing for commercial sale in

Q4 2023

Initial ramp-up on rebar, before

commissioning merchant

Strategic Benefits

Mill network optimization

Extension of merchant bar footprint

to West Coast

On-site optimization with original

AZ micro mill

- Leverage shared infrastructure

and staffing, improved

production planning

CMC

●

●

●

●

Plant Highlights

First micro mill in the world capable

of both rebar and merchant bar

production in a continuous process

500k tons of capacity, including

150k tons of merchant

Outlook

Expect EBITDA breakeven during

Q1 FY 2024

Targeting FY 2024 production of

approximately 400k tons

Anticipated through-the-cycle

annual EBITDA of $70M to $80M

- Earnings at run-rate volumes

should be above expected

through-the-cycle levels within

current market conditions

CMC mills

CMC recycling

CMC fabrication

✓ CMC's mill projects are expected to provide significant

network optimization opportunities

New mill sites will enhance geographical reach and scale

within key steel consuming markets

✓ Total incremental annual through-the-cycle EBITDA is

expected in the range of $140 million to $160 million

✓ Project economics for both mills benefit from significant

capital cost offsets:

Arizona 2: sale of former California steelmaking site

Steel West Virginia: upfront incentives from state and

local agencies

●

●

●

●

Steel West Virginia

CMC STEEL G

KLINOWA

Status

Expect groundbreaking this summer

Strategic Benefits

Network optimization across Eastern U.S.

footprint

- Improved logistics, production planning,

enhanced customer service capabilities

Plant Highlights

Strategically located to serve dense

Northeast and Mid-Atlantic markets, as

well as the Midwest

Outlook

Expect startup in calendar 2025

Anticipated through-the-cycle annual

EBITDA of $70M to $80M

Q3 FY23 Supplemental Slides | June 22, 2023

5View entire presentation