HSBC Investor Day Presentation Deck

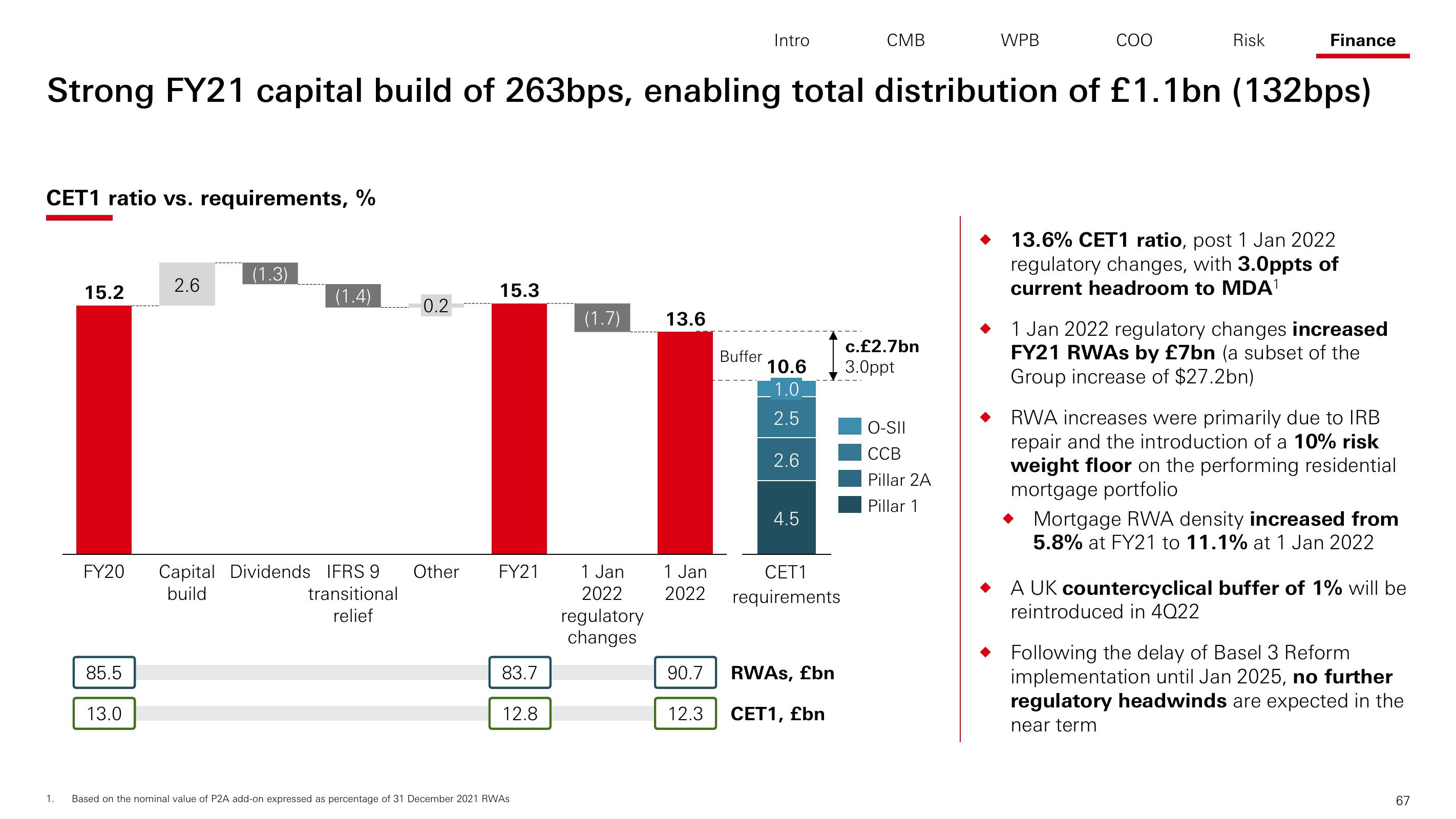

CET1 ratio vs. requirements, %

1.

15.2

FY20

85.5

Strong FY21 capital build of 263bps, enabling total distribution of £1.1bn (132bps)

13.0

2.6

(1.3)

(1.4)

0.2

transitional

relief

15.3

Capital Dividends IFRS 9 Other FY21

build

83.7

12.8

Based on the nominal value of P2A add-on expressed as percentage of 31 December 2021 RWAS

(1.7)

1 Jan

2022

regulatory

changes

13.6

1 Jan

2022

90.7

12.3

Intro

Buffer

10.6

1.0

2.5

2.6

4.5

CET1

requirements

CMB

RWAS, £bn

CET1, £bn

c.£2.7bn

3.0ppt

WPB

O-SII

CCB

Pillar 2A

Pillar 1

COO

Risk

Finance

13.6% CET1 ratio, post 1 Jan 2022

regulatory changes, with 3.0ppts of

current headroom to MDA¹

1 Jan 2022 regulatory changes increased

FY21 RWAs by £7bn (a subset of the

Group increase of $27.2bn)

RWA increases were primarily due to IRB

repair and the introduction of a 10% risk

weight floor on the performing residential

mortgage portfolio

Mortgage RWA density increased from

5.8% at FY21 to 11.1% at 1 Jan 2022

◆ A UK countercyclical buffer of 1% will be

reintroduced in 4Q22

Following the delay of Basel 3 Reform

implementation until Jan 2025, no further

regulatory headwinds are expected in the

near term

67View entire presentation