Nexters Results Presentation Deck

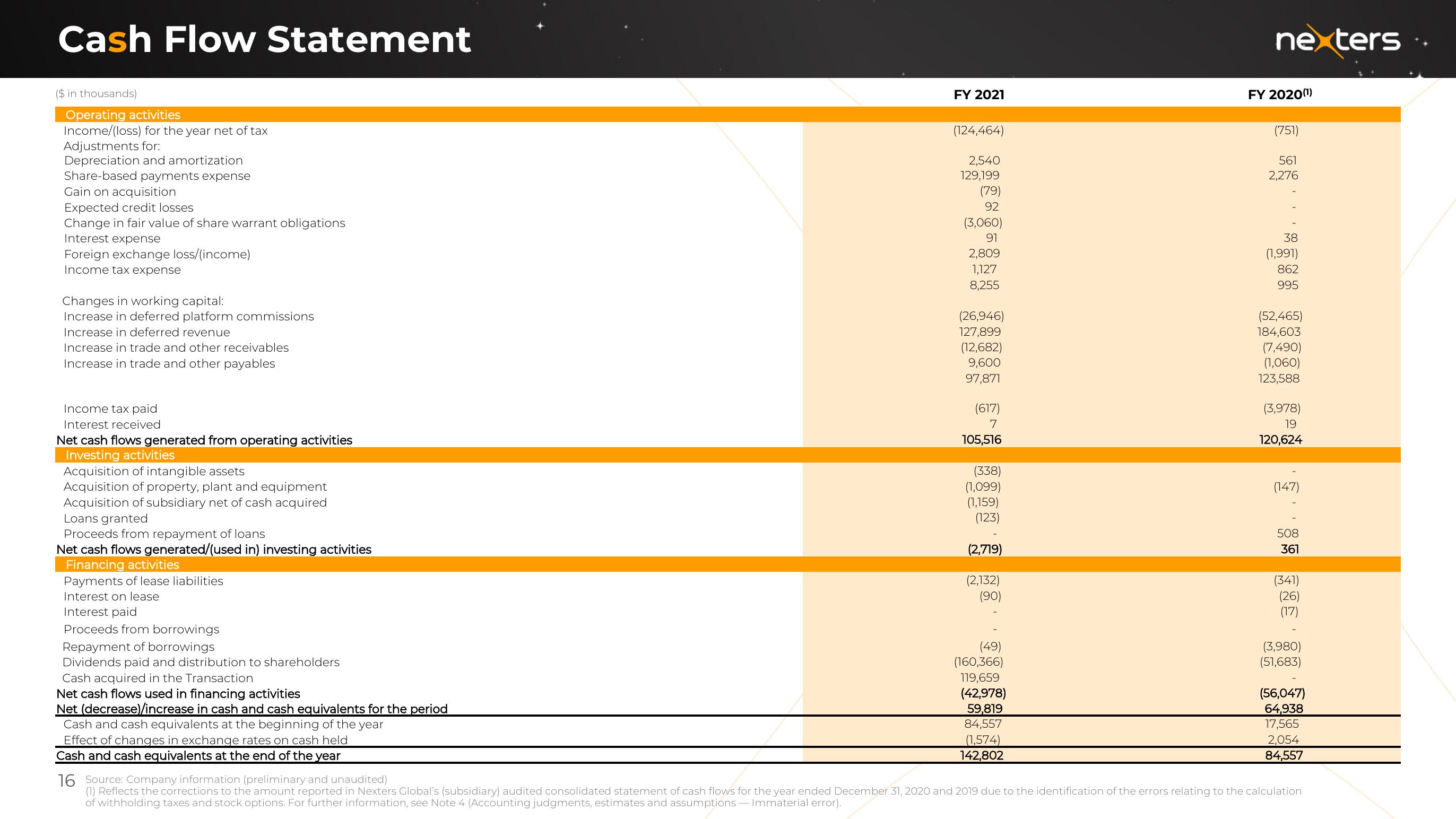

Cash Flow Statement

($ in thousands)

Operating activities

Income/(loss) for the year net of tax

Adjustments for:

Depreciation and amortization

Share-based payments expense

Gain on acquisition

Expected credit losses

Change in fair value of share warrant obligations

Interest expense

Foreign exchange loss/(income)

Income tax expense

Changes in working capital:

Increase in deferred platform commissions

Increase in deferred revenue

Increase in trade and other receivables

Increase in trade and other payables

Income tax paid

Interest received

Net cash flows generated from operating activities

Investing activities

Acquisition of intangible assets

Acquisition of property, plant and equipment

Acquisition of subsidiary net of cash acquired

Loans granted

Proceeds from repayment of loans

Net cash flows generated/(used in) investing activities

Financing activities

Payments of lease liabilities

Interest on lease

Interest paid

Proceeds from borrowings

Repayment of borrowings

Dividends paid and distribution to shareholders

Cash acquired in the Transaction

Net cash flows used in financing activities

Net (decrease)/increase in cash and cash equivalents for the period

Cash and cash equivalents at the beginning of the year

Effect of changes in exchange rates on cash held

Cash and cash equivalents at the end of the year

FY 2021

(124,464)

2,540

129,199

(79)

92

(3,060)

91

2,809

1,127

8,255

(26,946)

127,899

(12,682)

9,600

97,871

(617)

7

105,516

(338)

(1,099)

(1,159)

(123)

(2,719)

(2,132)

(90)

(49)

(160,366)

119,659

(42,978)

59,819

84,557

(1,574)

142,802

nexters

FY 2020(¹)

(751)

561

2,276

38

(1,991)

862

995

(52,465)

184,603

(7,490)

(1,060)

123,588

(3,978)

19

120,624

(147)

508

361

(341)

(26)

(17)

(3,980)

(51,683)

(56,047)

64,938

17,565

2,054

84,557

16 Source: Company information (preliminary and unaudited)

(1) Reflects the corrections to the amount reported in Nexters Global's (subsidiary) audited consolidated statement of cash flows for the year ended December 31, 2020 and 2019 due to the identification of the errors relating to the calculation

of withholding taxes and stock options. For further information, see Note 4 (Accounting judgments, estimates and assumptions-Immaterial error).View entire presentation