Credit Suisse Investment Banking Pitch Book

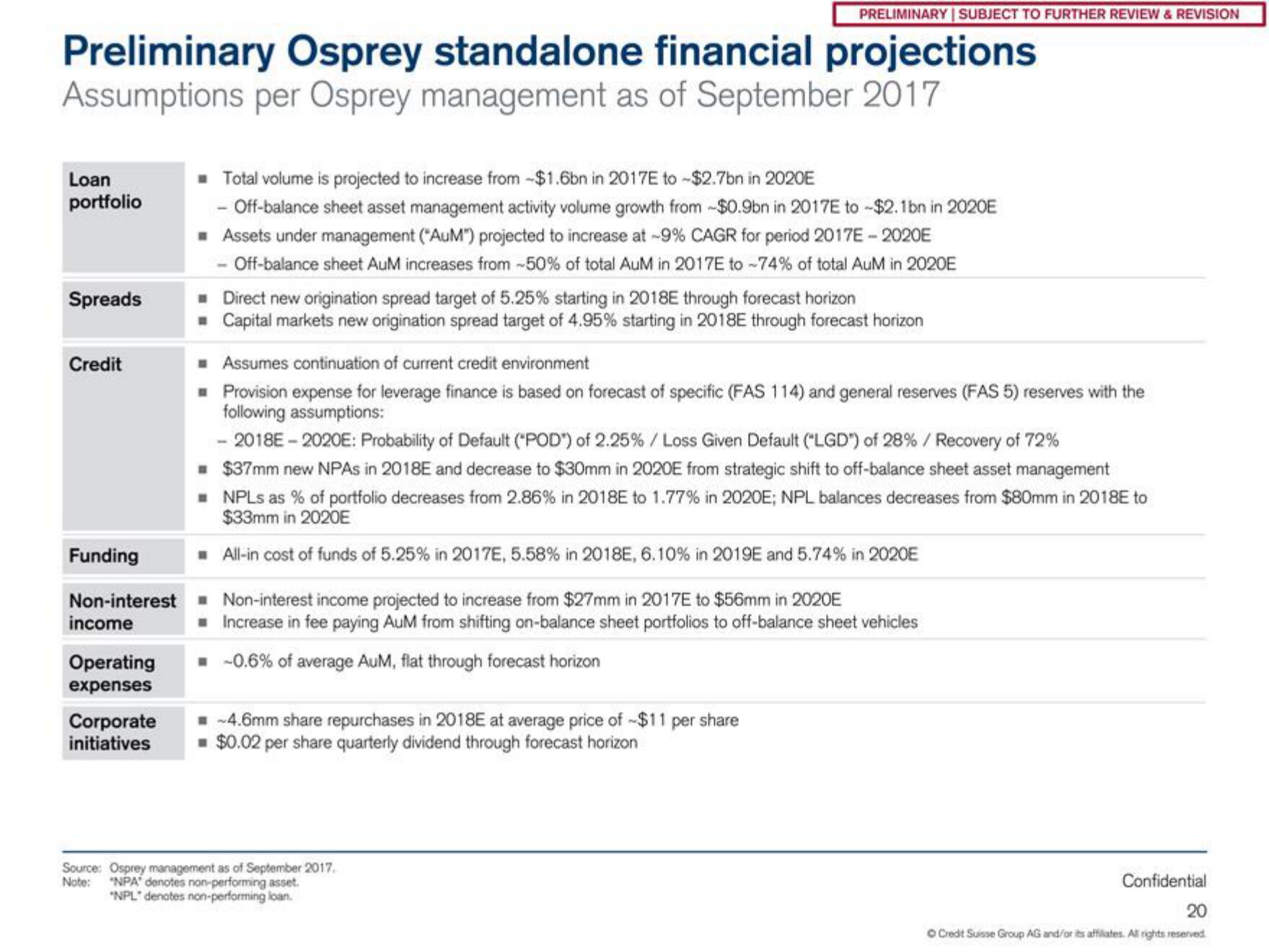

Preliminary Osprey standalone financial projections

Assumptions per Osprey management as of September 2017

Loan

portfolio

Spreads

Credit

Funding

Non-interest

income

Operating

expenses

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Total volume is projected to increase from $1.6bn in 2017E to -$2.7bn in 2020E

- Off-balance sheet asset management activity volume growth from $0.9bn in 2017E to -$2.1bn in 2020E

Assets under management ("AUM") projected to increase at -9% CAGR for period 2017E-2020E

- Off-balance sheet AuM increases from -50% of total AuM in 2017E to -74% of total AuM in 2020E

■ Direct new origination spread target of 5.25% starting in 2018E through forecast horizon

Capital markets new origination spread target of 4.95% starting in 2018E through forecast horizon

Assumes continuation of current credit environment

☐☐Provision expense for leverage finance is based on forecast of specific (FAS 114) and general reserves (FAS 5) reserves with the

following assumptions:

- 2018E-2020E: Probability of Default ("POD") of 2.25% / Loss Given Default ("LGD") of 28% / Recovery of 72%

$37mm new NPAs in 2018E and decrease to $30mm in 2020E from strategic shift to off-balance sheet asset management

NPLs as % of portfolio decreases from 2.86% in 2018E to 1.77% in 2020E; NPL balances decreases from $80mm in 2018E to

$33mm in 2020E

All-in cost of funds of 5.25% in 2017E, 5.58% in 2018E, 6.10% in 2019E and 5.74% in 2020E

Non-interest income projected to increase from $27mm in 2017E to $56mm in 2020E

■ Increase in fee paying AuM from shifting on-balance sheet portfolios to off-balance sheet vehicles

-0.6% of average AuM, flat through forecast horizon

Corporate -4.6mm share repurchases in 2018E at average price of $11 per share

initiatives ■ $0.02 per share quarterly dividend through forecast horizon

Source: Osprey management as of September 2017.

Note:

"NPA denotes non-performing asset.

NPL denotes non-performing loan.

Confidential

20

Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation