Apollo Global Management Investor Presentation Deck

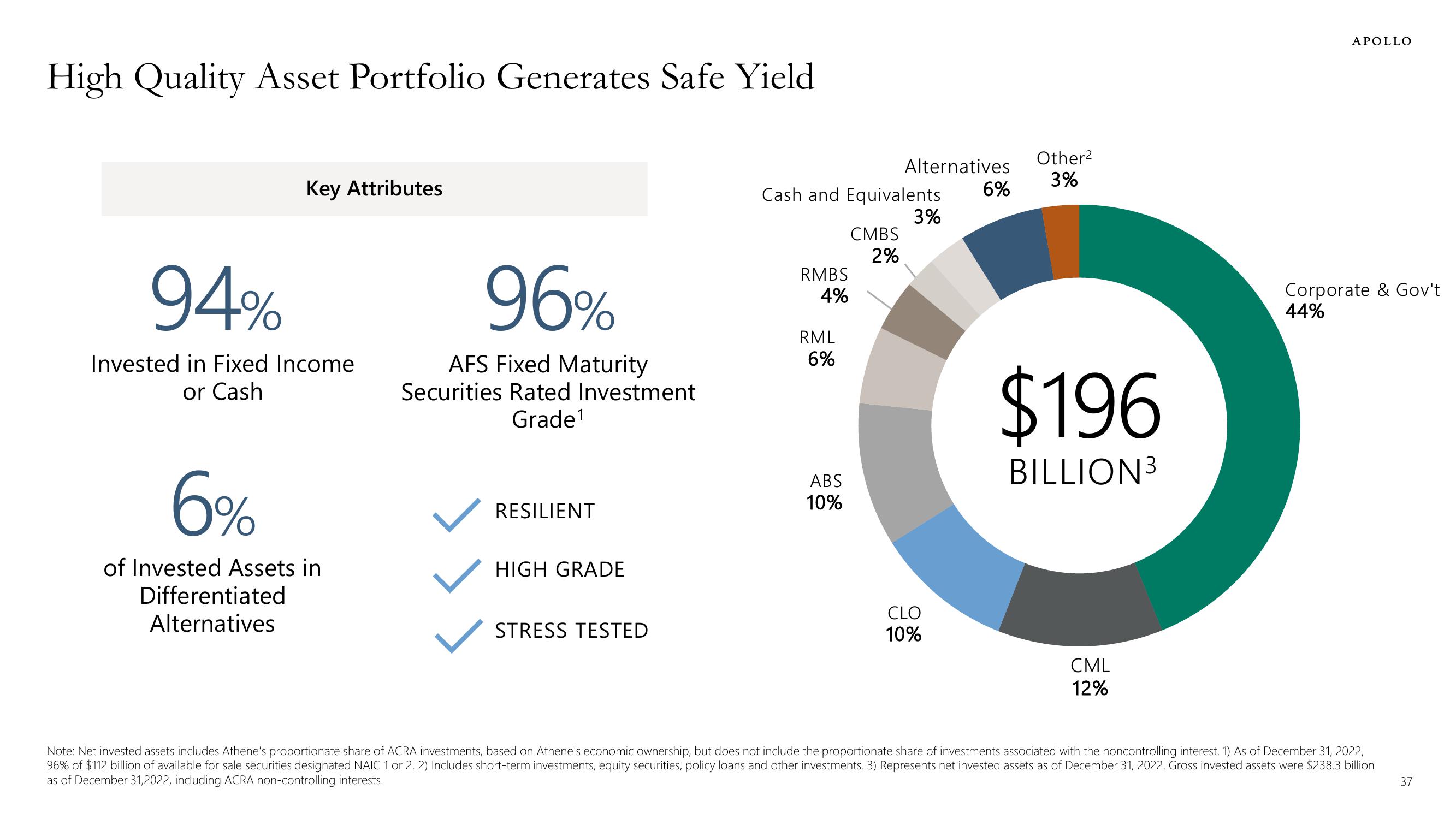

High Quality Asset Portfolio Generates Safe Yield

Key Attributes

94%

Invested in Fixed Income

or Cash

6%

of Invested Assets in

Differentiated

Alternatives

96%

AFS Fixed Maturity

Securities Rated Investment

Grade¹

RESILIENT

HIGH GRADE

STRESS TESTED

Cash and Equivalents

3%

RMBS

4%

RML

6%

ABS

10%

Alternatives

CMBS

2%

CLO

10%

6%

Other²

3%

$196

BILLION³

CML

12%

APOLLO

Corporate & Gov't

44%

Note: Net invested assets includes Athene's proportionate share of ACRA investments, based on Athene's economic ownership, but does not include the proportionate share of investments associated with the noncontrolling interest. 1) As of December 31, 2022,

96% of $112 billion of available for sale securities designated NAIC 1 or 2.2) Includes short-term investments, equity securities, policy loans and other investments. 3) Represents net invested assets as of December 31, 2022. Gross invested assets were $238.3 billion

as of December 31,2022, including ACRA non-controlling interests.

37View entire presentation