Sequoia Capital Market Presentation Deck

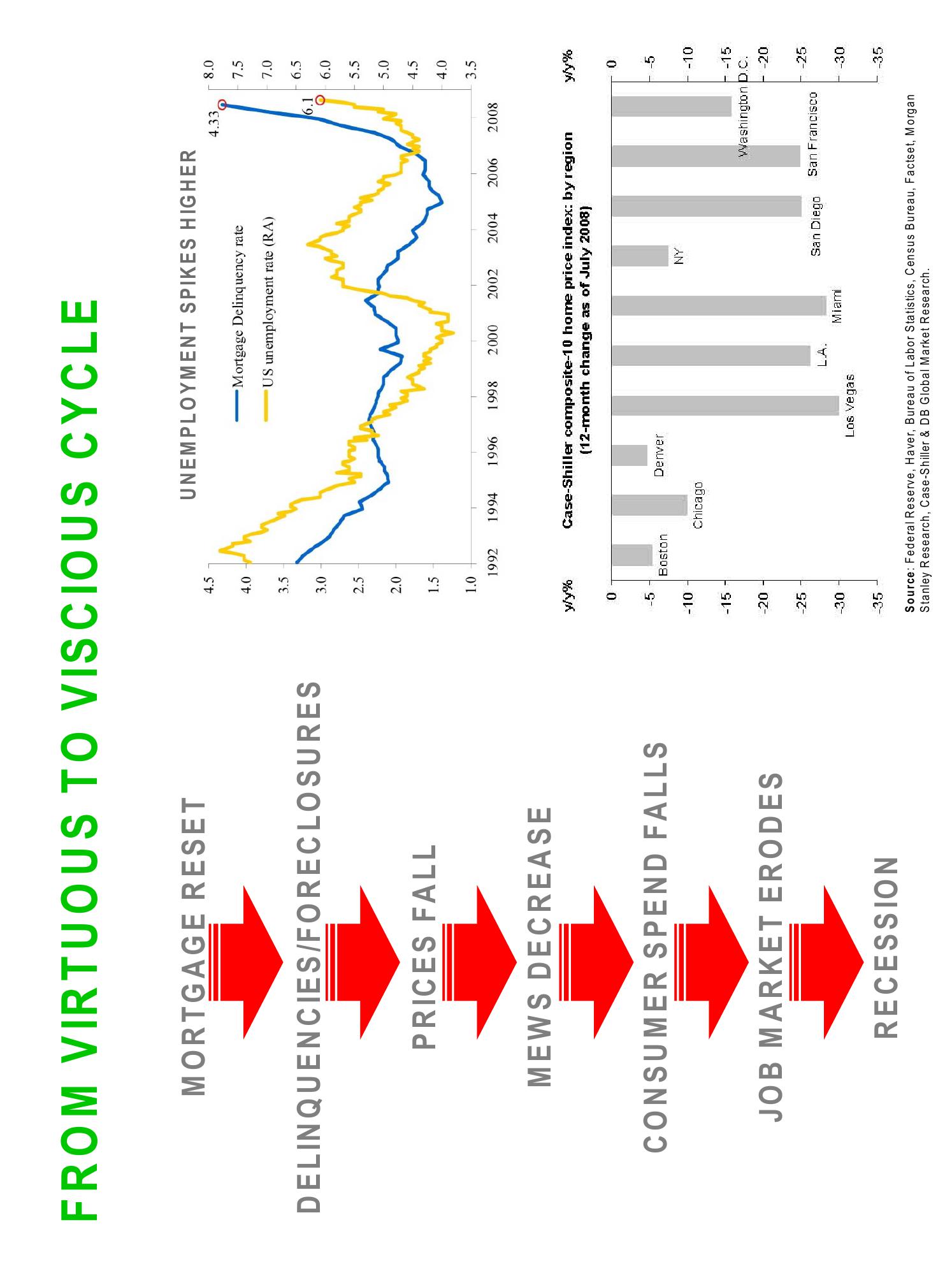

FROM VIRTUOUS TO VISCIOUS CYCLE

MORTGAGE RESET

DELINQUENCIES/FORECLOSURES

PRICES FALL

MEWS DECREASE

CONSUMER SPEND FALLS

JOB MARKET ERODES

RECESSION

4.5

4.0

3.5

3.0

2.5

2.0

1.5

1.0

Wy%

0

-5

-10

-15

-20

-25

-30

-35

UNEMPLOYMENT SPIKES HIGHER

1992 1994 1996

Boston

Chicago

Mortgage Delinquency rate

US unemployment rate (RA)

Denver

Case-Shiller composite-10 home price index: by region

(12-month change as of July 2008)

1998 2000 2002 2004 2006 2008

Los Vegas

L.A.

4.33

Miami

6.1

O

San Diego

NY

II

San Francisco

8.0

7.5

Source: Federal Reserve, Haver, Bureau of Labor Statistics, Census Bureau, Factset, Morgan

Stanley Research, Case-Shiller & DB Global Market Research.

7.0

6.5

6.0

5.5

5.0

4.5

4.0

3.5

y/y%

0

-5

-15

Washington D.C.

-20

-10

-25

-30

-35View entire presentation