Telia Company Results Presentation Deck

GROUP HIGHLIGHTS

N

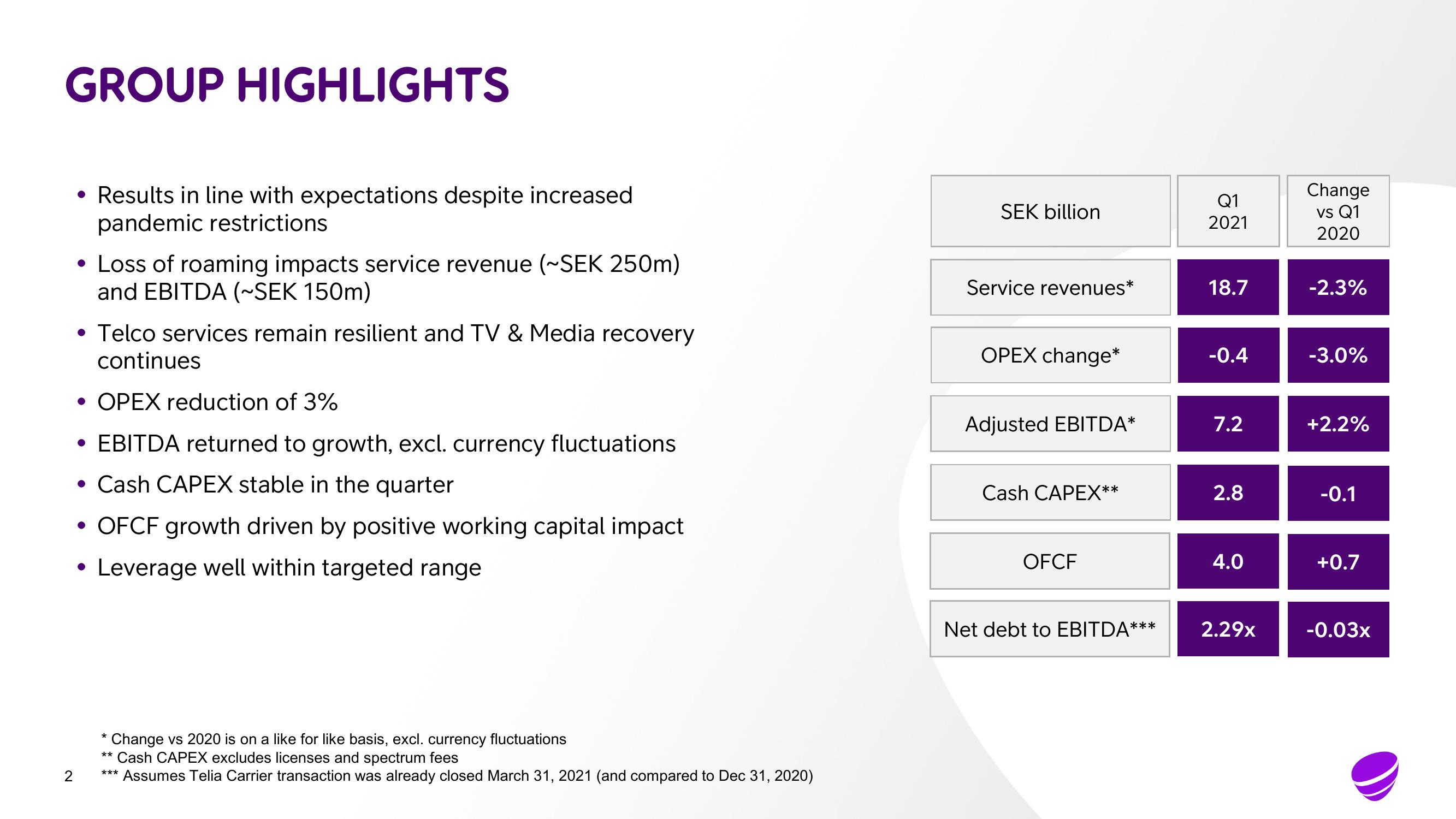

• Results in line with expectations despite increased

pandemic restrictions

• Loss of roaming impacts service revenue (~SEK 250m)

and EBITDA (~SEK 150m)

• Telco services remain resilient and TV & Media recovery

continues

• OPEX reduction of 3%

• EBITDA returned to growth, excl. currency fluctuations

• Cash CAPEX stable in the quarter

• OFCF growth driven by positive working capital impact

●

• Leverage well within targeted range

●

Change vs 2020 is on a like for like basis, excl. currency fluctuations

** Cash CAPEX excludes licenses and spectrum fees

*** Assumes Telia Carrier transaction was already closed March 31, 2021 (and compared to Dec 31, 2020)

*

SEK billion

Service revenues*

OPEX change*

Adjusted EBITDA*

Cash CAPEX**

OFCF

Net debt to EBITDA***

Q1

2021

18.7

-0.4

7.2

2.8

4.0

2.29x

Change

vs Q1

2020

-2.3%

-3.0%

+2.2%

-0.1

+0.7

-0.03xView entire presentation