OpenText Investor Day Presentation Deck

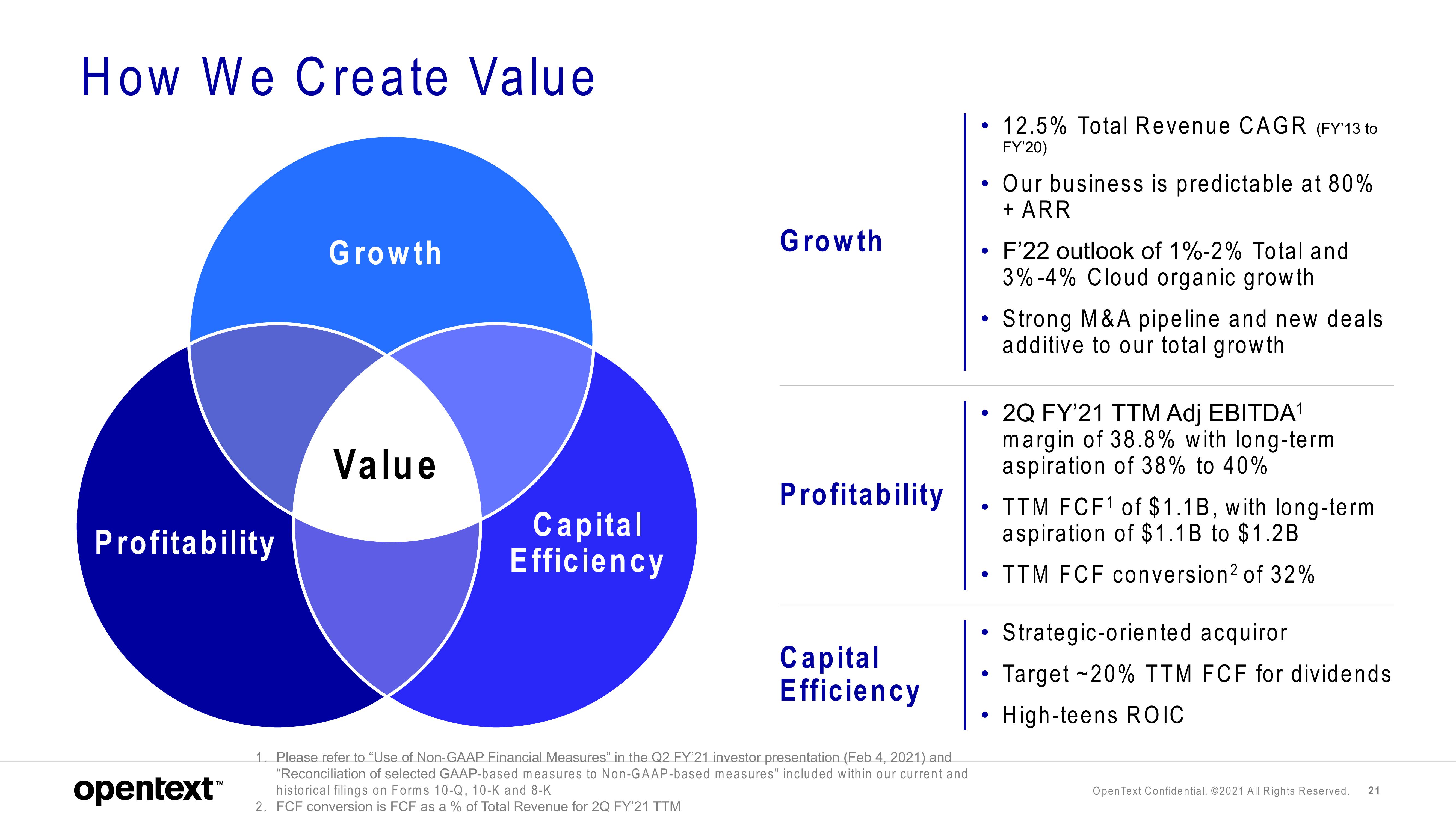

How We Create Value

Profitability

opentext

Growth

Value

Capital

Efficiency

Growth

Profitability

Capital

Efficiency

1. Please refer to "Use of Non-GAAP Financial Measures" in the Q2 FY'21 investor presentation (Feb 4, 2021) and

"Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and

historical filings on Forms 10-Q, 10-K and 8-K

2. FCF conversion is FCF as a % of Total Revenue for 2Q FY'21 TTM

●

●

●

●

●

12.5% Total Revenue CAGR (FY'13 to

FY'20)

Our business is predictable at 80%

+ ARR

F'22 outlook of 1%-2% Total and

3% -4% Cloud organic growth

Strong M&A pipeline and new deals

additive to our total growth

2Q FY'21 TTM Adj EBITDA¹1

margin of 38.8% with long-term

aspiration of 38% to 40%

TTM FCF¹ of $1.1B, with long-term

aspiration of $1.1B to $1.2B

TTM FCF conversion² of 32%

Strategic-oriented acquiror

Target -20% TTM FCF for dividends

High-teens ROIC

Open Text Confidential. ©2021 All Rights Reserved. 21View entire presentation