Maersk Investor Presentation Deck

Terminals & Towage - highlights Q1 2020

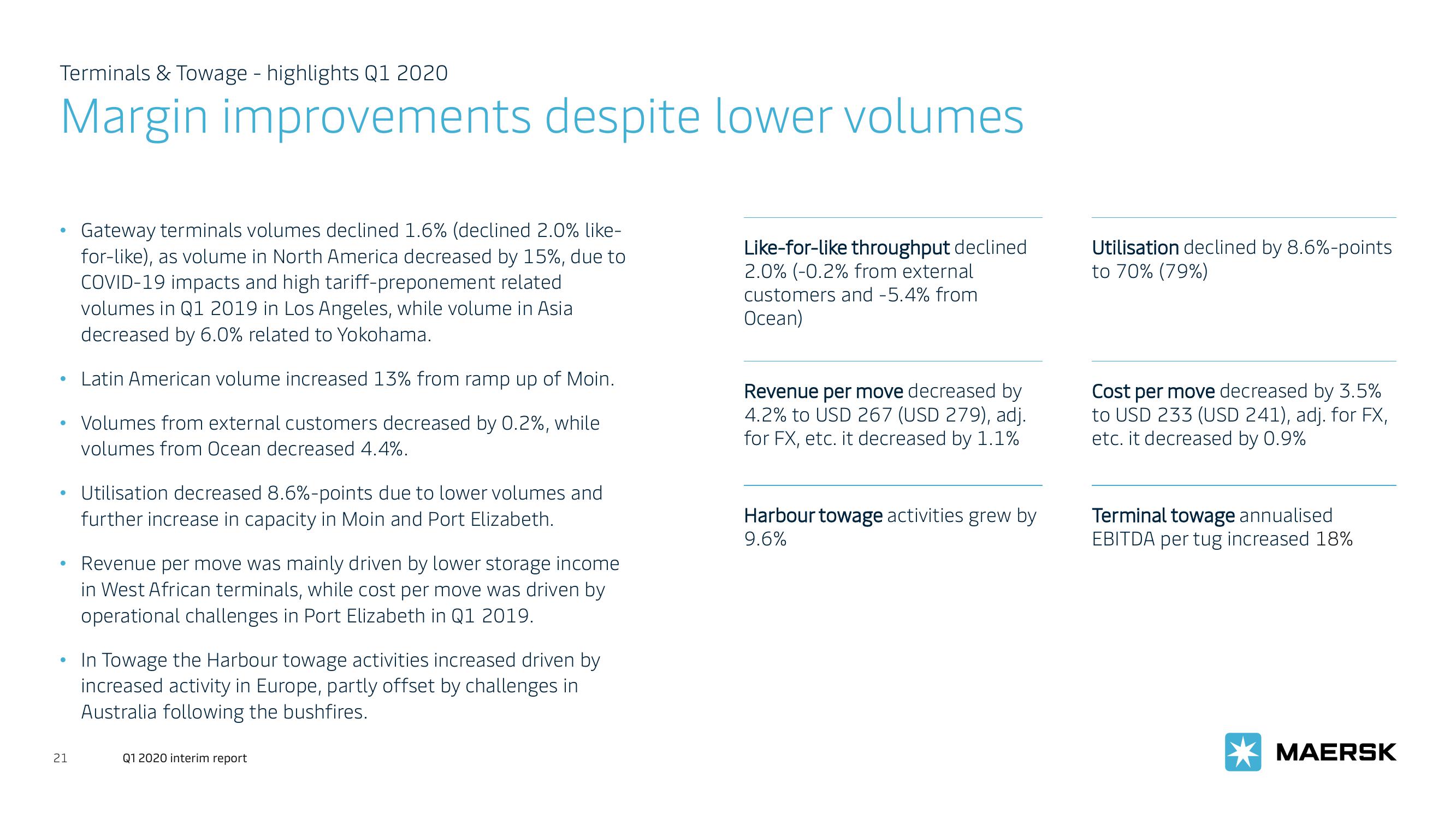

Margin improvements despite lower volumes

●

●

●

●

●

21

Gateway terminals volumes declined 1.6% (declined 2.0% like-

for-like), as volume in North America decreased by 15%, due to

COVID-19 impacts and high tariff-preponement related

volumes in Q1 2019 in Los Angeles, while volume in Asia

decreased by 6.0% related to Yokohama.

Latin American volume increased 13% from ramp up of Moin.

Volumes from external customers decreased by 0.2%, while

volumes from Ocean decreased 4.4%.

Utilisation decreased 8.6%-points due to lower volumes and

further increase in capacity in Moin and Port Elizabeth.

Revenue per move was mainly driven by lower storage income

in West African terminals, while cost per move was driven by

operational challenges in Port Elizabeth in Q1 2019.

In Towage the Harbour towage activities increased driven by

increased activity in Europe, partly offset by challenges in

Australia following the bushfires.

Q1 2020 interim report

Like-for-like throughput declined

2.0% (-0.2% from external

customers and -5.4% from

Ocean)

Revenue per move decreased by

4.2% to USD 267 (USD 279), adj.

for FX, etc. it decreased by 1.1%

Harbour towage activities grew by

9.6%

Utilisation declined by 8.6%-points

to 70% (79%)

Cost per move decreased by 3.5%

to USD 233 (USD 241), adj. for FX,

etc. it decreased by 0.9%

Terminal towage annualised

EBITDA per tug increased 18%

MAERSKView entire presentation