Antero Midstream Partners Mergers and Acquisitions Presentation Deck

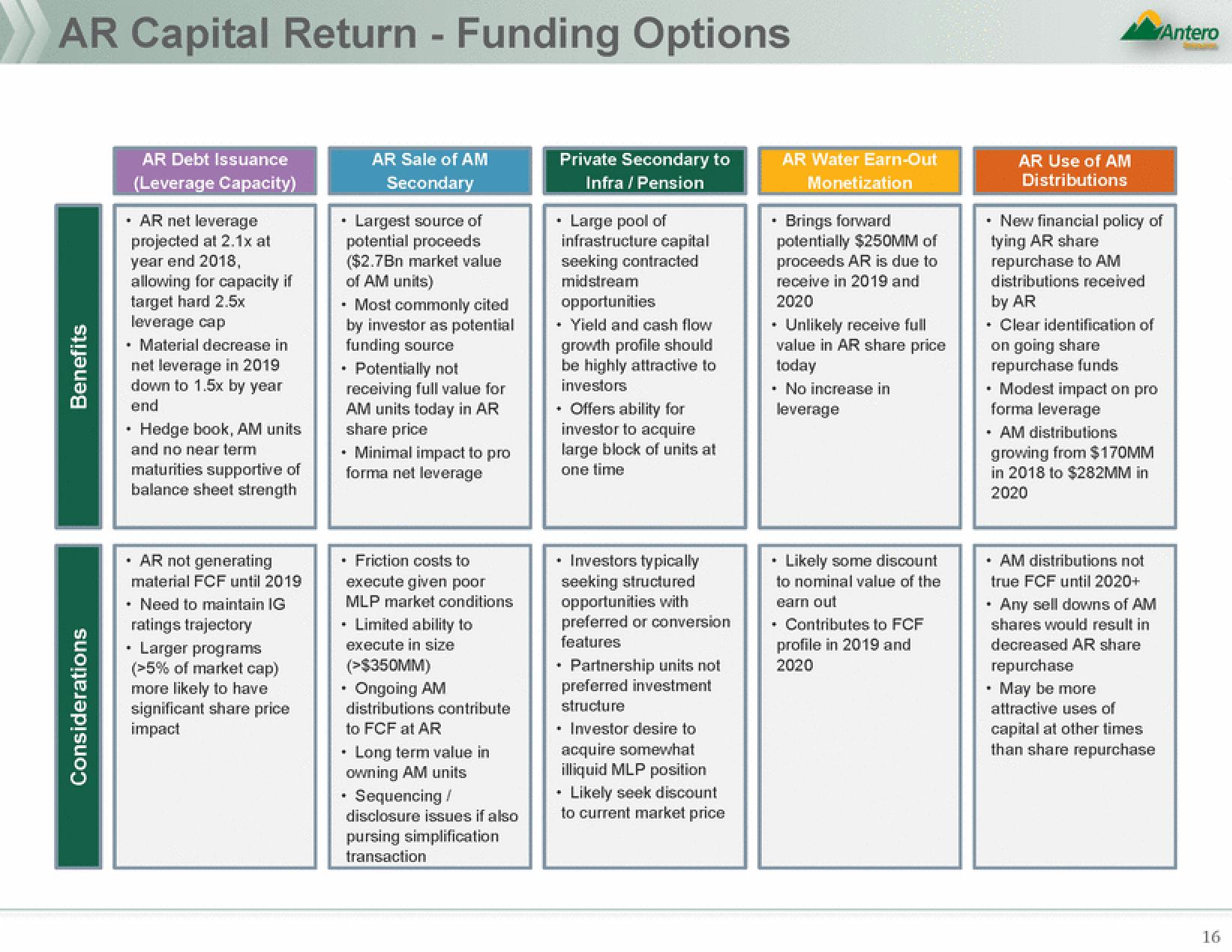

AR Capital Return - Funding Options

Benefits

Considerations

• AR net leverage

projected at 2.1x at

year end 2018,

allowing for capacity if

target hard 2.5x

leverage cap

AR Debt Issuance

(Leverage Capacity)

• Material decrease in

net leverage in 2019

down to 1.5x by year

end

• Hedge book, AM units

and no near term

maturities supportive of

balance sheet strength

.

AR not generating

material FCF until 2019

* Need to maintain IG

ratings trajectory

Larger programs

(>5% of market cap)

more likely to have

significant share price

impact

"

.

Largest source of

potential proceeds

($2.7Bn market value

of AM units)

* Most commonly cited

by investor as potential

funding source

AR Sale of AM

Secondary

* Potentially not

receiving full value for

AM units today in AR

share price

+

Minimal impact to pro

forma net leverage

+ Friction costs to

execute given poor

MLP market conditions

• Limited ability to

execute in size

(>$350MM)

·

Ongoing AM

distributions contribute

to FCF at AR

. Long term value in

owning AM units

+

Sequencing /

disclosure issues if also

pursing simplification

transaction

Private Secondary to

Infra / Pension

Large pool of

infrastructure capital

seeking contracted

midstream

opportunities

• Yield and cash flow

growth profile should

be highly attractive to

investors

Offers ability for

investor to acquire

large block of units at

one time

+

• Investors typically

seeking structured

opportunities with

preferred or conversion

features

Partnership units not

preferred investment

structure

• Investor desire to

acquire somewhat

illiquid MLP position

Likely seek discount

to current market price

+

AR Water Earn-Out

Monetization

Brings forward

potentially $250MM of

proceeds AR is due to

receive in 2019 and

2020

• Unlikely receive full

value in AR share price

today

• No increase in

leverage

Likely some discount

to nominal value of the

earn out

. Contributes to FCF

profile in 2019 and

2020

AR Use of AM

Distributions

• New financial policy of

tying AR share

repurchase to AM

distributions received

by AR

+ Clear identification of

on going share

repurchase funds

. Modest impact on pro

forma leverage

AM distributions

growing from $170MM

in 2018 to $282MM in

2020

AM distributions not

true FCF until 2020+

⠀

Any sell downs of AM

shares would result in

decreased AR share

repurchase

Antero

May be more

attractive uses of

capital at other times

than share repurchase

16View entire presentation