Baird Investment Banking Pitch Book

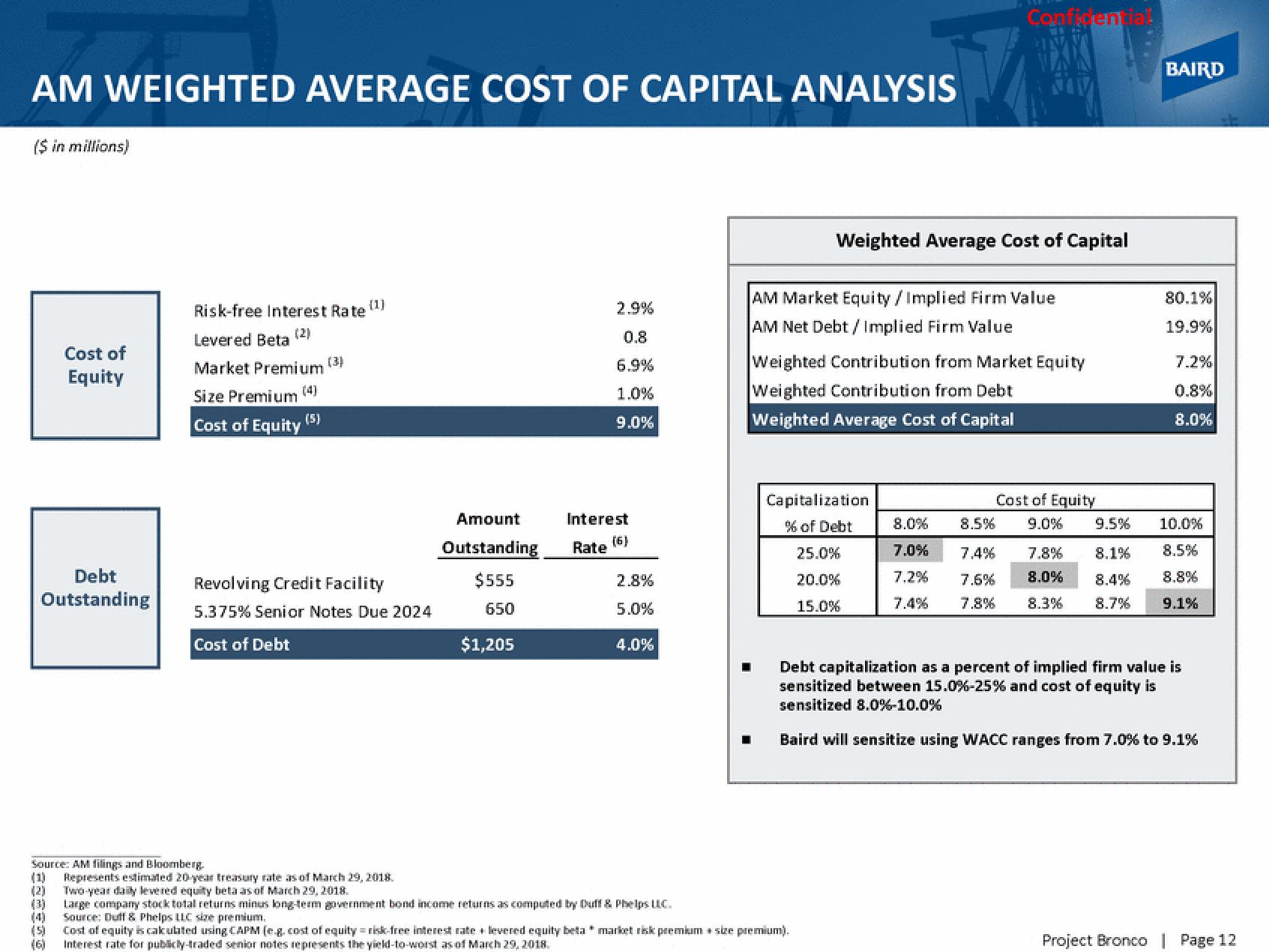

AM WEIGHTED AVERAGE COST OF CAPITAL ANALYSIS

($ in millions)

Cost of

Equity

Debt

Outstanding

(1)

(2)

(3)

(4)

(5)

(6)

Risk-free Interest Rate

(2)

Levered Beta

Market Premium

(4)

Size Premium

Cost of Equity

(5)

(3)

(1)

Revolving Credit Facility

5.375% Senior Notes Due 2024

Cost of Debt

Source: AM filings and Bloomberg.

Represents estimated 20-year treasury rate as of March 29, 2018.

Two-year daily levered equity beta as of March 29, 2018

Amount

Outstanding

$555

650

$1,205

2.9%

0.8

6.9%

1.0%

9.0%

Interest

(6)

Rate

2.8%

5.0%

4.0%

Confidentia!

Weighted Average Cost of Capital

AM Market Equity / Implied Firm Value

AM Net Debt / Implied Firm Value

Weighted Contribution from Market Equity

Weighted Contribution from Debt

Weighted Average Cost of Capital

Capitalization

% of Debt

25.0%

20.0%

15.0%

Large company stock total returns minus long-term government bond income returns as computed by Duff & Phelps LLC.

Source: Duff & Phelps LLC size premium.

Cost of equity is calculated using CAPM (e.g. cost of equity risk-free interest rate + levered equity beta market risk premium size premium).

Interest rate for publicly-traded senior notes represents the yield-to-worst as of March 29, 2018,

Cost of Equity

9.0%

8.0% 8.5%

7.0% 7.4%

7.2% 7.6%

7.4% 7.8% 8.3%

7.8%

8.0%

9.5%

8.1%

8.4%

8.7%

BAIRD

80.1%

19.9%

7.2%

0.8%

8.0%

10.0%

8.5%

8.8%

9.1%

Debt capitalization as a percent of implied firm value is

sensitized between 15.0 %-25% and cost of equity is

sensitized 8.0% -10.0%

Baird will sensitize using WACC ranges from 7.0% to 9.1%

Project Bronco | Page 12View entire presentation